- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

The Week Ahead – Charts to watch EURUSD, Crude Oil, Gold

27 November 2023Global markets enter the new week in a risk on tone with as market participants are positioning for no more rate hikes out of the Federal Reserve and pricing in cuts from Q2 2024. In last week’s low volatility, holiday shortened week this translated to a steady rise in equities (DOW hitting 3-month highs), a steady decline in the US dollar (DXY hitting 3-month lows) and a multi-year low in the “fear index” with the VIX dropping to its lowest point since 2020.

With traders back at their desks and some key economic figures due this week we could see this narrative tested and likely see a bit more volatility in markets to finish the month off.

Charts to watch this week

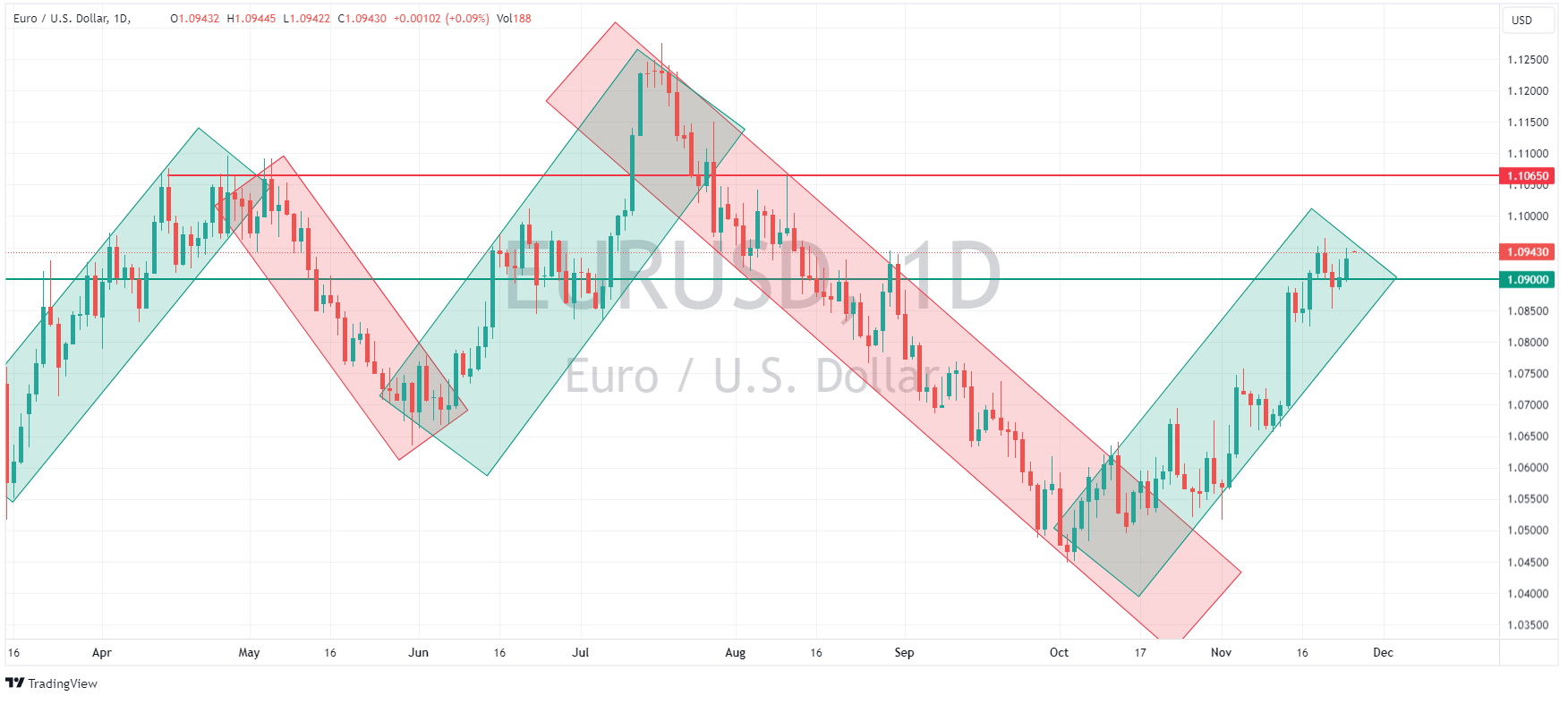

EURUSD

The Euro drifted higher against the USD last week, EURUSD still respecting its upward trend channel and managing to break and hold the psychological 1.09 level. In the week ahead we have some high impact inflation related figures for EURUSD traders to navigate. Starting with Spanish and German inflation on Wednesday and followed by the Feds favourite inflation gauge, the PCE reading on Friday.

Key levels this week in EURUSD will be the 1.09 level to the downside and the May and August resistance level at 1.1065 to the upside.

Source:TradingView.com

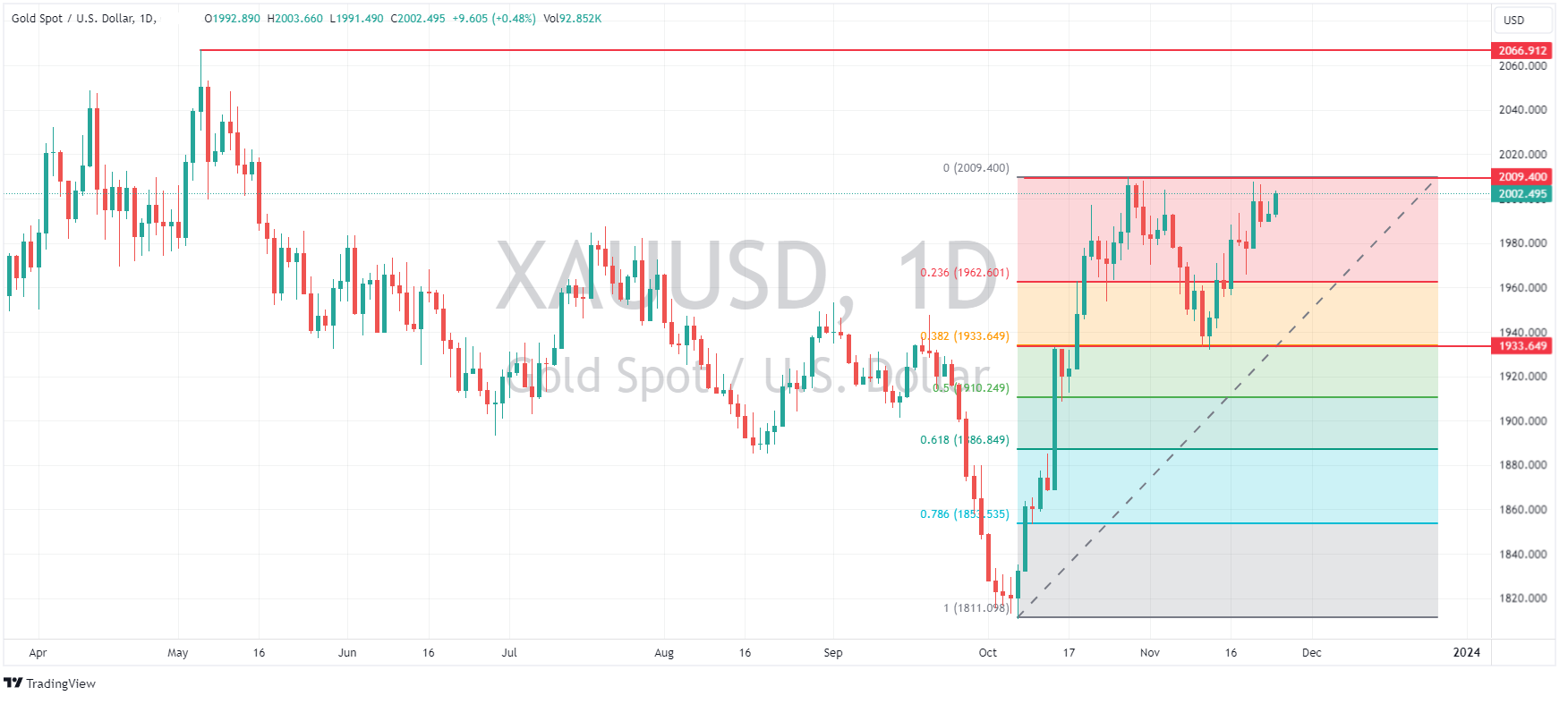

XAUUSD

Gold saw a positive week as the bulls took advantage of a weak dollar and were encouraged by US yields holding steady. XAUUSD made two attempts to breach the October high resistance at 2009 USD an ounce but was rejected both times. We enter the new week with XAUUSD again drifting higher to that level and it will be a key level to watch. If XAUUSD can take this level and get some support a test of the May highs at 2067 is the next obvious technical resistance level. If 2009 holds as resistance and XAUUSD is rebuffed again, the support at 1962 will be the key level to watch to the downside.

Source:TradingView.com

USOUSD

Crude Oil enters the week after another down week, making it five in a row to be sitting just above 75 USD a barrel. This week is an interesting one though with the delayed OPEC+ meeting taking place on Thursday. There is a possibility that Saudi Arabia and Russia could extend or deepen their voluntary curbs to support the crude price, there is also the (smaller) possibility that no changes are made, seeing further pressure on USOUSD that could see a test of the major support at 67 USD a barrel in the near future.

Source:TradingView.com

The weeks full calendar can be seen at the following link:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

PDD Holdings shares skyrocket as earnings top estimates

PDD Holdings Inc. (NASDAQ: PDD) reported Q3 financial results before the market open in the US on Tuesday. The Chinese company beat both revenue and earnings per share (EPS) estimates, sending the stock higher. Company overview Founded: 2015 Headquarters: Shanghai, China Number of employees: 12,992 (2022) Industry: Internet, Agricu...

November 29, 2023

Read More >

Previous Article

FX Analysis – EUR and GBP rally on PMIs, USDJPY tests key level.

Markets were predictably quite due to holidays in the US and Japan on Thursday. USD was marginally softer overall with DXY dropping to test the sup...

November 24, 2023

Read More >