- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

US equities mixed but hold post-Powell gains ahead of today’s NFP report

2 December 2022After Wednesday’s explosive up move on what was seen as dovish comments from Fed chair Jerome Powell, Thursdays US session was more of a consolidation ahead of today’s all-important NFP figure.

Us indexes were mixed, with falling treasury yields favouring Tech and hurting banks , seeing the Nasdaq as the only index to eke out a gain for the session.

The S&P 500 did manage to hold the important 200 day Moving Average which it surged through on Wednesday, this has been stiff resistance on previous rallies and bodes well for market bulls.

US 10 year yields continued to tumble as the market dovishly re-prices Fed interest rate expectations, sinking below 3.5% at one stage in the session and putting pressure on the USD.

This drop in treasury yields saw a big win for precious metals with Gold and Silver soaring, XAUUSD breaking through the psychological 1800 level and testing the resistance from the highs set in August.

Bitcoin tested the top of its $16k – 17k range, which it has been meandering in since the FTX fraud shock in November.

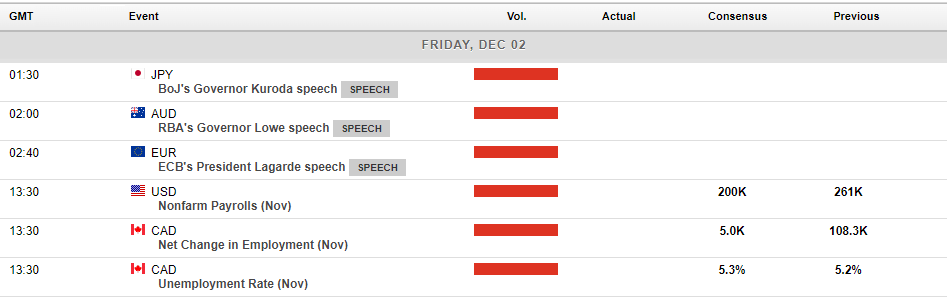

Today’s economic announcements will be dominated by the Non-Farm payroll report released an hour before the US stock market opens. A strong figure of 200k new jobs created has been forecast, but some pundits are predicting a much lower figure based on the way the rates markets are trading and other indicators, if that comes to pass expect a steep rally in equities on the “bad news is good news” narrative.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Hold up, the ASX200 is only 4% off its all-time high

It has been a tough year for the stock market in 2022 with a war in Eastern Europe and record high inflation have dominating the news. Furthermore, the drop in growth assets has been spectacular. Bitcoin has capitulated by almost 77% and the once exuberant technology sector has suffered some of its worst losses in years, with the FANG stocks droppi...

December 2, 2022

Read More >

Previous Article

Salesforce tops Q3 estimates, Co-CEO steps down

The world’s leading customer relationship management company Salesforce Inc. (NYSE: CRM) announced its latest financial results after the market clo...

December 2, 2022

Read More >