- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Markets to watch this week – USDJPY, AUDUSD, NZDUSD, Gold, Oil

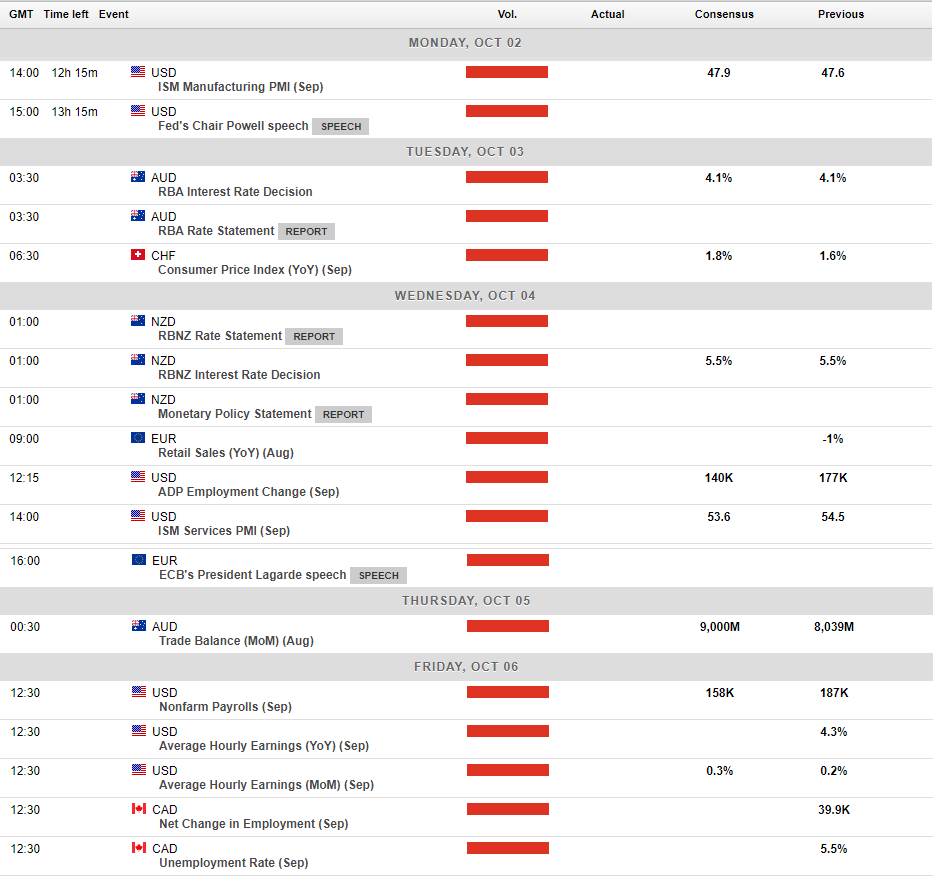

2 October 2023Global markets enter Q4 this week on a downbeat mood after a shellacking of risk assets in Q3 seeing the S&P 500 having its worst quarter in a year. The “higher for longer” narrative coming out of the Federal reserve and other Central banks over the last month pushing yields higher, (the US 10-year yield at 16-year highs), pressuring risk assets and seeing a relentless rally in the US dollar, whether this remains the narrative in Q4 will no doubt be based on data, and this week has a few important figures to kickstart the quarter, including central bank meetings in Australia and New Zealand and the always high impact Non-farm payrolls out of the US on Friday.

Charts to watch this week

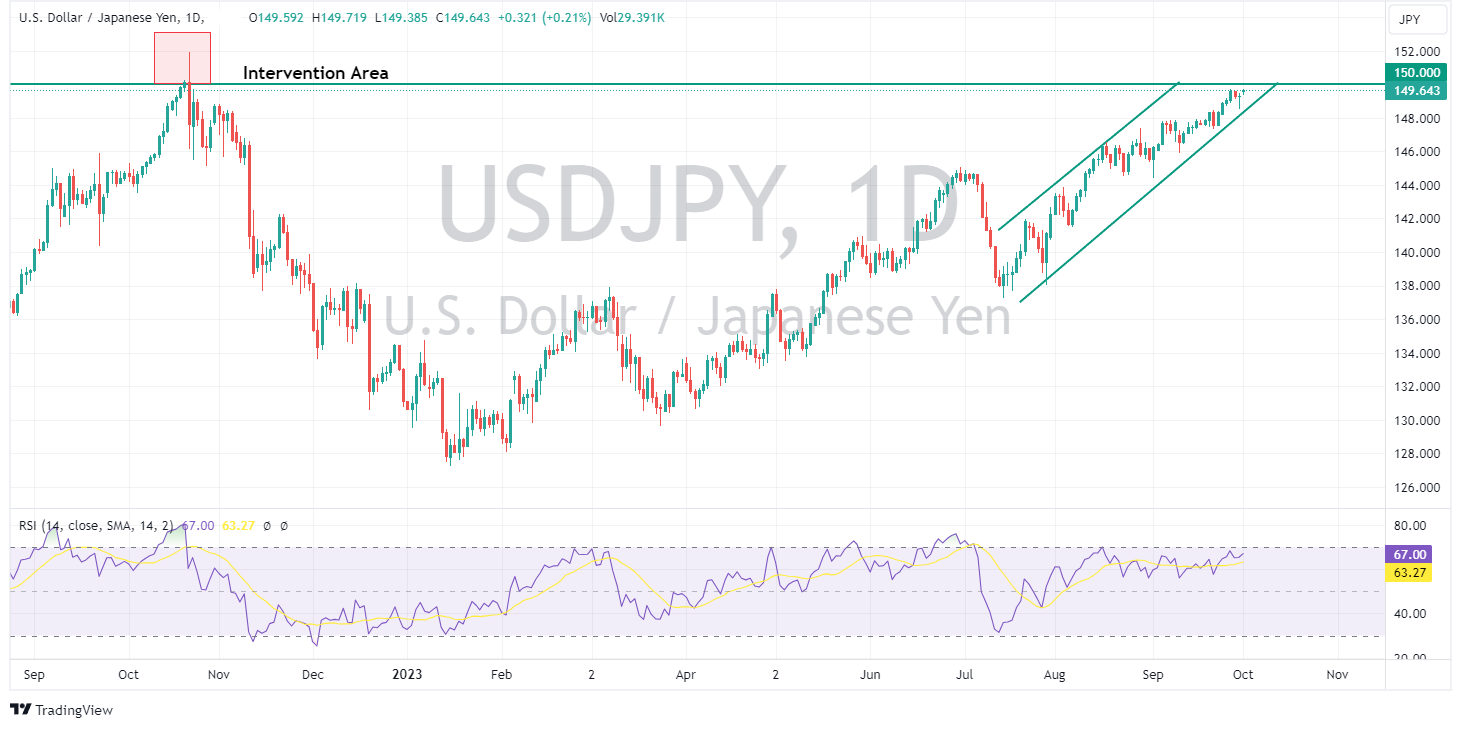

USDJPY

USDJPY traders continue to play chicken with the BoJ, pushing the pair to touching distance of the key 150 level, a level late last year where the Japanese Ministry of Finance gave the green light to the BoJ to forcefully intervened in the currency markets. Stubbornly high US bond yields have given this pair a big tailwind, but will traders be brave enough to hold above 150 when the danger of a sharp intervention caused correction could be seen, this week we may find out.

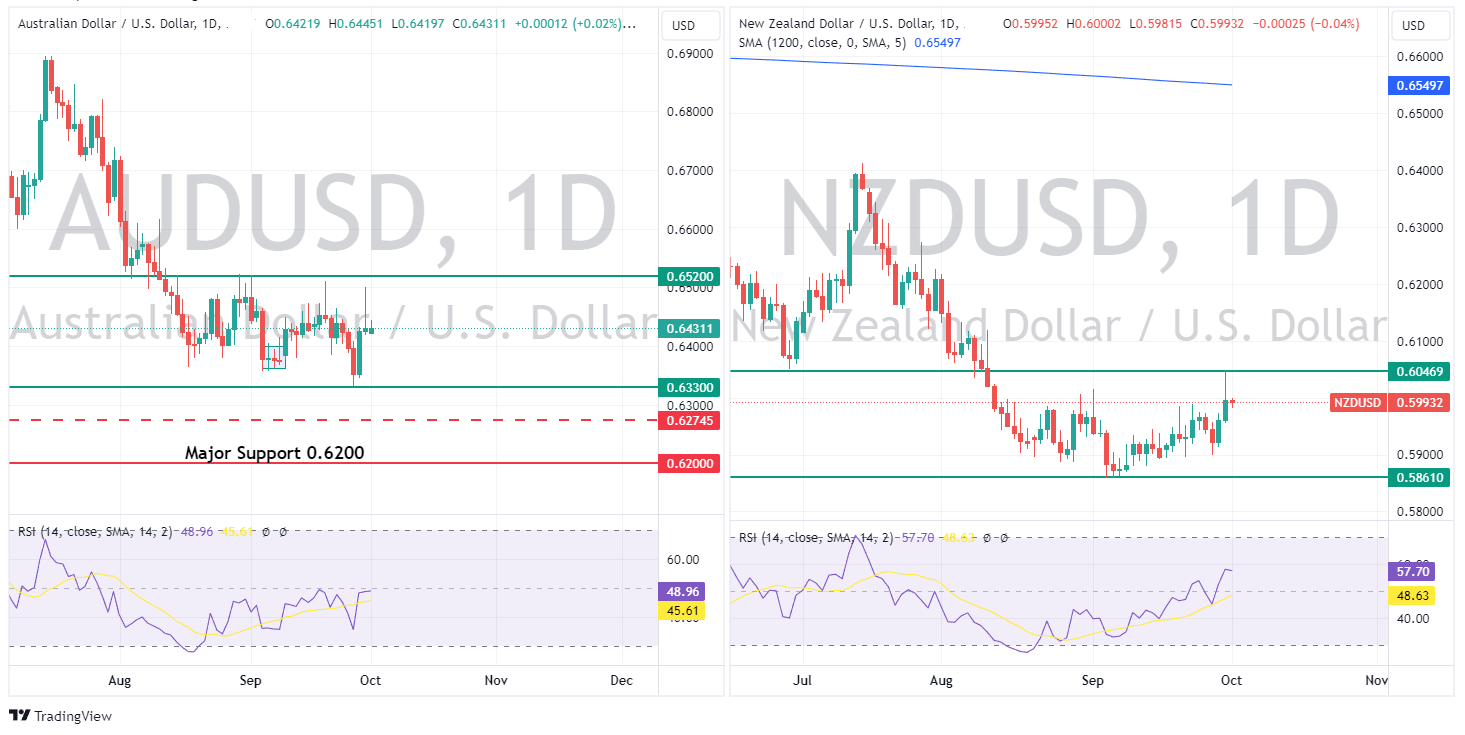

AUDUSD – NZDUSD

Both the Aussie and Kiwi performed admirably well in September in the face of a rampant USD and a shaky risk environment, both AUDUSD and NZDUSD both holding a trading range and both easily outperforming their larger peers such as GBP and EUR.

We come into a key week for both currencies with rate decisions coming from the RBA and RBNZ where both Central Banks are expected to hold rates, though with inflation still well above the RBA and RBNZ targets, it will be the accompanying statements released with the rate decisions that will drive currency moves.

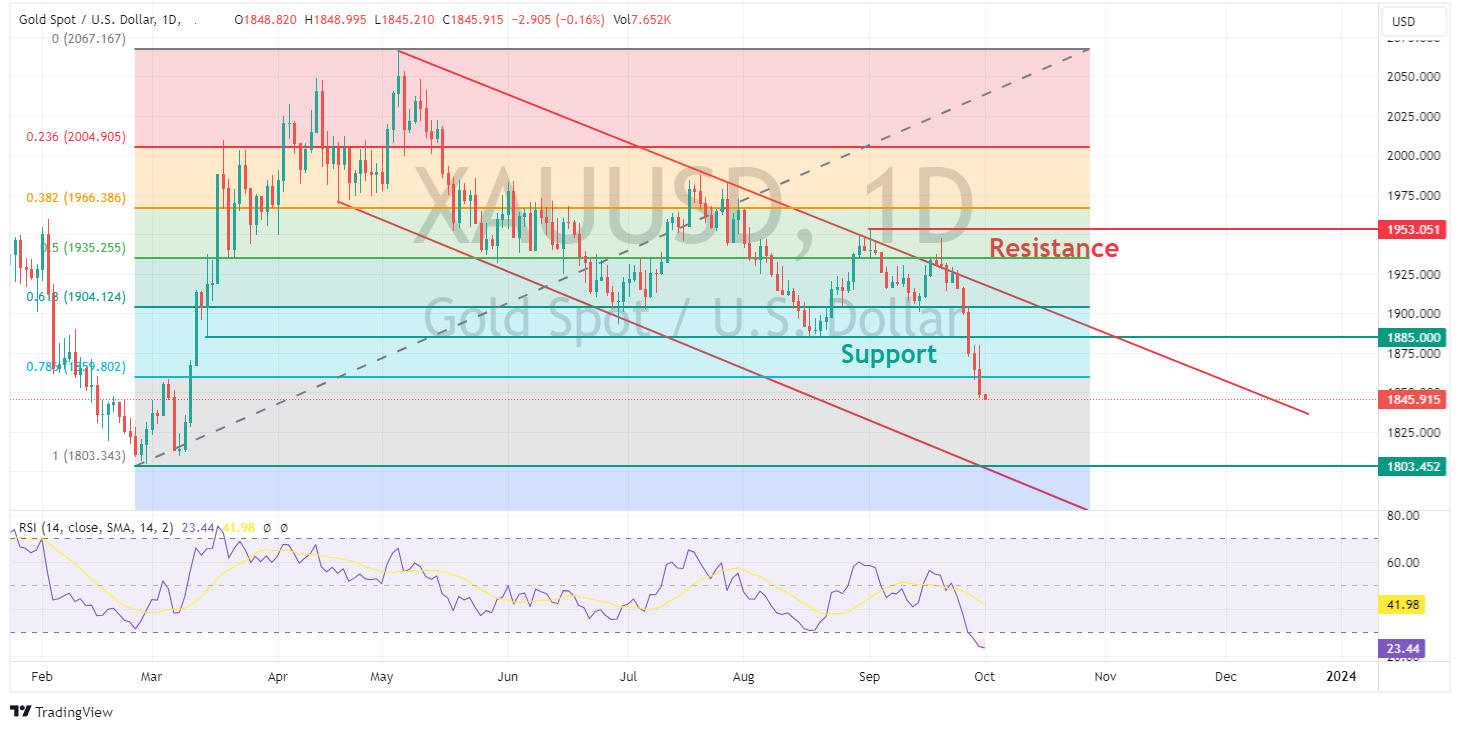

In the commodity space you couldn’t see a more different story in the recent performance of Oil and Gold. XAUUSD forcefully broke through its support level of 1885 last week as higher yields (bonds being a competing safe haven asset) and a relentless rally in USD has seen the precious metal take a beating. From a chartist point of view, it is fresh air from here until the 1803 support level, which would be a 100% retrace of the rally that started in March, and also meeting its lower trend line.

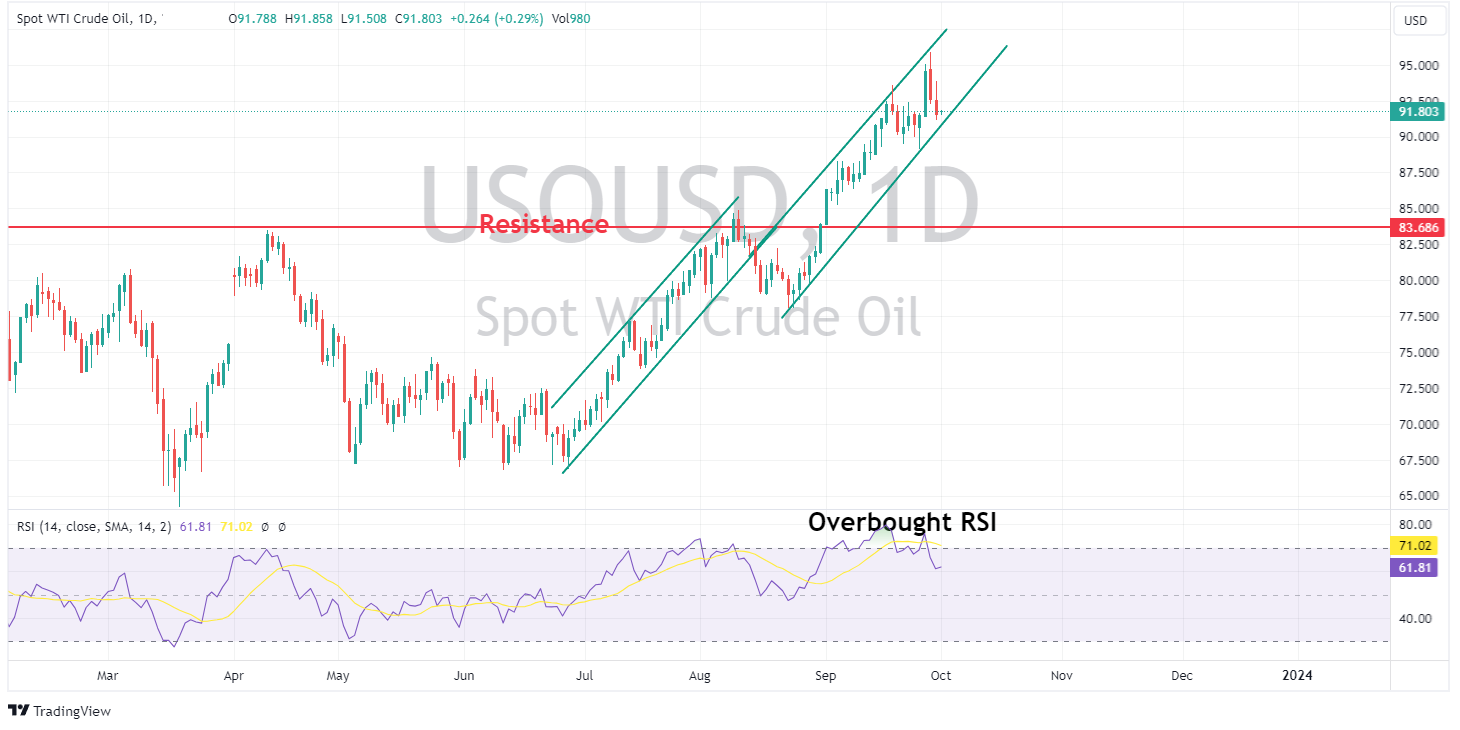

On the flip side, Oil has seen a sustained rally despite a stronger USD and weakening economic figures. Supply fears, with cuts from OPEC+ and record low storage levels in the US seemingly the main driver of USOUSD. We have seen a couple of decent pullbacks recently when the Daily RSI has entered overbought territory, an indicator to watch for chart technicians.

The weeks full calendar below:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – USD surges, USDJPY tests BoJ resolve at 150, AUD weak ahead of RBA

USD continued to run higher in Monday’s session with US yields surging to highs not seen since 2007. Beats in both US manufacturing and employment data along with some hawkish Fed Speak supporting yields. Monday’s risk tone started off upbeat after the US Congress came to an agreement over the weekend to narrowly avoided a government shutdown, ...

October 3, 2023

Read More >

Previous Article

FX Analysis – Rising US yields set FX tone as USD continues to grind higher

The ongoing sell-off in the US bond market has set the tone in FX and wider risk markets on Tuesday in an otherwise very slow news day. The USD has co...

September 26, 2023

Read More >