- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Market Analysis – USD and yields rise on Fedspeak, Oil tumbles on OPEC+

1 December 2023USD bounced back in Thursday’s session with the US Dollar Index (DXY) recouping the weeks losses after finding some technical support at its 61.8 Fib level and an extreme oversold RSI reading. Fundamentally, some hawkish Fedspeak from voting member Daly, where she commented that it is too soon to call the end on rate hikes and the battle against inflation may not yet be over also lending a strong tailwind to USD as yields spiked on her comments. DXY retaking the 103 handle and pushing to the key levels of its 50% Fib level and 200 Day SMA before finding resistance. After some mixed messaging from Fed officials this week, no doubt Dollar watchers will be waiting for some clarification from Chair Powell who is due to speak during the US session.

Chart Source : TradingView.com

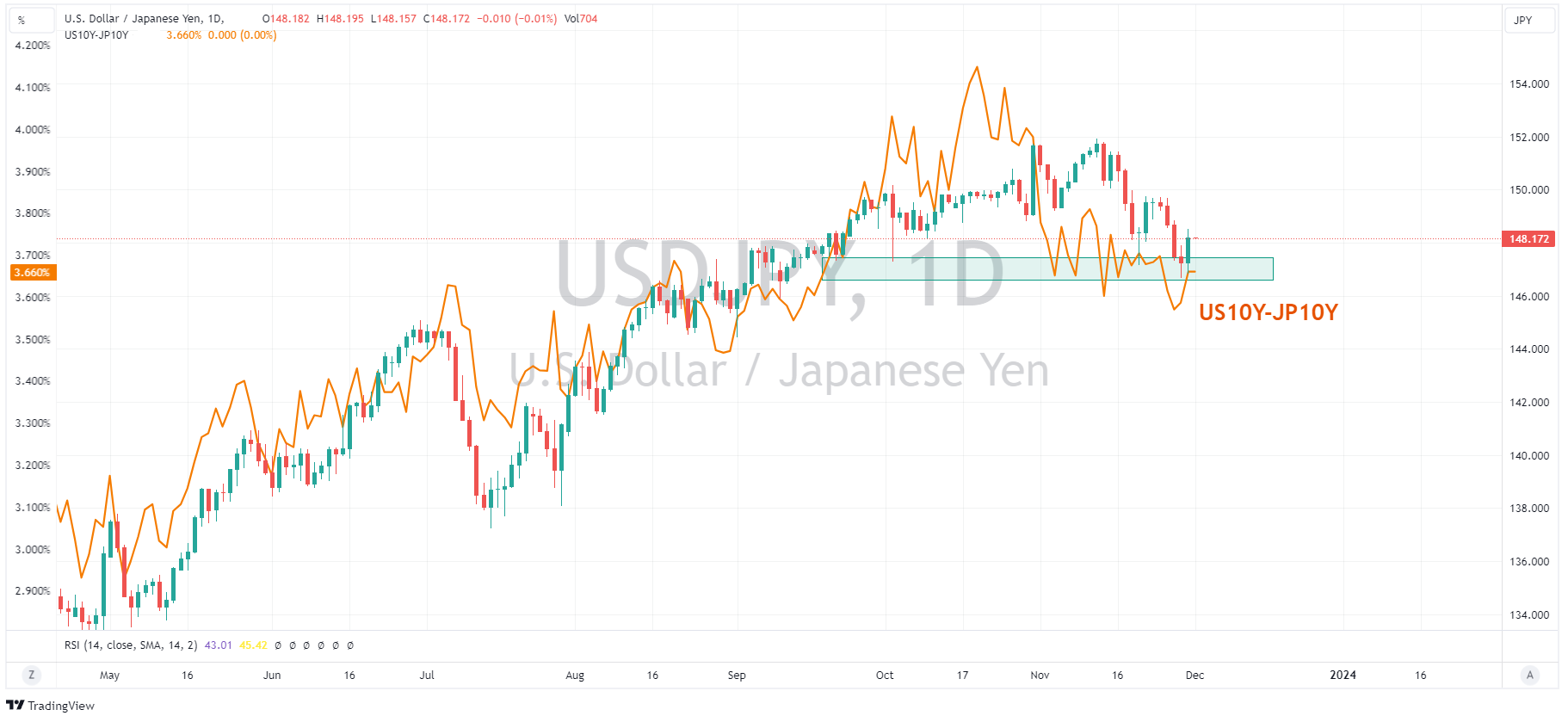

The Yen was hit by dollar strength and a jump in US yields saw US-JP yield differentials bounce back. USDJPY retaking the 148 handle to hit a high of 148.52. Thursday some mixed data out of Japan with a miss in retail sales but a beat in industrial production. Due out of today is Japanese Unemployment and a manufacturing data, but likely the biggest driver in this cross will be Powells comments later.

Chart Source : TradingView.com

The long awaited (and delayed) OPEC+ meeting on Thursday failed to inspire the Oil bulls, with Crude dumping over 2.5% as details of the meeting were released. Although cuts were confirmed to be extended until year end by Russia and the Saudis it was the “voluntary” nature of the cuts and some disagreement from smaller members as to their size which saw traders hit the sell button on crude. Crude finishing November down for a second straight monthly loss. Technically the 200 Day SMA has also proven stiff resistance for any further upside in WTI.

Chart Source : TradingView.com

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – USD pushes above key level, AUD ahead of the the RBA

USD bounced back to start the first full week of December after a horror run in November where the Dollar Index (DXY) fell around 3%. DXY breaking through the 200 Day SMA resistance and printing a high of 103.850. Sour risk sentiment and higher treasury yields (particularly in the short end) helping DXY erase the Powell inspired drop on Friday. W...

December 5, 2023

Read More >

Previous Article

Kroger tops third quarter expectations

One of the largest food retailers in the United States, Kroger Co. (NYSE: KR), announced Q3 earnings results before the opening bell in Wall Street on...

December 1, 2023

Read More >