- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

US Markets Rise Ahead of GDP, Tech Outperforms, USD higher on JPY dip

30 March 2023US Stocks were firmer on Wednesday, with a reversal of yesterday’s session with Tech leading the charge higher the recent rise in bond yields lost some momentum , the Nasdaq 100 was up over 200 points and has now entered a technical bull market, rising 20% from its December low, while the S&P500 closed above its 50dma for the first time since March 6th.

Most of the flow into tech went into the mega caps , with Meta , Google ,Microsoft and Netflix all having big up days.

In FX markets the USD was mostly firmer despite improving risk sentiment, This improving risk sentiment did see an unwinding of safe haven flows into the JPY, which saw the USDJPY rally strongly which gave the USD a tailwind across the board.

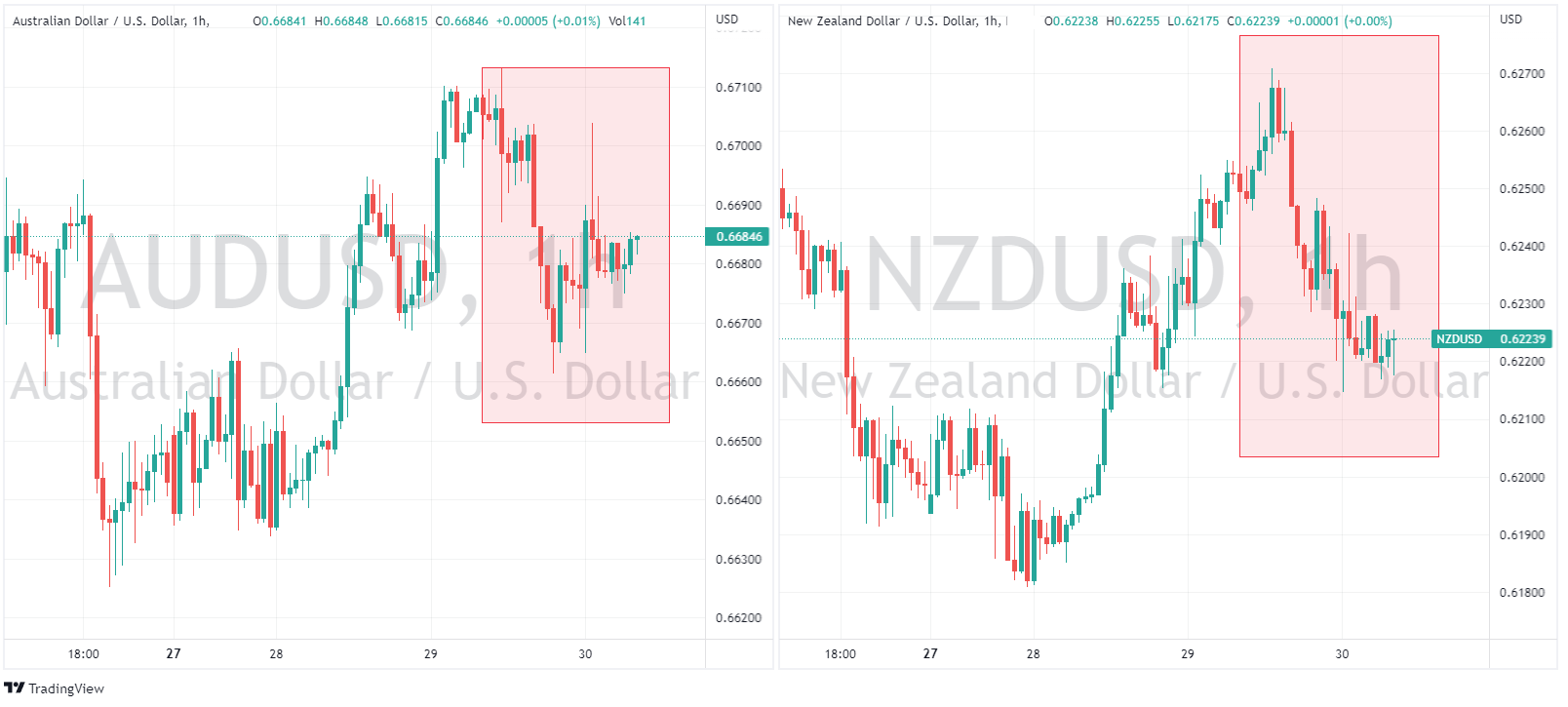

The AUD and Kiwi dollars were the next worse performers, the Aussie dragged down by a cooler than expected CPI figure yesterday, seeing further market pricing of a pause at next weeks RBA meeting.

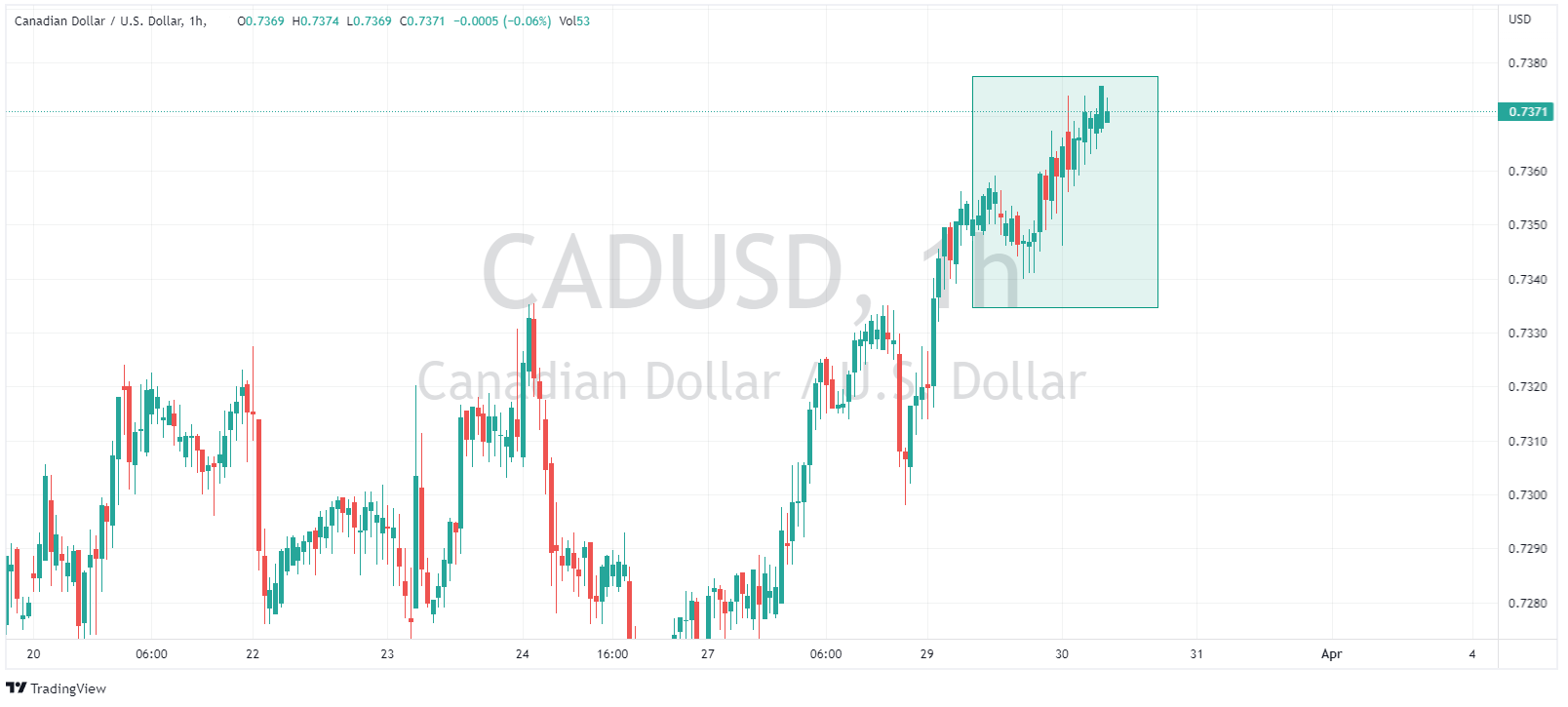

The outperformer was the Canadian dollar, given a tailwind by a rebound in oil prices and comments overnight from the Deputy Governor of the BoC regarding their QT programme.

In commodities, gold was down slightly, but held up pretty well considering USD strength and an improvement in risk sentiment, finishing the day above $1960 USD an ounce.

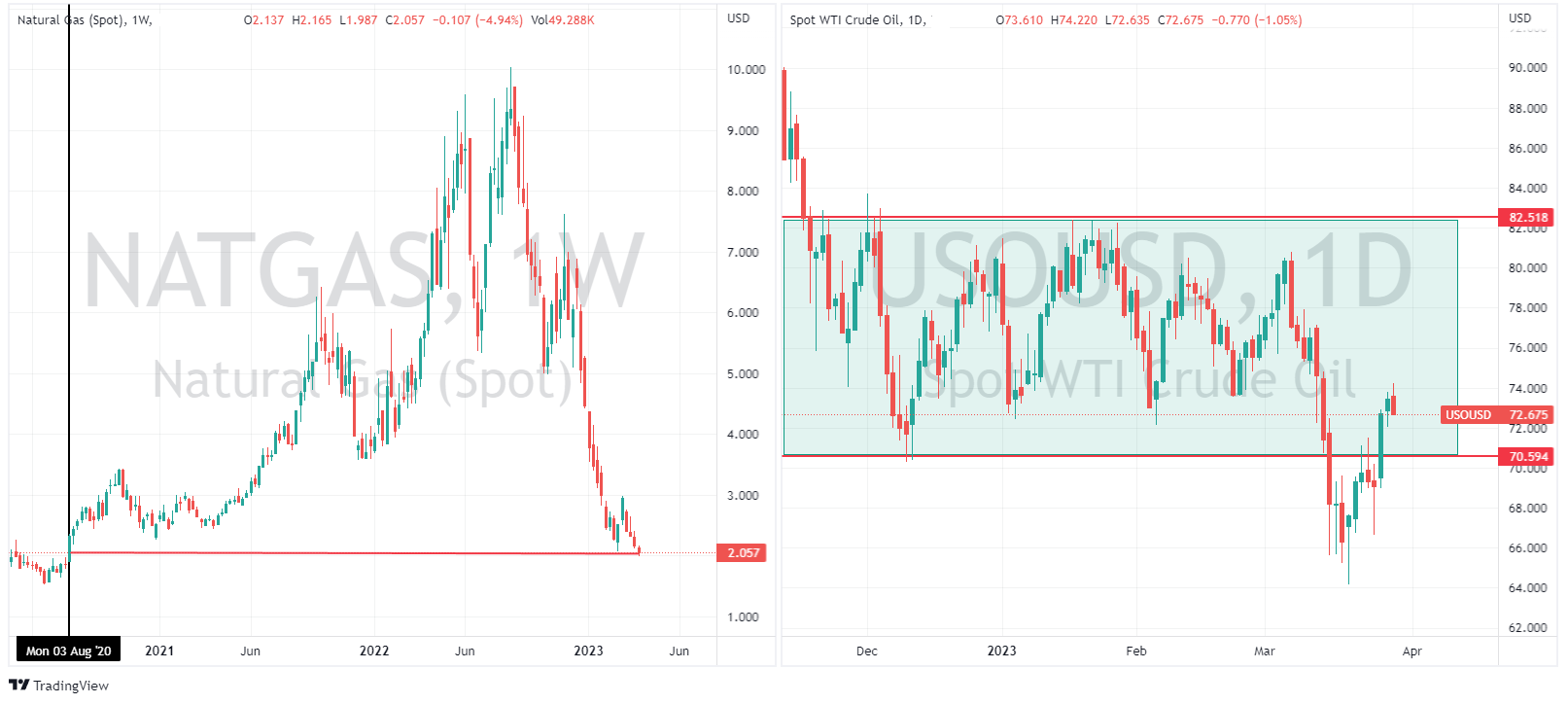

Natural gas continued it’s downtrend, hitting lows not seen since 2020 and Oil after a week-long bounce, ended lower despite a large inventory draw, dropping back to a $72 handle.

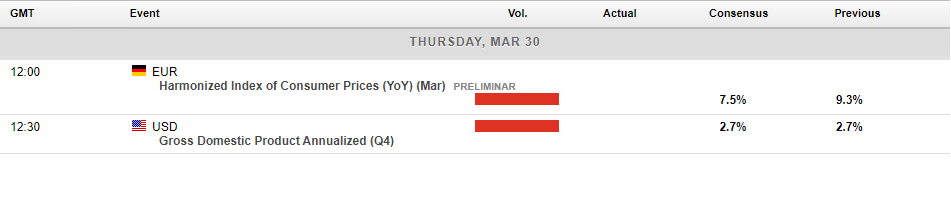

In economic announcements, later today we have the US GDP figure released, this will be an important one to gauge how resilient the US economy has been in the face of the Feds aggressive rate tightening cycle and should get the FX markets moving.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US Stocks Rally on Economic Data and End of Quarter Flows Ahead of PCE Reading

US stocks rose again in Thursdays session on a mixture of “bad news is good news” and end of quarter flows as fund managers did some window dressing on their portfolios. The bad news was a rise in unemployment claims to 198k for the week, and a US GDP figure that came in below expectation at 2.6%. We also had a couple of Fed speakers that cause...

March 31, 2023

Read More >

Previous Article

Lululemon tops estimates – the stock is rising

Lululemon athletica inc. (NASDAQ: LULU) announced Q4 and full-year earnings results on Wednesday. World’s second largest sporting goods company r...

March 30, 2023

Read More >