- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

US stocks mixed in choppy session amid an OPEC+ surprise and weak manufacturing data

4 April 2023Markets on Monday opened to the news of a surprise OPEC+ Oil output cut seeing WTI oil gap open over 5% that along with weak manufacturing figures out of the US saw a whipsawing session in equities, the Dow did finish strongly though, up over 300 points, dramatically outperforming the Nasdaq by the most since October last year, the tech heavy index finishing in the red by about a quarter of a percent.

The DOW was helped along by outperformance of energy stocks, with Dow component Chevron rallying over 4% on the OPEC news, while market uncertainty saw investors rotate from the more risk sensitive growth stocks listed on the Nasdaq.

The big news of the day was the surprise oil output cut from OPEC+ after they announced on Sunday that they would be cutting daily production by more than 1 million barrels a day starting in May and running until the end of the year. This sent WTI crude surging past 80$ a barrel and hitting it’s highest point since January this year and back to the highs of it’s 2023 trading range.

This also makes the Feds job a bit harder, as the spectre of higher oil prices will likely end in higher energy costs which will in turn fuel inflation which could lead to a more hawkish Fed, rate hike odds for the May meeting increased to 56% from the 53% previously.

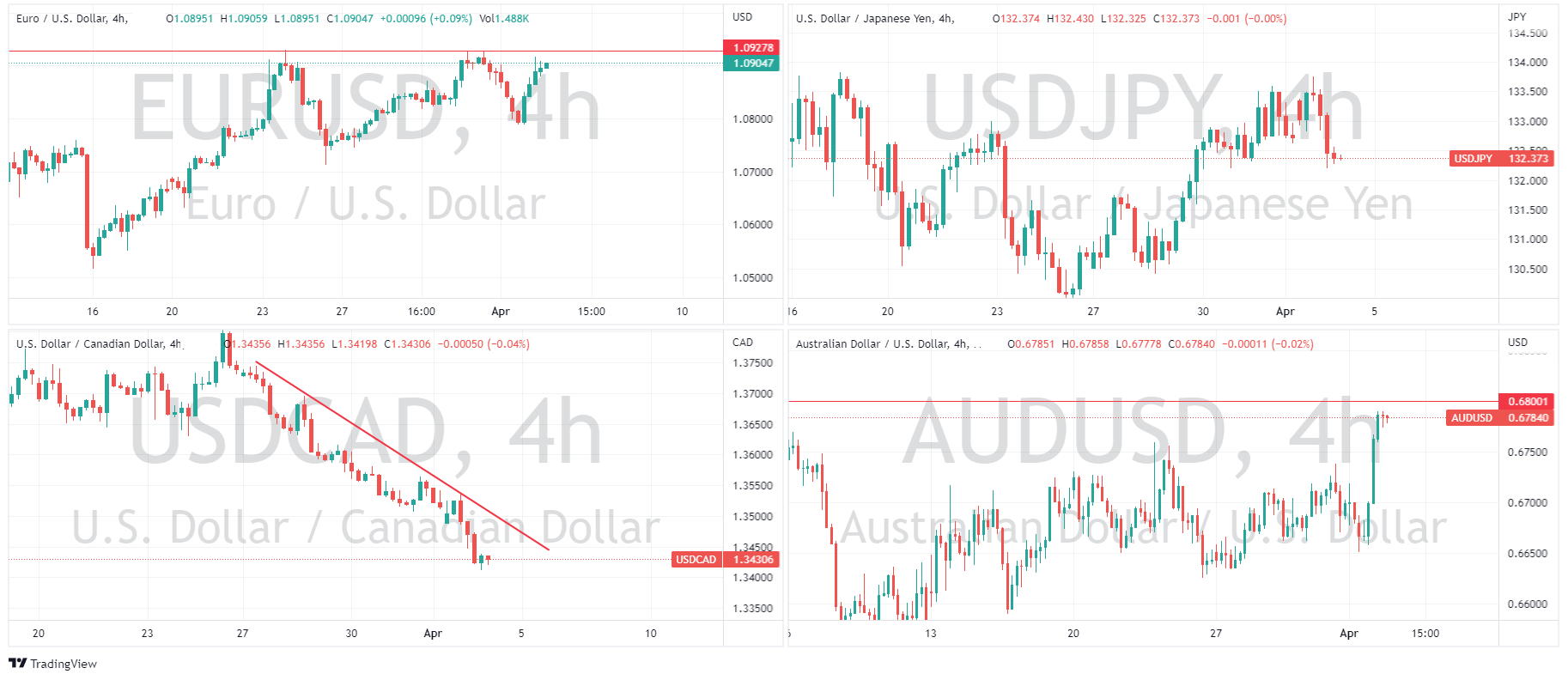

In FX the USD was weaker across the board.

Gold pushed higher on this weakness, along as being a safe haven as the markets were bit shaken by the OPEC news, it touched on 1990 USD an ounce before pulling back modestly.

EURUSD rallied again above 1.09 to test the resistance level round 1.0930 where it again found sellers to hold it there.

The Yen found some extra support in a move lower in US 10 year yields and rallied despite some weak manufacturing figures out of Japan.

CAD also performed strongly, the dramatic surge in oil prices helping the Loonie to outperform the USD.

AUD outperformed ahead of today’s RBA rate decision, hitting the highs just under .68 that were set back in March. The futures market is fully pricing in a pause later today from the RBA, but there are a few economists who are predicting another 25bp hike, so there could be an upside surprise come 2:30pm Sydney time.

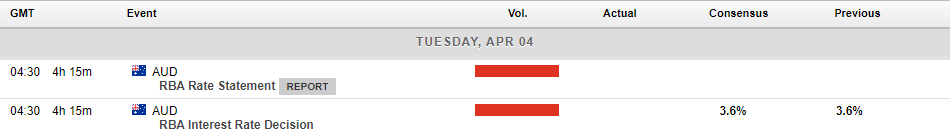

Todays calendar below:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US stocks decline as weak JOLTS data and Dimon comments spook investors

US equities snapped a 4-day winning streak as the “bad news is good news” narrative for equities faltered in Tuesdays session. Before the cash session the JOLTS job openings figure was released and came in much lower than expected, this is a key gauge of US labour market tightness that the Fed has referenced throughout its aggressive interes...

April 5, 2023

Read More >

Previous Article

Market Analysis 3-7 April 2023

XAUUSD Analysis 3 – 7 April 2023 The gold price trend can be viewed both positively and negatively in the short and medium term. As the closi...

April 4, 2023

Read More >