- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Paychex beats estimates

31 March 2022Paychex Inc. reported its latest financial results before the opening bell on Wall Street on Wednesday.

The US payroll services company reported total revenue of $1.276 billion for the quarter ending February 28, 2022 (a 15% increase year-over-year) vs. $1.22 billion expected.

Earnings per share reported at $1.15 per share, above analyst estimates of $1.05 per share.

Martin Mucci, Chairman and CEO commented on the latest results: ”Our strong results for the third quarter, including double-digit growth in both revenue and earnings are a result of progress against key initiatives. We had a strong calendar year end and selling season, delivering a record quarter for new sales revenue and maintaining high levels of client retention. Our value proposition continues to resonate in the market with our unique blend of innovative Paychex Flex® technology and breadth of solutions to help small and mid-sized businesses.”

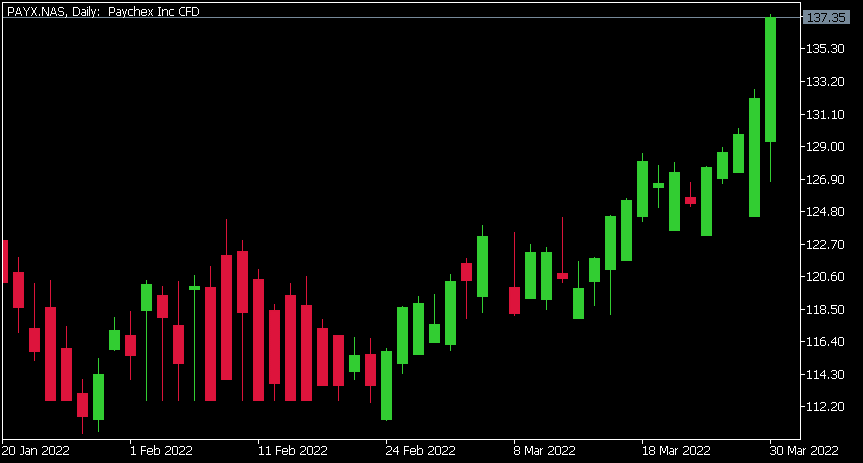

Paychex Inc. chart

Shares of Paychex were up by around 3% on Wednesday at $137.35 a share.

Here is how the stock has performed in the past year –

- 1 Month: +13.59%

- 3 Month: -0.47%

- Year-to-date: +0.17%

- 1 Year: +39.50%

Paychex is the 366th largest company in the world with a market cap of $49.59 billion.

You can trade Paychex Inc. (PAYX) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Paychex Inc., TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Biden’s push toward electric vehicles as he looks to invoke the Defence Production Act

US President Joe Biden is pushing to invoke the Defence Production Act as soon as the end of the week. The president is aiming to boost domestic production of critical minerals which are essential to the production of Electric Vehicle (EV) batteries and military hardware. The legislation was originally designed to help the federal government gai...

April 1, 2022

Read More >

Previous Article

Woolworths’ latest green light from Goldman Sachs explained

Woolworths Group Limited is an Australian trans-Tasman retailer headquartered in Bella Vista, Sydney, with extensive operations throughout Australia a...

March 31, 2022

Read More >