- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

US Markets finish mostly down in quiet session as Big Tech drags down the Nasdaq

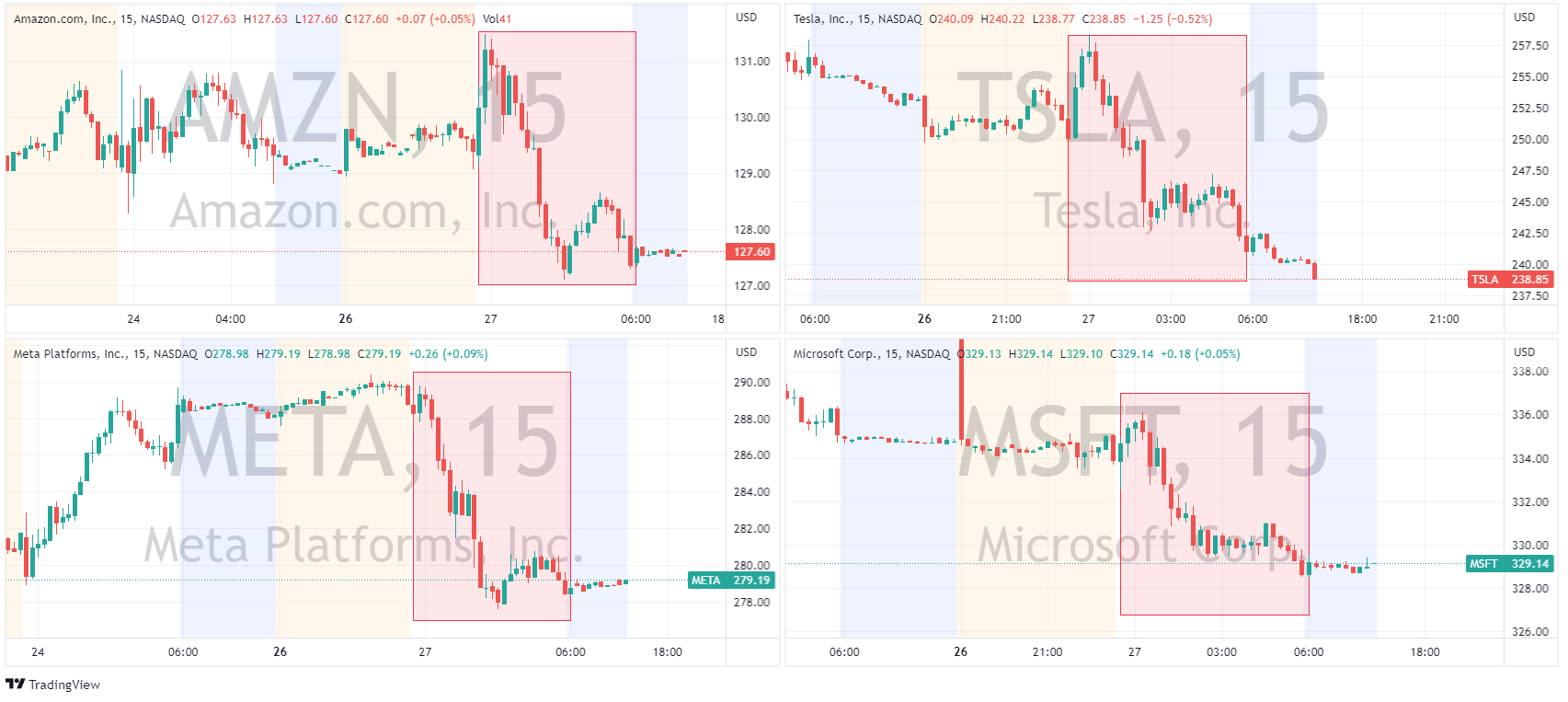

27 June 2023US Indices were mixed to start the week in Monday’s session in a low volatility session, Big Tech gave back some of their recent gains with a major pullback in Tesla (-6% on a Goldman Sachs downgrade) and Meta, Amazon and Microsoft all falling 2-3% saw the Nasdaq down over 1% to be the worst performing index.

The Russell 200 was the only major index to finish in the green, with a bounce in regional banking helping to lift that index seeing the Nasdaq 100 / Russell 2000 ratio again find stiff resistance at 8.2, a level that historically indicated Tech being overvalued to the broader market.

FX Markets

USD was flat to start the week in a thin session with a lack of any real news flow, the US Dollar index trading within a tight range, highlighted by a low of 102.610 and a high of 102.830 as traders await a slew of central bank speakers and US data in todays session which should see some more volatility.

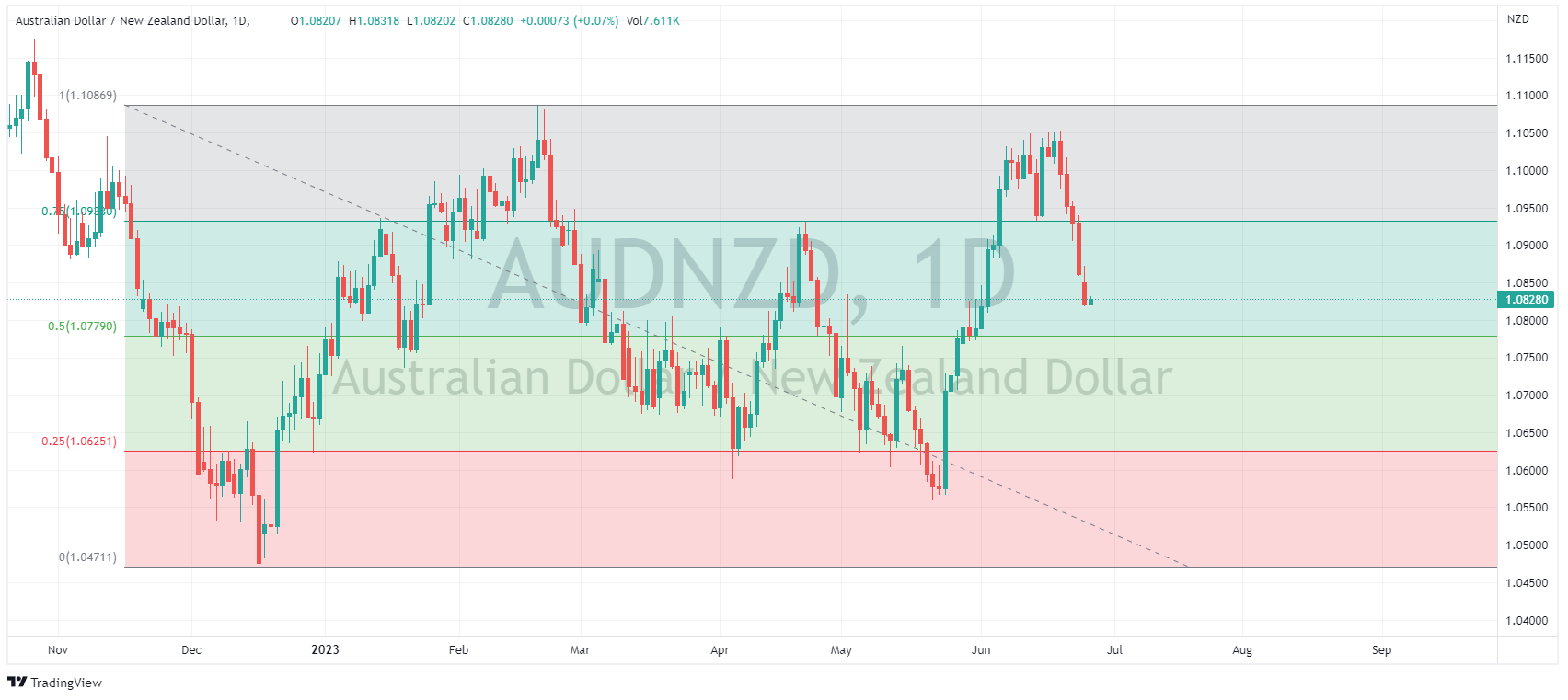

NZD was the G10 outperformer while the AUD was flat against the USD. NZD saw tailwinds after New Zealand’s Trade Minister said he had positive discussions with China on joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). NZDUSD hitting a high of 0.6177 and seeing the AUDNZD take a leg down and looking to test the 1.08 level.

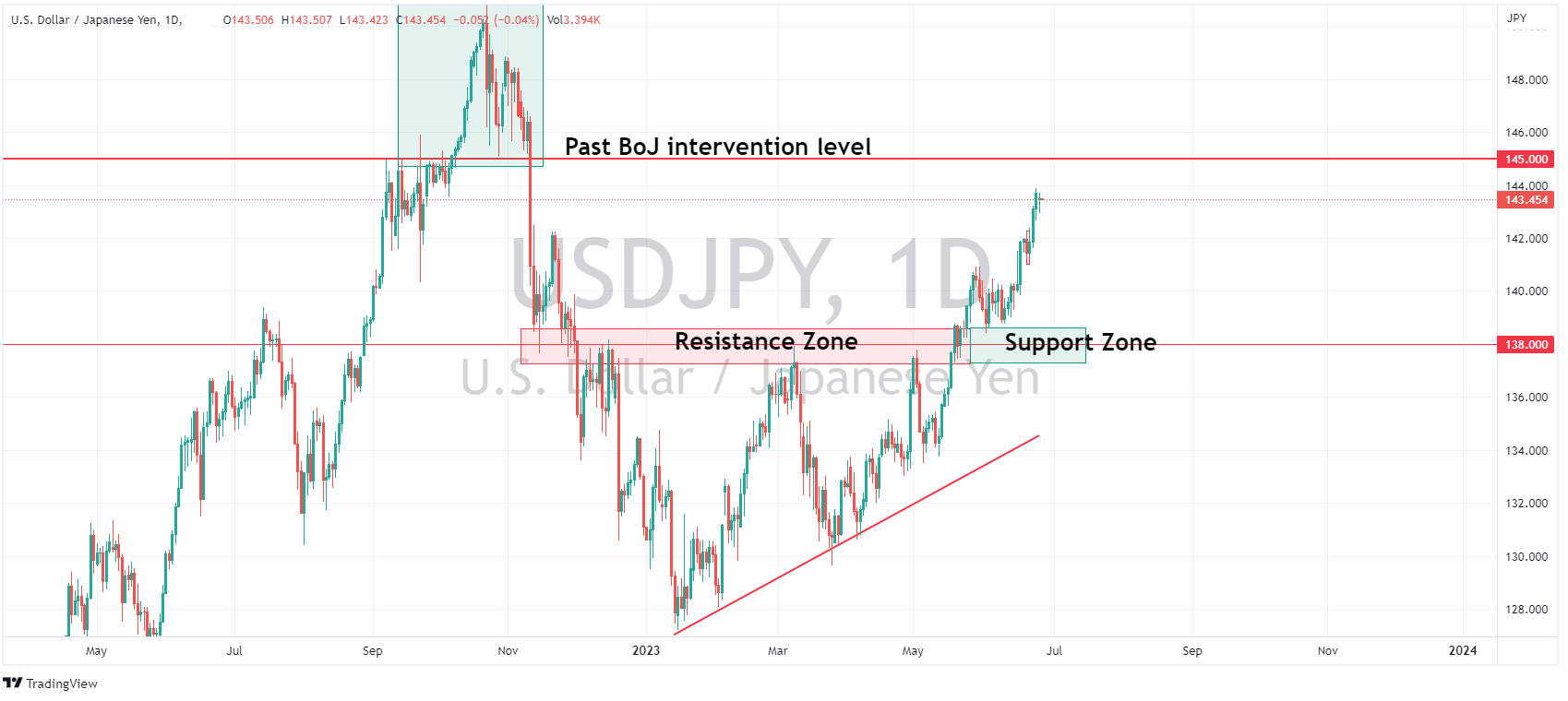

Safe-havens, CHF and JPY, were both marginally firmer against the USD. The recent slide towards 145 halted in USDJPY as comments from Secretary Matsuno and BoJ member Kanda regarding their displeasure at the one-sided trading of the Yen raised the specter of FX intervention (which the BoJ is no stranger to)

EUR was more-or-less flat as EURUSD traded between 1.0888-0920, with the single-currency briefly losing grip of the psychological 1.0900 level on the back of a bleak German Ifo survey and downbeat accompanying commentary. A late session rally did see EURUSD reclaim it , though as support it would be best described as precarious and is shaping to be a key level in the short term.

Gold tested the lower band of its recent range at 1933 to the upside in an attempt to re-enter the range. XAUUSD found some stiff resistance though, with the up move halted, and gold settling below the range where 1933 is shaping to have switched from support to resistance.

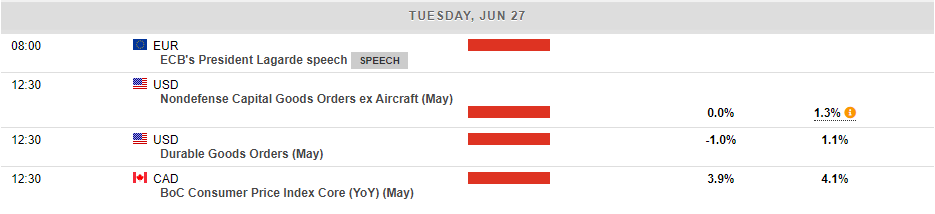

Tuesdays calendar is a little busier with Canadian CPI, US Consumer data and an appearance from ECB President Lagarde.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US Markets rally strongly after strong data and big tech rebound

US indices bounced back strongly in Tuesday's session as the yesterdays losers in big tech became the winners as strong data encouraged traders to buy the dip. MSFT, AMZN, META and TSLA all posted strong sessions after Mondays sell-off, helping the Nasdaq to outperform, finishing up over 200 points or +1.65% Risk sentiment was spurred by str...

June 28, 2023

Read More >

Previous Article

The Week Ahead – More Fed speak, Inflation and the Charts to Watch, AUD, USD, JPY, BTC

Despite a pull back last week, Global markets are coming into the last week of June and marking the half year point on an impressive run, with the Nas...

June 26, 2023

Read More >