- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

The Week Ahead – Powell and Jackson Hole, EU PMI’s, Japanese Inflation

21 August 2023Global markets enter the final full week of August on a downbeat risk-sentiment after another losing week in US equities saw the Nasdaq 100 have its lowest weekly close since June. The hangover from the surprise Fitch downgrade of US debt continues to keep yields elevated, the US 10 Year stubbornly holding above 4%, creating a headwind for risk assets which were also not helped by a hawkish read of FOMC minutes last week.

NDX100 approaching a key support trend line:

US 10-year treasury yields holding above 4% which has previously been a resistance zone.

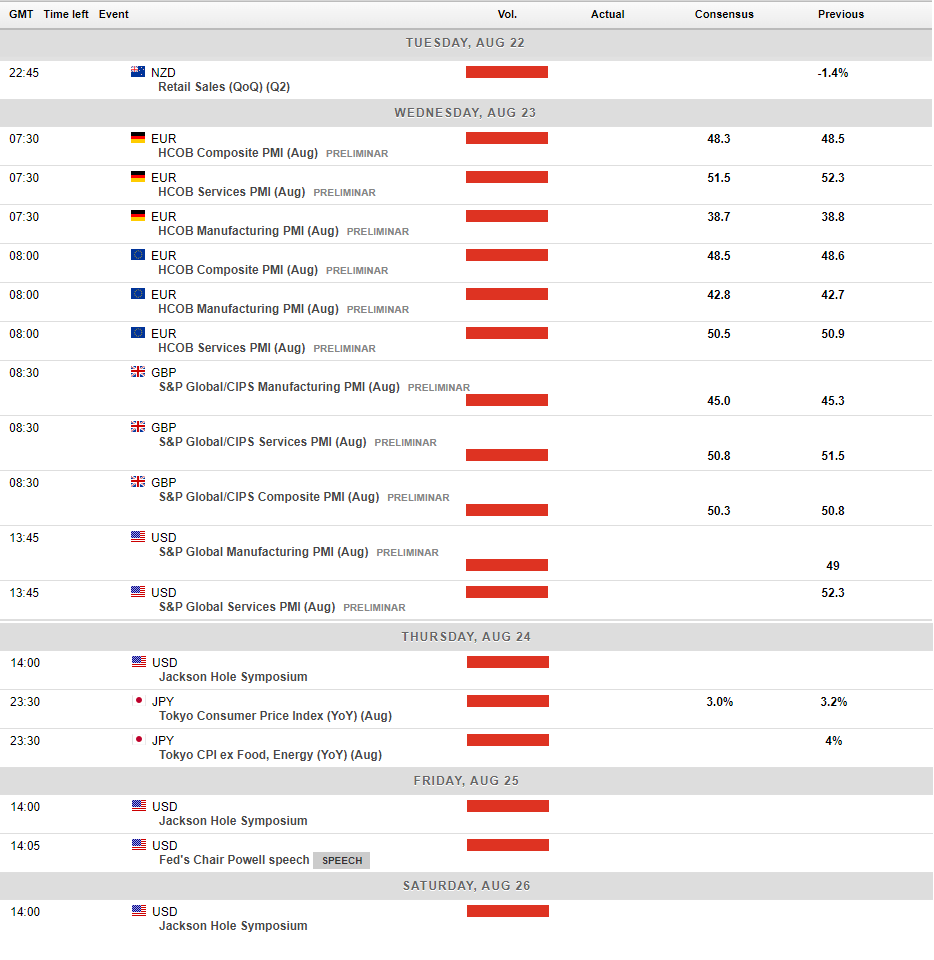

Looking forward at the week ahead, the key focus in the US next week will be on Fed Chair Jerome Powell’s speech at the Jackson hole symposium, which begins on Friday, and a slew of PMI data out of the UK and the Eurozone which will be key indicators of economic activity and inflation from those areas.

US – Fed Chair Powell to speak

With US Treasury yields remaining stubbornly high in the wake of the Fitch rating downgrade and ongoing strong US data has cast doubt on a pivot in FOMC policy anytime soon. Near time rate expectations have remained steady with the market pricing in around a 10% chance of a FOMC hike at their September meeting, the main change has come further down the curve where traders are not so confident in the prediction of when rate cuts will come.

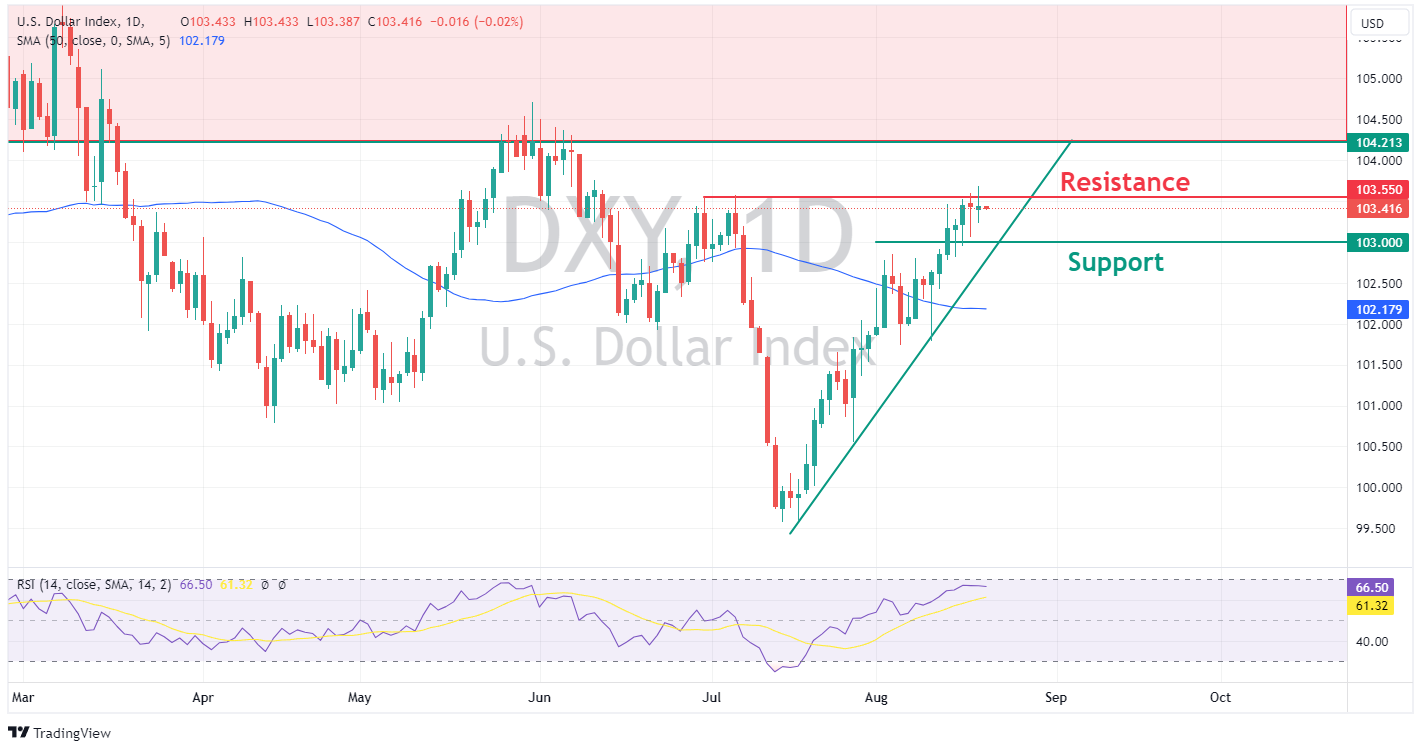

This hawkish re-pricing has seen the US Dollar Index continue its steep rally, with DXY testing the major resistance at 103.55, the July highs. This level will be key to a continued rally in the DXY, or again a turning point.

EU – PMIs and Lagarde

This week will see manufacturing and Service PMIs released from France and Germany all being key indicators of economic sentiment in the Eurozone after sliding in recent months. ECB President Lagarde is also due to speak at the Jackson Hole symposium a few hours after Jerome Powell, traders will be watching this one too for hints of how the ECB has interpreted these figures.

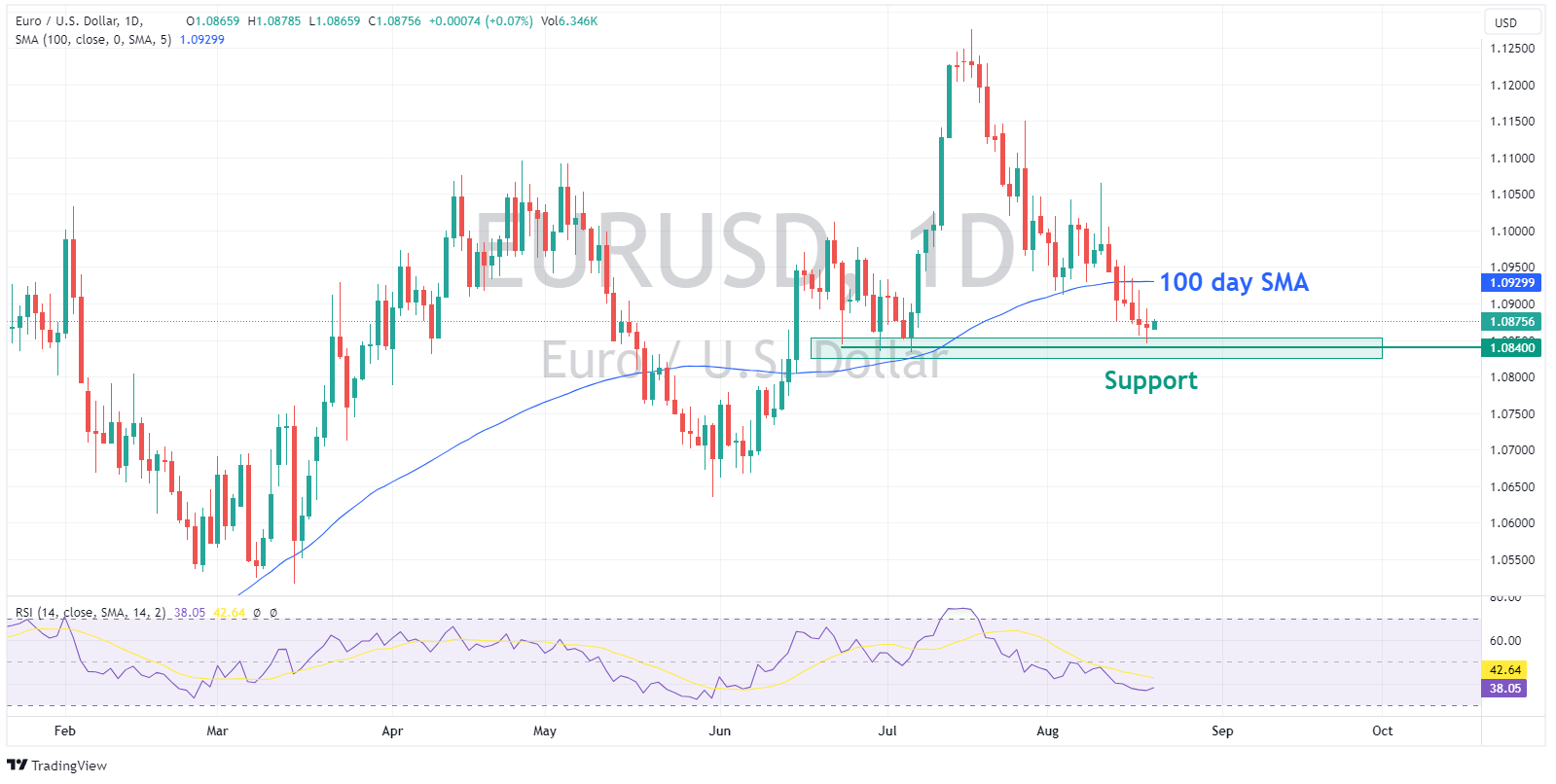

EURUSD continued its slide last week, breaking below the 100-day moving average before testing the major support at 1.0840, an area that saw a lot of chop in July before being a springboard for a significant move higher, and being the key level to watch this week.

Japan – CPI to show inflation likely steady

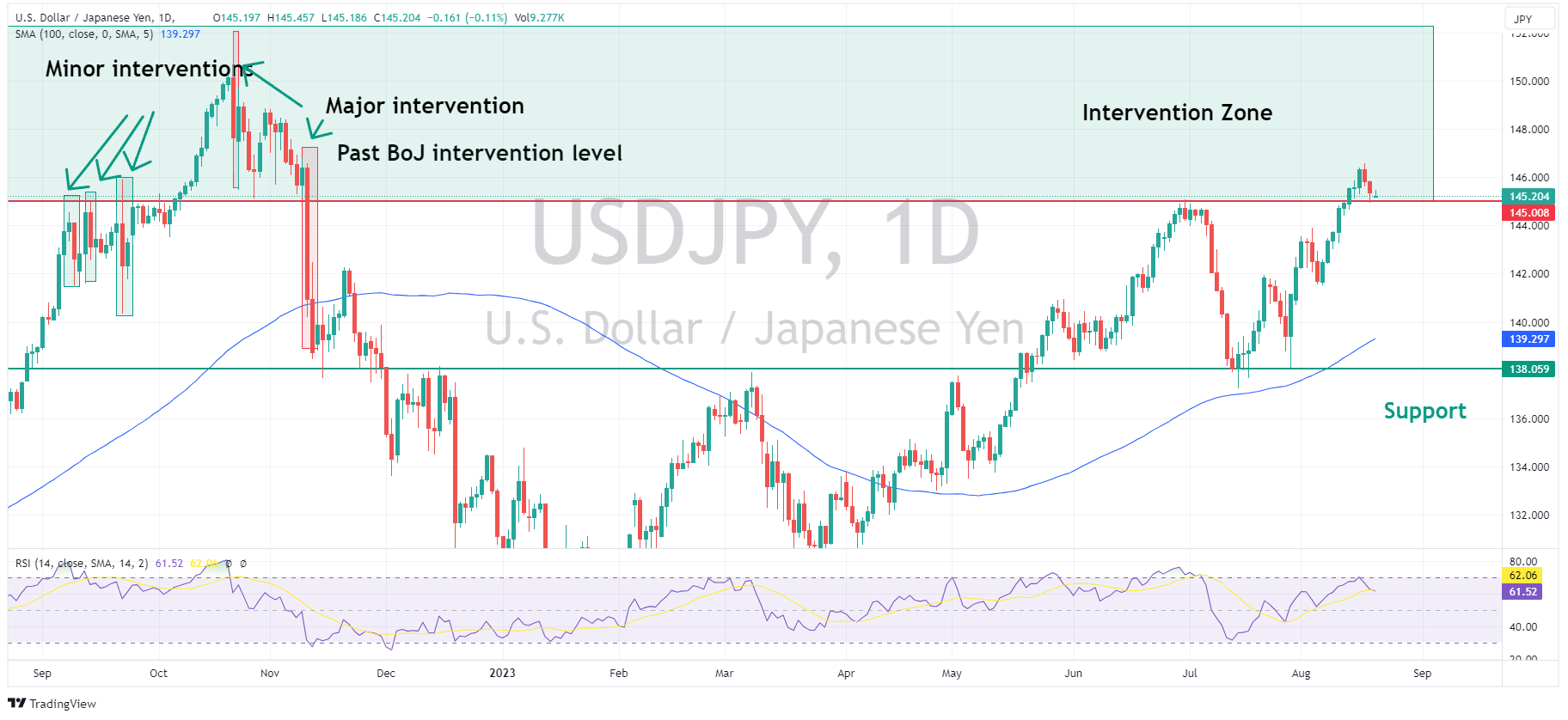

Tokyo’s CPI inflation released on Friday is expected to stay steady at 3%, with inflation staying in the 3% range and the big beat on Q2 GDP recently, the BoJ is likely to consider making further YCC policy changes in the coming months, especially as USDJPY continues to test their patience in the 145+ area. The continued weakness of JPY is a clear reflection of the yield gap between JGB’s and US Treasuries, though direct FX intervention is a possibility, any lasting effect on the exchange rate will need to be dealt with at the root cause, Japan capping their JGB yields with the YCC.

USDJPY is still above the “intervention zone” of 145 where the BoJ directly intervened in the FX market late last year, though did pullback somewhat late last week. This will be the key level this week, and a fascinating one to watch as the market continues to play chicken with the BoJ.

Full calendar of the weeks main risk events below:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Upcoming Nvidia earnings: Has the AI hype cooled?

Nvidia has been the star of the US markets since the AI hype kicked off late 2022. The trillion-dollar chip manufacturer’s shares have almost tripled in 2023 alone, with the price increasing every month so far this year. In May, Nvidia surprised the markets by posting earnings and revenue figures well above analysts’ expectations. This se...

August 21, 2023

Read More >

Previous Article

FX Analysis – CNH strengthens on intervention talk – JPY breaks losing streak – Gold breaks key support

FX WRAP USD was choppy with the US Dollar Index ending the session flat in range bound trade. Unemployment claims dropped to 239k from 250k the pri...

August 18, 2023

Read More >