- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

US stocks lift off after Bostic comments, EU sees record inflation print driving bond yields higher

3 March 2023A strong US labour market figure , unemployment claims dropped to 190k when 196k was expected, in combination with a record high Core CPI figure out of Europe saw the US equity session get off to a rocky start as bond yields soared.

That all changed later in the session as a Bloomberg headline hit with comments from Fed member Bostic.

Which saw an instant reaction in stocks which rallied steeply, sending the Nasdaq back above it’s critical 200 day moving average support level.

Interestingly, a pause in rates in July was already priced in by Fed fund futures, and Bostic isn’t even a voting member which I think shows how desperate the bulls seem to be for any perceived “dovish” tone from the Fed to kickstart another up move in equities.

In the Eurozone, CPI figures came out hotter than expected, with the Core reading hitting a record high, this sent terminal ECB rate expectations to 4.00% for the first time. The reaction in the Euro was muted though, these higher readings seemingly did not surprise FX traders after hot German, Spanish and French CPI figures already released earlier in the week.

The EURUSD briefly rallied before resuming its downtrend, breaking through the 1.06 level.

Gold limped lower in the face of a stronger USD , still holding below it’s 23.6 Fibonacci retracement level which has proven to be stiff resistance since mid February.

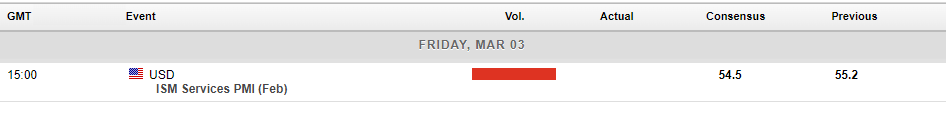

In major economic announcement coming up, only the US ISM Services PMI looks likely to move the markets. As any figure recently that has anything to do with inflation and business activity, this one will be closely watched.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

USDJPY – Bank of Japan Policy Decision & the 10-yr JGB Yield

The USDJPY had been trading steadily higher in February, from the 128.50 support level, up toward the 137 round number resistance level. This move was driven by a combination of fundamental reasons (strengthening of the DXY and overall weakness of the Japanese Yen) and technical setup (the golden cross, where the 50-period Moving Average crossed ov...

March 6, 2023

Read More >

Previous Article

US Stocks Mixed in Choppy Session Driven by Data and Fed Speakers

US stock indexes went on a rollercoaster ride in their Wednesday session after weaker then expected US ISM and Manufacturing PMI figures were offset b...

March 2, 2023

Read More >