- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

QANTAS confirms its plan for Project Sunrise

2 May 2022The major Australian airline announced its commitment to direct flights from Sydney and Melbourne to mainland Europe and the East Coast of America by 2026. The commitment was announced on the back of encouraging quarterly figures due to a strong recovery in the travel sector and the easing of many Covid restrictions.

Trading results

QANTAS announced its trading results for the quarter with the highlights being a strong reduction in debt from $5.5 billion to $4.5 billion from December 2021 to the end of April 2022. This is compared to a peak of over $6.4 billion of debt during the height of the border closures. The company is still expected to release significant underlying EBIT losses for the FY22 but insists it is on track for 2H22 underlying EBITDA of between $450 million and $550 million. Looking forward, QANTAS believes that by the fourth quarter of FY22 domestic capacity will be at 105% of pre covid levels and international capacity will be at 70% by the first quarter of FY23.

CEO Allan Joyce stated, “The recovery in business traffic has been faster than expected. Once mask mandates were removed and people went back to the office, there was a clear uptick in demand. We’re now at around 85% of pre-covid levels for domestic corporate travel and more than 100% for small businesses.”

Increasing Fuel Prices

With extremely high fuel prices, because of inflationary pressure and geopolitical crises, there was the potential for a costly blowout for QANTAS. However, the company was able to hedge its positions to protect itself from the ongoing volatility. The company outlined that 90% of its fuel for the second half of FY22 is hedged at levels below the current prices. Additionally, they will continue to adjust fare and fuel prices to meet market demands and volatility.

Project Sunrise and Commitment towards Airbus

The announcement of project sunrise and QANTAS’s firm order for 18 A321LRs, and 12 A350-1000s are a potential game-changer for the airline. The A350 -1000 will form the backbone of the strategy. By 2026, QANTAS is planning on being the first airline to connect the East Coast of Australia with cities such as Chicago, NYC, London, and Paris. This shift presents a chance for QANTAS to push itself forward and differentiate itself from the rest of the market.

Shift from Boeing

Qantas has long been a loyal customer of Boeing, however, as the airline moved into the 21st century this loyalty was beginning to wane as QANTAS began acquiring the Airbus A380 and the A330 over the Boeing 777 as part of its fleet. Whilst the company was and continues to operate the Boeing 737 as its major domestic workhorse, the shift towards Airbus for its long-haul flights signals a move away from the American manufacturer.

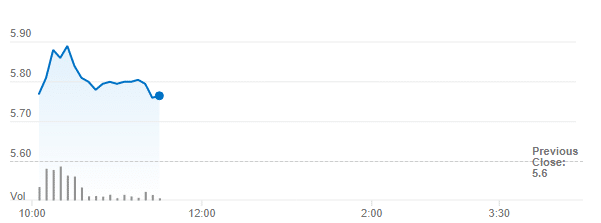

As of the 11.52 am 2 April 2022 the QANTAS share price was up by 2.32%

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Amazon records its first loss since 2015

Amazon has followed some of the other tech sector players in providing weaker than expected quarterly results. The global giant saw its share price drop dramatically after hours in response to the release of the report. Key Report Figures Revenue at Amazon increased by just 7% which marks its lowest figure since the .com bust in 2001. The rev...

May 2, 2022

Read More >

Previous Article

AbbVie posts mixed results for Q1

AbbVie Inc. reported its financial results for the first quarter before the market open on Friday in the US. The biotechnology and pharmaceutical c...

May 2, 2022

Read More >