- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Tesla delivers in Q2

21 July 2022Tesla Inc. (TSLA) announced its latest financial results after the market close on Wall Street on Wednesday.

World’s largest automaker reported solid results for Q2 of 2022.

Revenue reported at $16.934 billion vs. $16.539 billion expected.

Earnings per share also exceeded Wall Street expectations at $2.27 per share vs. $1.81 per share estimate.

Tesla produced over 258k vehicles in the second quarter and delivered over 254k vehicles, despite supply chain challenges and factory shutdowns.

June was the highest vehicle production month in company’s 19 year history.

”We continued to make significant progress across the business during the second quarter of 2022. Though we faced certain challenges, including limited production and shutdowns in Shanghai for the majority of the quarter, we achieved an operating margin among the highest in the industry of 14.6%, positive free cash flow of $621M and ended the quarter with the highest vehicle production month in our history.”

”New factories in Berlin-Brandenburg and Austin continued to ramp in Q2. Gigafactory Berlin-Brandenburg reached an important milestone of over 1,000 cars produced in a single week while achieving positive gross margin during the quarter. From our Austin factory, the first vehicles with Tesla-made 4680 cells and structural battery packs were delivered to our U.S. customers. We are continuing to invest in capacity expansion of our factories to maximize production.”

”The Energy business made meaningful progress in Q2 as well, achieving higher volumes with stronger unit economics. This resulted in an overall record gross profit. Customer interest in our storage products remains strong and well above our production rate.”

”With each of the Fremont and Shanghai factories achieving their highest-ever production months and new factory growth, we are focused on a record-breaking second half of 2022,” Tesla said in a statement to shareholders.

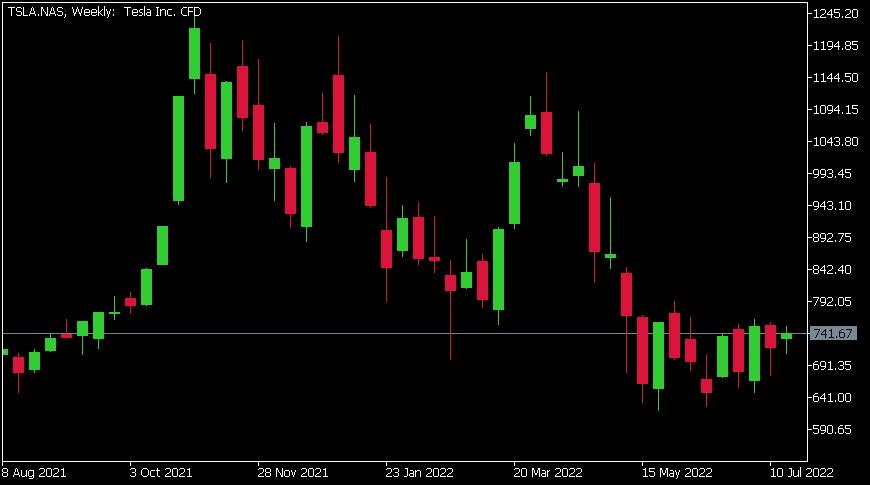

Tesla Inc. (TSLA) chart

Share price was little changed at the end of the trading day on Thursday, up by 0.80% at $741.67 per share.

Here is how the stock has performed in the past year:

- 1 Month +5.00%

- 3 Month -23.89%

- Year-to-date -29.63%

- 1 Year +13.49%

Tesla price targets

- Credit Suisse $1000

- Barclays $380

- Morgan Stanley $1150

- Truist Securities $1000

- Wells Fargo $820

- JP Morgan $385

- Deutsche Bank $1125

- Mizuho $1150

Tesla Inc. is the 6th largest company in the world with a market cap of $772.06 billion.

You can trade Tesla Inc. (TSLA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Tesla Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US equities rally despite European pessimism , BOJ, ECB preview

The short squeeze continued in the US overnight as equites were well bid during the cash session seeing a second straight rise as slowly improving investor sentiment seeing the S&P 500 close up 23 points or 0.6%. In Europe, things were not so rosy , with political issues in Italy and fears of Russian gas being curtailed after the Nord Stream...

July 21, 2022

Read More >

Previous Article

Is the AUDUSD ready to reverse?

Recent History The USD has been on a tear in recent months as volatile market conditions have sent the currency rocketing. Inflationary pressures and...

July 20, 2022

Read More >