- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

The Week Ahead- RBA, FOMC minutes and NFP headline

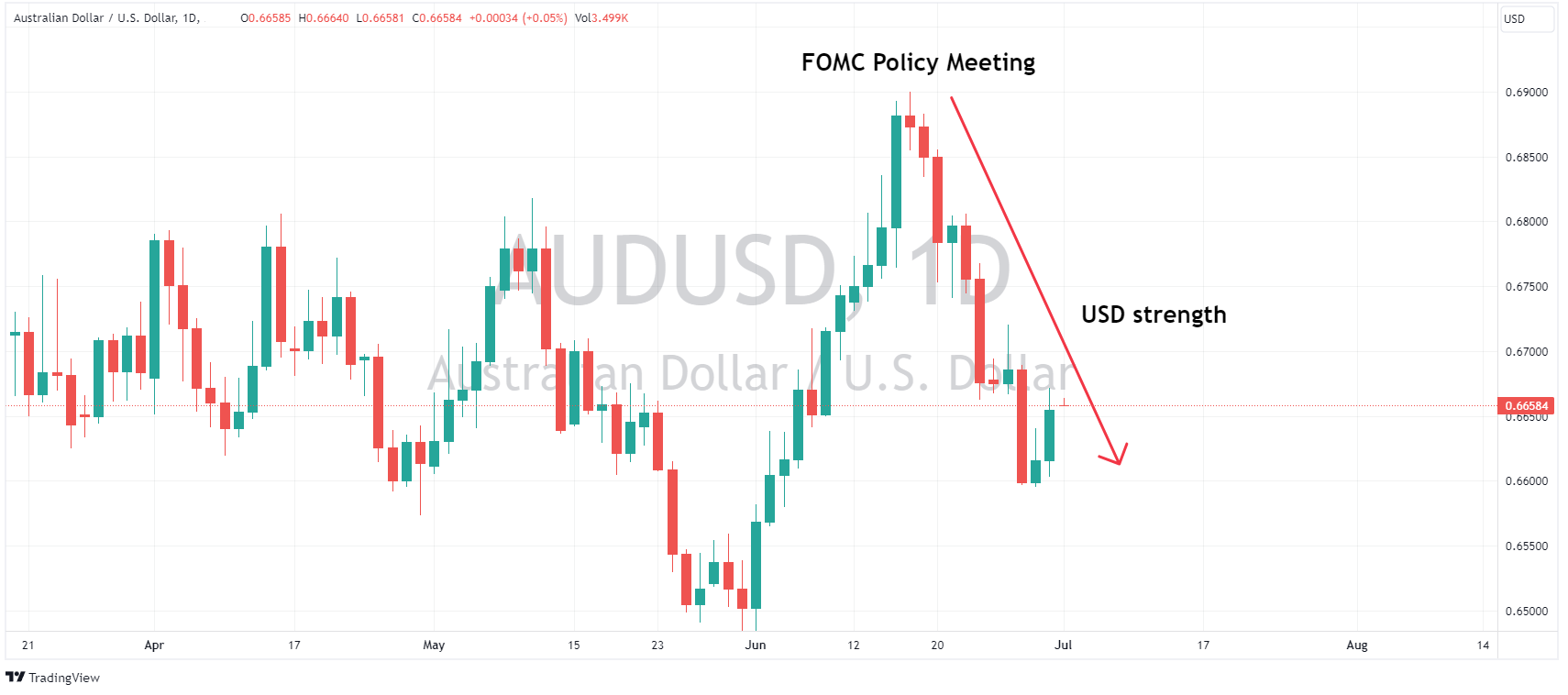

3 July 2023The FX market enters the new week after the USD has dominated for the last fortnight, reversing it’s early June weakness on the back of a Fed that has pushed back hard against markets pricing in a rate pivot, jawboning odds of a hike at their July meeting as almost now fully priced in. This week’s US data will play a big part in whether markets believe the Fed rhetoric or start re-pricing in a more dovish Fed again with some tier one data due to be released.

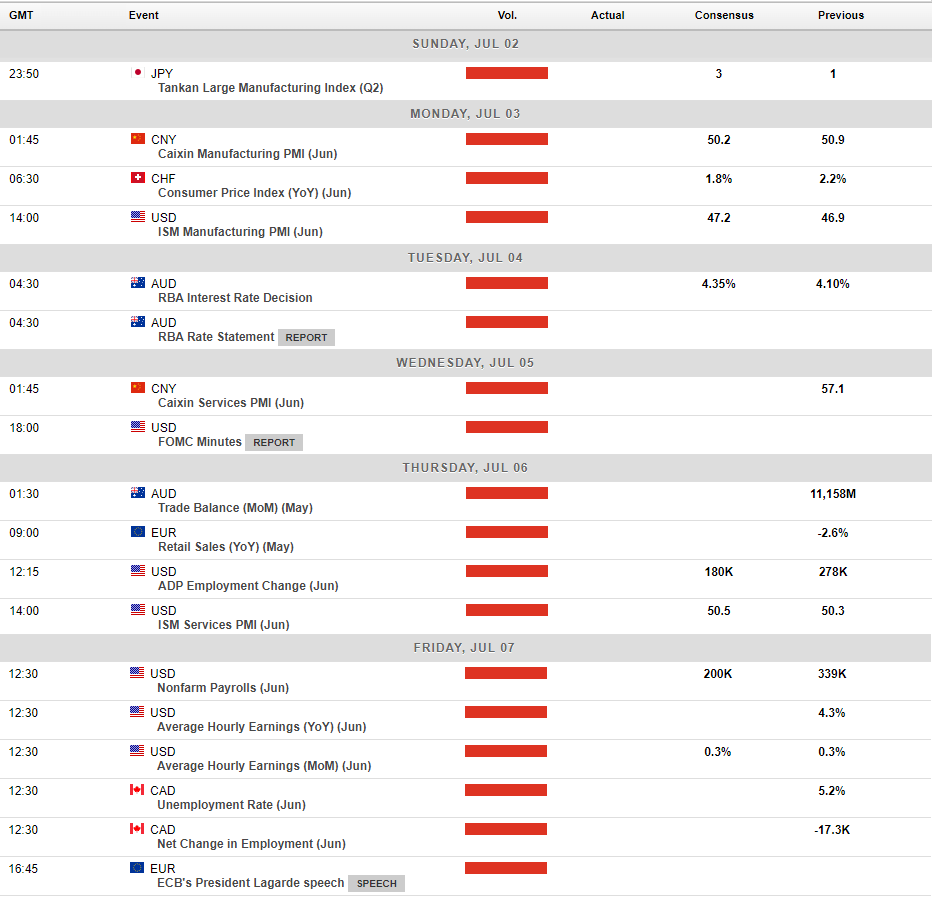

US – FOMC minutes to give more colour to Feds hawkish commentary – NFP jobs report.

USD strength has been fairly relentless after the FOMC rate monetary policy meeting on June 15th when the Fed held rates, as the market expected, but somewhat surprised to the hawkish side with a raising of its rate projections for 2023 via the Dot Plot and Chair Jerome Powell being fairly convincing the despite the pause, two more rate hikes would likely be needed to rein in inflation. Wednesdays FOMC minutes from this meeting will give USD traders important clues on just how close a decision this was and the thoughts of other Fed members.

Fridays Non-Farm Payrolls will also be big piece in the puzzle, the strength is the US Labour market has been a crutch the Fed has used to justify their tightening cycle, a drop in jobs created is expected from Junes big beat, but a figure well outside expectation (in either direction) will certainly see a market re-pricing of the Feds expected move in July and see some excessive USD volatility, NFP rarely disappoints for traders looking for volatility, so certainly one to watch.

Australia – RBA Policy meeting

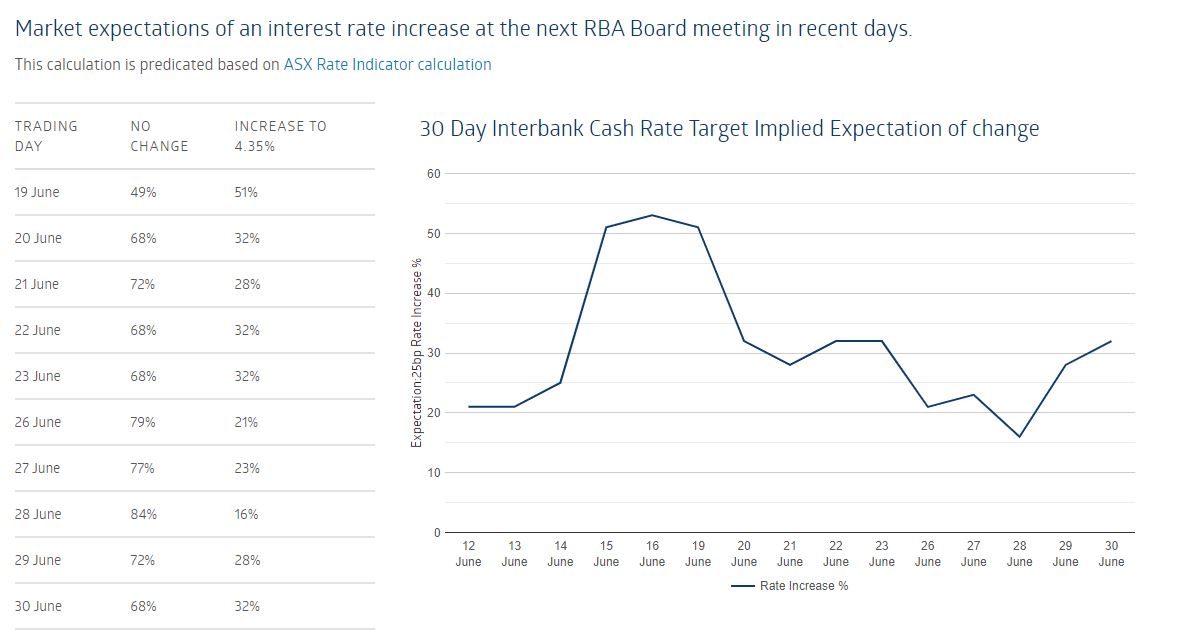

The other big main event for the week is the RBA cash rate decision on Tuesday. The futures market is currently pricing in a 32% chance of a 25bp hike from the RBA on Tuesday and with the surprises of the last two meeting where the RBA hiked against expectations it is certainly a possibility. However, the difference with this meeting is a surprisingly large fall in May headline CPI inflation to 5.6% year-on-year from 6.8% in April, and recent RBA minutes that showed June’s hike was very much a line ball decision, probably pushed over the line by the shock April CPI figure. Another hike here would seem odd with the recent inflation surprise to the downside.

Full Calendar of major economic releases below:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Could the RBA Surprise with another rate hike?

In June, the Reserve Bank of Australia (RBA) surprised markets with a decision to hike rates by 25bps, taking the Australian cash rate to 4.10%. This was decided on the basis that further increases were required to provide greater confidence that inflation would return to the target range within a reasonable timeframe. This decision led to the AUDU...

July 3, 2023

Read More >

Previous Article

USDJPY enters the intervention “danger zone”

USDJPY briefly pushed above 145 in today’s session before a sharp pullback, with traders wary of recent jawboning from Japanese officials regarding ...

June 30, 2023

Read More >