- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & Analysis

- Economic Updates

- US stocks rally, Dollar slides as markets turns risk on amid UK fiscal U-turn and positive US earnings

- Home

- News & Analysis

- Economic Updates

- US stocks rally, Dollar slides as markets turns risk on amid UK fiscal U-turn and positive US earnings

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks rally, Dollar slides as markets turns risk on amid UK fiscal U-turn and positive US earnings

18 October 2022 By Lachlan MeakinUS stocks soared in Monday’s session in an epic short squeeze as markets turned risk-on after new UK Chancellor pivoted on proposed tax cuts that had roiled UK bond markets and Strong bank earnings from the US calmed recession fears.

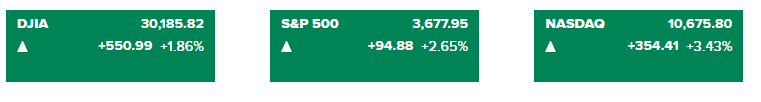

The Dow Jones finished the session up 1.86% , with the tech and growth heavy Nasdaq outperforming, up 3.43% underlying the drastic shift in market sentiment from Fridays session.

Bolstering US stocks was an upbeat earnings report from Bank of America, where the strength of the US consumer was lauded and recession fears largely downplayed, seeing it’s stock price soar over 6% and boding well for future bank earnings to come in this earnings season.

In FX , GBP, AUD, NZD, and CAD, all saw gains in excess against their peers against the USD amid the broad risk-on sentiment, the Pound was the outperformer, following the aforementioned U-turn from the new UK Chancellor. GBPUSD printed a high of 1.1439, falling short of the October peak at 1.1495 as it approached major resistance levels and traders belief that not all of the UK’s economic risks have vanished.

AUD, NZD, and CAD all rode the risk-on sentiment and broad USD weakness, as opposed to anything currency specific. AUDUSD and NZDUSD printing highs of 0.6312 and 0.5649, respectively, while USD/CAD reached a trough of 1.3700,

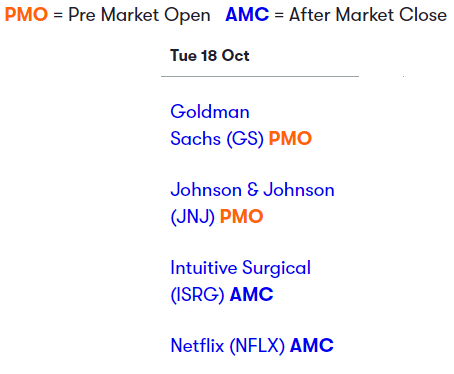

US earnings will continue with Goldman Sachs (GS) and Johnson & Johnson (JNJ) reporting before the bell, while tech heavyweight Netflix (NFLX) will be reporting after US market close.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Qantas shares price lift off, but Dividends on hold for FY22

Qantas Airways Limited (QAN:ASX) is the flagship carrier of Australia and the country's largest airline by fleet size. The company has had a resurgence in 2022 and the share price has rebounded from the lows of the pandemic. The “Flying Kangaroo” as it’s known throughout the industry, said that it would report an underlying pre-tax profit ...

October 18, 2022Read More >Previous Article

Natural Gas – Technical Analysis

Natural gas has fallen roughly 30% since the start of September, and has now landed on a daily trend line. Taking a look at the last couple of weeks o...

October 18, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.

- Trading