- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Rio Tinto’s record setting performance

4 March 2022All prices in this article will be in USD unless otherwise stated.

Rio Tinto Group is an Anglo-Australian multinational and the world’s second-largest metals and mining corporation, behind BHP, producing iron ore, copper, diamonds, gold and uranium.

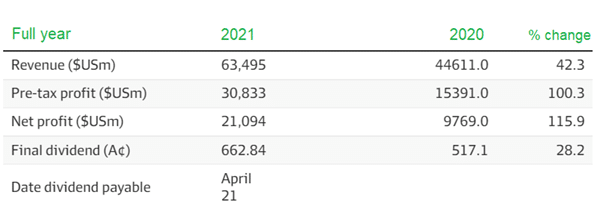

Rio Tinto made history last week by posting the second biggest profit in Australian corporate history, the biggest belonging to BHP. They have decided to reward their shareholders with Australia’s biggest ever dividend worth $16.8 billion, which is roughly $23 billion AUD.

The $21.4 billion of underlying earnings for 2021 was the biggest in all of Rio Tinto’s 149 year history. The achievement has allowed a dividend payment of $4.79 per share. The final and special dividends took Rio Tinto’s total dividends for the year to a record-breaking $10.40 per share. The total dividends paid by Rio Tinto for the year is almost doubled the previous year’s $5.57.

The greatest profit recorded by an Australian company was BHP. They set this record in 2011 with a recorded $21.68 billion in underlying profit.

Comparing both companies, BHP’s record profit was when the Australian dollar was much stronger than today. This means the profit announced by Rio Tinto would be much bigger than BHP, in Australian dollars, $22.5 billion vs $23 billion AUD. This does not take into account inflation.

Rio Tinto’s great result was largely attributed to its most important commodity, iron ore. However, the decade high prices for copper and aluminium have also bolstered their profits.

The shareholder returns unleashed by Rio Tinto over the past four years rank as the four biggest in the company’s history, meaning shareholders in the miner are enjoying a golden era of returns.

The “golden era” was initially built on the proceeds of asset divestments, however, Australian mining companies have been fortunate due to rival mining companies in Brazil suffering massive dam failures in 2019. Australia was able to capitalise on the weak iron ore supply in the aftermath.

The strong operating environment for mining companies like Rio Tinto has only continued since the onset of the COVID-19 pandemic. The pandemic had prompted governments to announce stimulus spending on infrastructure which drove strong demand for the raw materials which were produced by the likes of Rio Tinto and BHP.

Most of Rio’s record setting dividend will be paid to shareholders outside of Australia; the company’s biggest shareholder is Chinese state-owned entity Chinalco while most investors own the stock through the London Stock Exchange.

All in all, the mining industry is currently experiencing a strong year. Rio Tinto, being one of the biggest players, has set the benchmark for other companies in the industry. The strong start to the year is a good indication as to where the industry is going.

If you would like to take this opportunity to invest in Rio Tinto Group and don’t already have a trading account, you can register for a Shares or Shares CFD account at GO Markets.

Sources: ASX, Wikipedia, AFR.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Commodities finish the week on a high as indices falter

The market closed the week down overall as volatility continues due to the Russia and Ukraine conflict. The Dow Jones dipped 0.5%, the S&P500 fell 0.8%, and the NASDAQ performed the worst, declining 1.7%, despite generally positive sentiment from the USA concerning the employment figures released on Friday. Employers added 678,000 jobs to the w...

March 7, 2022

Read More >

Previous Article

Volatile market continues following failed peace talks between Russia and the Ukraine

Global indices were choppy overnight, mainly finishing lower on the back of failed peace talks and Russia continued advances in Ukraine. According to ...

March 4, 2022

Read More >