- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

The Week Ahead – RBA and RBNZ rate decisions , US employment

3 April 2023US Stocks finished Q1 with a bang as Wall st wrapped up a volatile, and event filled quarter with Federal Reserve rate tightening, a banking sector panic spurred on by the collapse of Silicon Valley Bank and Credit Suisse.

The S&P 500 and Nasdaq were up 7.03% and 16.77%, respectively, for the first quarter. It was the best quarter since 2020 for the tech-heavy Nasdaq. The Dow ended the period with amore modest 0.38% increase.

The market got a boost Friday after the Fed’s preferred inflation gauge showed a cooler-than-expected increase in prices. The core PCE index, which rising 0.3% in February, less than the 0.4% expected by economists.

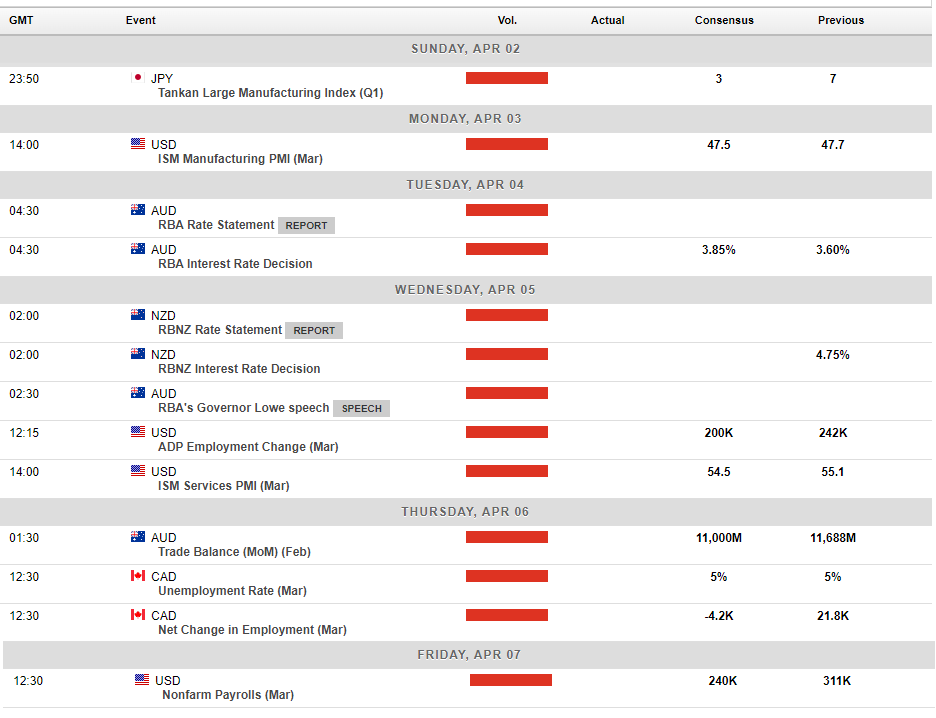

In the week ahead, the highlights will be rate decisions from the RBA and RBNZ on Tuesday and Wednesday, and also the US NFP employment report released on Friday.

RBA Decision

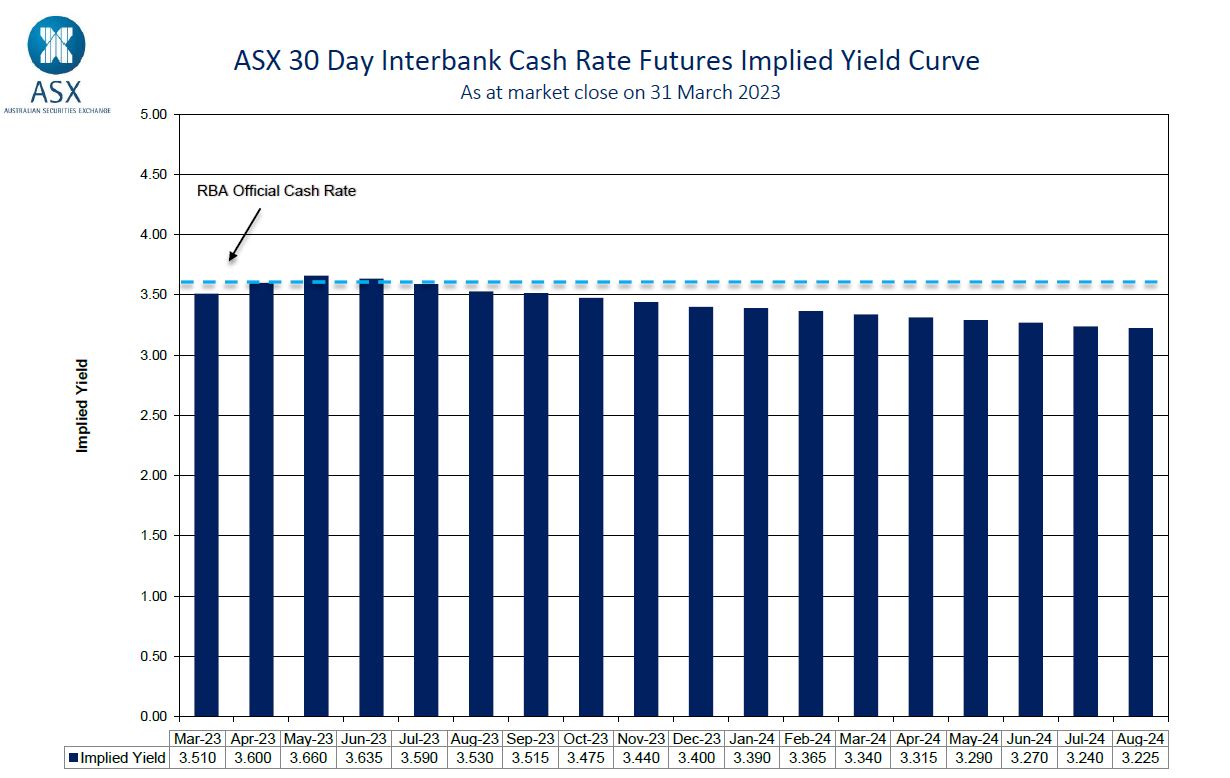

The RBA hinted at its last rate-setting meeting that it was looking at a possible pause in rates, since then we’ve had a softer than expected inflation figure which has seen the futures market fully price in a pause on Tuesday . Whether this marks the peak or a temporary pause will become clearer in the statement released with the rate decision, I wouldn’t be surprised to see a “hawkish” pause, one where the accompanying statement doesn’t rule out further rate hikes, that scenario should see the AUD get a short term boost.

RBNZ Decision

Across the ditch the RBNZ is expected to hike 25bp, NZ has had a mixed bag of economic figures lately, a weak GDP, House prices declining steeply counteracted by continuing strong employment and spending picking up. Like the RBA, the real volatility will come from the accompanying statement, as traders look for signals if there is more hikes to come or we are at the end of the tightening cycle from the RBNZ.

It’s important to remember that the NZD and AUD both trade as proxies for risk, so any move from these decisions will probably be short lived as other market forces take over.

US Employment

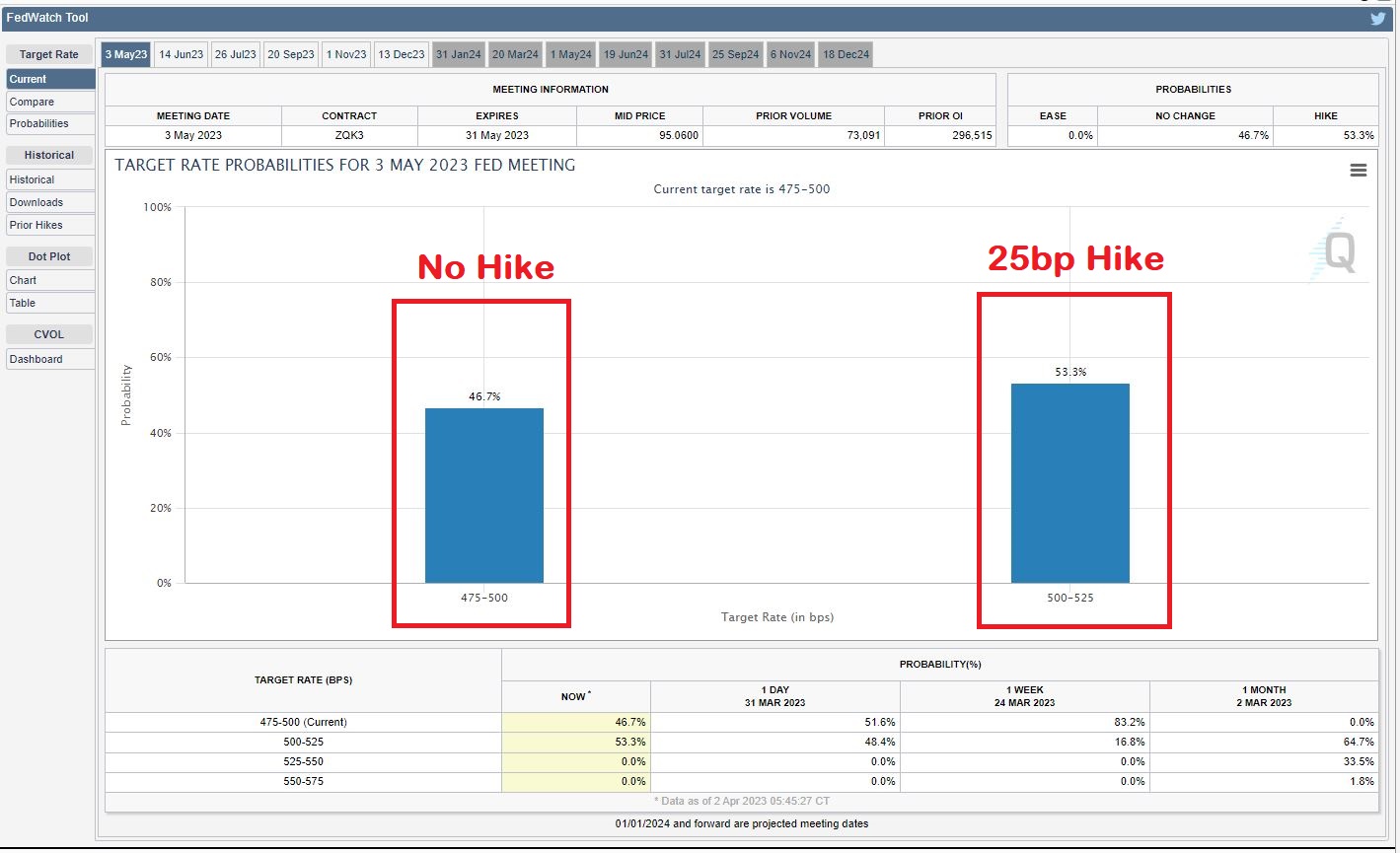

Friday we have the always exciting NFP. Rates markets are split 50-50 on whether the Fed will hike again at their May meeting so this figure will be closely watched and is pretty much guaranteed to cause some volatility in the FX markets. A figure on 235k new jobs is expected, you’d expect any reading that came close or higher would boost expectations of a hike and a push higher in the USD , a big miss would see the opposite as the pause odds increased, pushing the USD down.

Full calendar of the week ahead below:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Market Analysis 3-7 April 2023

XAUUSD Analysis 3 – 7 April 2023 The gold price trend can be viewed both positively and negatively in the short and medium term. As the closing of the Doji bar and last week's sell pressure bar indicate market hesitation. Although the previous week, gold has had strong buying momentum and has continued since the beginning of March. But ...

April 4, 2023

Read More >

Previous Article

USDJPY loses ground with Risk-On sentiment

The overall risk appetite in the market has increased this week following the news that the banking sector’s issues appear to have been resolved. As...

March 31, 2023

Read More >