- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

US Stocks lower in quiet US Session, Tech Underperforms on Higher Yields, Gold Finds Support

29 March 2023US stocks declined modestly in a fairly quiet session with most of the downside coming from Tech stocks whose future valuation become less attractive as bond yields rose, with the Nasdaq finishing down almost 0.5% while the Dow and S&P 500 were almost unchanged.

The only real news out overnight was US consumer confidence which rose to 104 from the previous 103 reading which showed the resilience of the US consumer and supported stocks somewhat.

FX markets saw the USD drop against most of its peers in a quiet news flow session, the Euro held above the 1.08 USD level, Cable was supported by the weak dollar, AUDUSD gained on a weak dollar and gains in iron ore while the Kiwi saw similar gains on improved risk sentiment, seeing the AUD/NZD remain mostly unchanged. The outlier was the Swiss Franc which was the big underperformer for the day as the Credit Suisse collapse still weighs on it.

In commodities, gold gained on a weak dollar after finding support at the 1950 level, WTI oil rallied as well on easing of banking fears and ahead of tonight’s inventories, Oil has pushed back into its 2023 range that was broken to the downside after the banking issues we saw over the last couple of weeks.

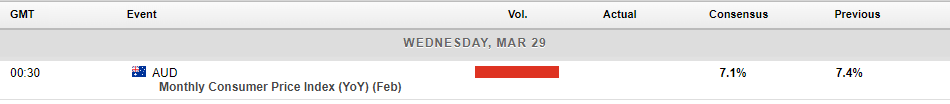

In economic announcements today we have the Australian CPI figure at 11:30 am Sydney time, the futures market is currently pricing in a pause from the RBA at their next meeting, so a hot print here could see a repricing of those odds and see some volatility in the AUSUSD at the release.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Lululemon tops estimates – the stock is rising

Lululemon athletica inc. (NASDAQ: LULU) announced Q4 and full-year earnings results on Wednesday. World’s second largest sporting goods company reported revenue of $2.772 billion for the quarter (up by 30% year-over-year or 33% on a constant currency basis) vs. $2.701 billion estimate. Earnings per share (EPS) also topped analyst expectatio...

March 30, 2023

Read More >

Previous Article

Walgreens Boots Alliance beats Wall Street estimates

Walgreens Boots Alliance Inc. (NASDAQ: WBA) announced the latest financial results before the market open in the US on Tuesday. The company beat bo...

March 29, 2023

Read More >