- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

The Week Ahead – US inflation, UK GDP headline, DXY and GBP outlook

7 August 2023Inflation readings are the main theme for this week in economic releases with CPI readings from the US and China the quarterly NZ inflation expectations all set to test traders’ predictions on rates from Central Banks who all seem to be on “data dependent” mode.

US: CPI and PPI readings

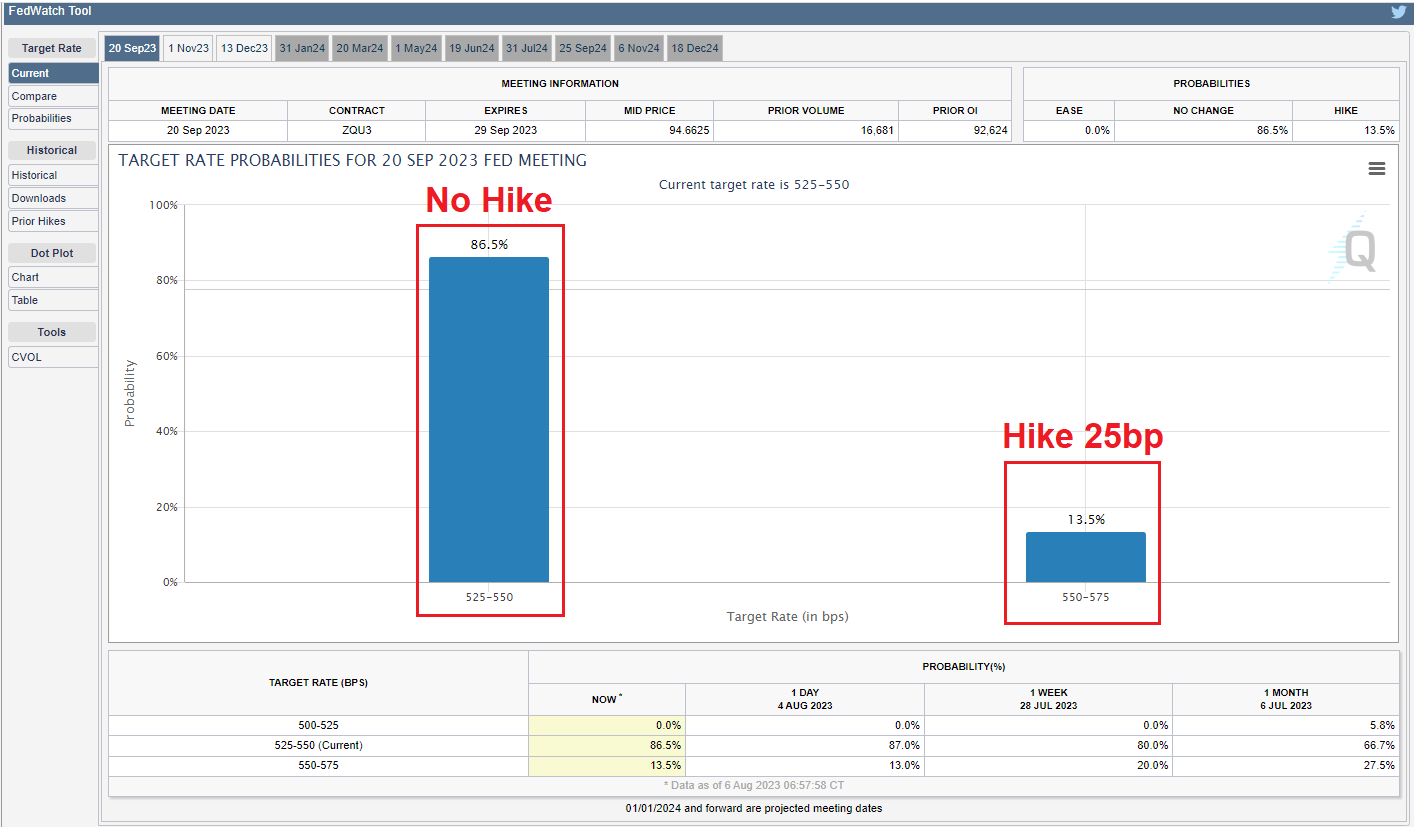

With a market split on the Fed’s next move in their September meeting this weeks CPI and PPI will go someway to making market participants minds up as to whether we’ve seen the end of the Fed hiking cycle or July’s hold was just a pause. With 10Y Treasury yields holding stubbornly above 4% arguments for an end to the Feds tightening cycle are growing, with Fed Fund futures reflecting this with current pricing showing only a 13.5% chance of a hike at the next FOMC meeting.

Source:CME Fedwatch tool

With a messaging from the Fed being on of future decisions will be data dependent, this week’s CPI and to a lesser extent PPI could either shore up the no hike odds or move the split closer to a 50-50 shot with accompanying volatility in the USD and US equity markets. Fed will be focused on the month-on-month readings which are expected to come in at 0.2% for headline and core for both CPI and PPI, this is needed at a minimum for a while to bring inflation back to the 2% Fed target. A hot reading would certainly see hike odds in September tick to the upside.

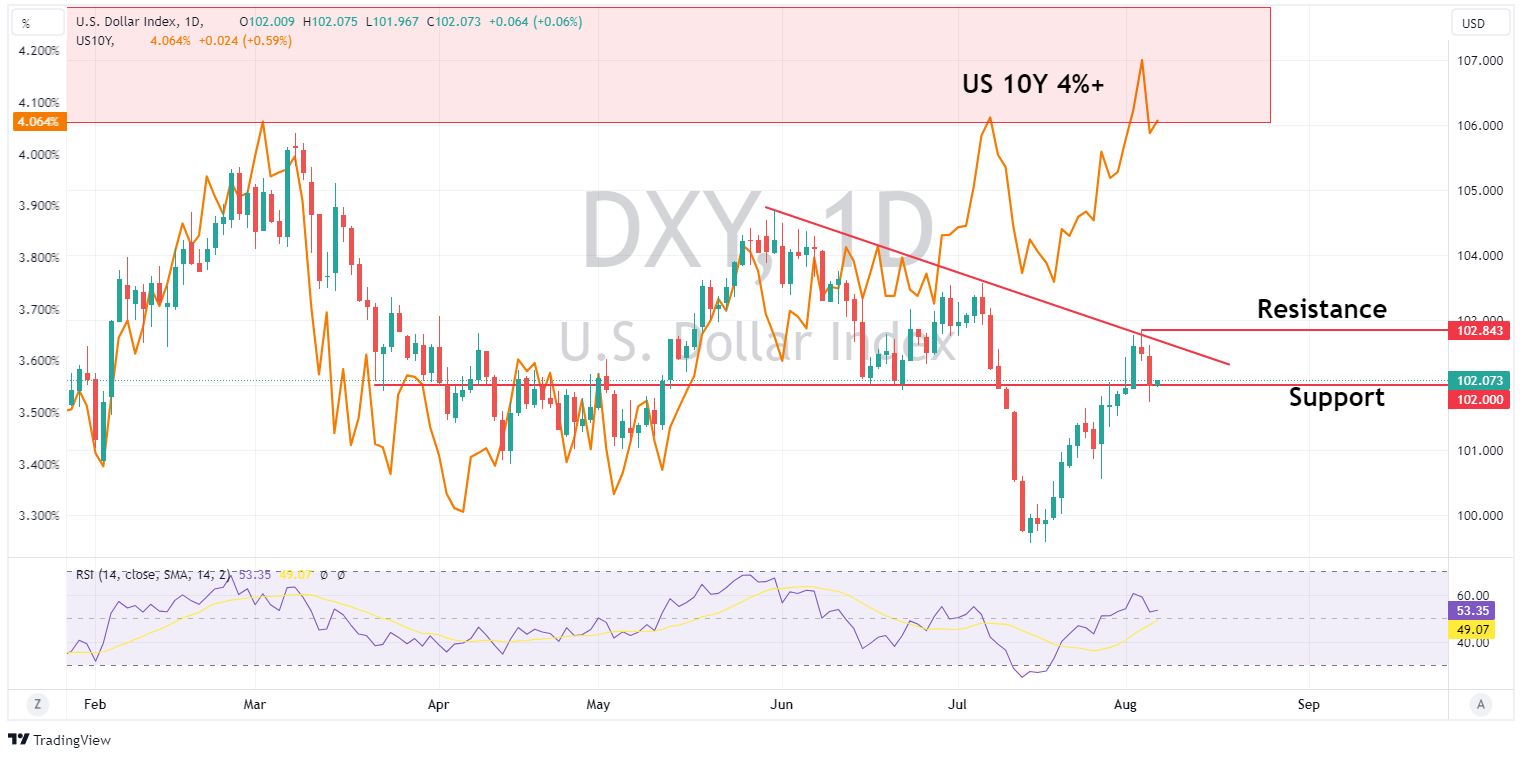

DXY has seen a resurgence since mid-July, rallying strongly from an extreme oversold level to reclaim the big figure at 102, this will be a key level to watch, with 10y yields over 4% and looking to be topping out, further upside on the USD will be tough going and anything less than a hot CPI will likely see a pullback in DXY.

UK: GDP predicted to show a modest increase for Q2

UK GDP for July released on Friday is expected to show the UK economy growing by 0.2% after June’s contraction. While promising news for a struggling UK economy, it should be of little consequence for rate hike/hold expectations from the Bank of England. The Bank has made it clear that it is looking at services inflation and wage growth and not a lot else in its data-dependent mode.

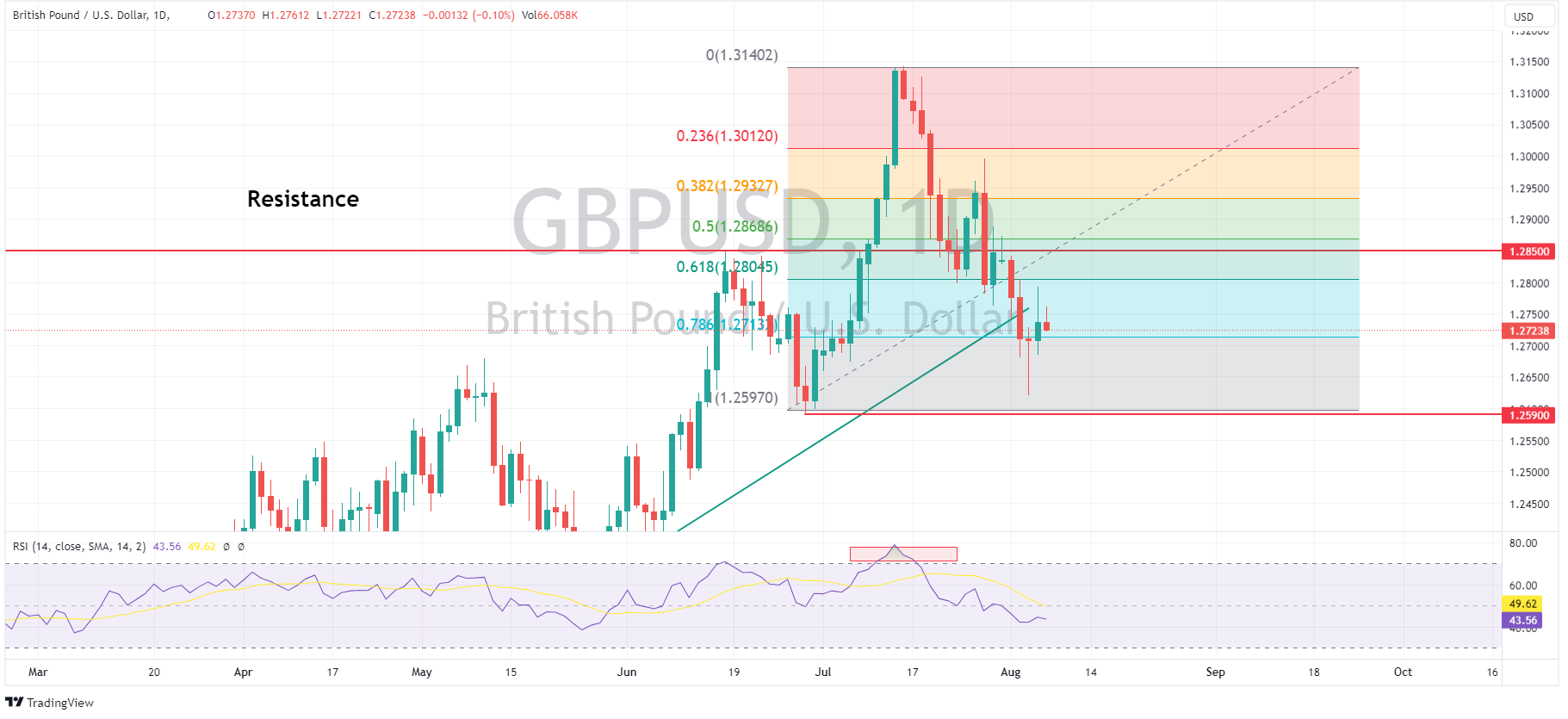

We could still see some action in GBP though, GBPUSD has suffered recently, pulling back a full 100% on the Fibs from its lows at the end of June to the Mid-July highs before finding some buyers. Levels to watch will be the 100% Fib level at 1.2590 and the June highs at 1.2850, Cable would need to break and hold this level to see a new possible leg up.

Weeks Calendar:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

$APPL: Apple finds key support after August sell-off.

Apple has had a spectacular start to 2023, locking in 7 consecutive positive months and putting in an increase of 52.16% year to date at its peak. However, August so far isn’t looking as healthy. Despite the positive financial performance beating Q3 earnings expectations, Apple shares are down 8.48% for the start of August. Profit taking aft...

August 9, 2023

Read More >

Previous Article

Non-Farm Payrolls Preview – Charts to watch – DXY – US10Y

Todays NFP figure out of the USA is shaping up to be a pivotal moment in market expectations as to whether we’ve seen peak rates from The Federal Re...

August 4, 2023

Read More >