- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Walgreens Boots Alliance exceeds Wall Street expectations

1 April 2022Walgreens Boots Alliance Inc. reported its latest financial results for the second quarter of fiscal 2022 on Thursday.

The pharmaceutical company reported revenue of $33.756 billion in the quarter, beating analyst forecast of $33.228 billion.

Earnings per also topped analyst estimates at $1.59 per share vs. $1.39 per share expected.

CEO Rosalind Brewer commented on the latest results: “Second quarter results demonstrated broad-based execution, driving strong comparable sales and robust earnings growth. We continue to make important strides along our strategic priorities, building a consumer-centric, technology-enabled healthcare enterprise at the center of local communities. VillageMD and Shields are delivering tremendous pro forma sales growth compared to their year-ago standalone results, and our Walgreens Health segment is on track toward long-term targets. The strategic review of our Boots business is progressing, and our transformational actions are accelerating sustainable value creation.”

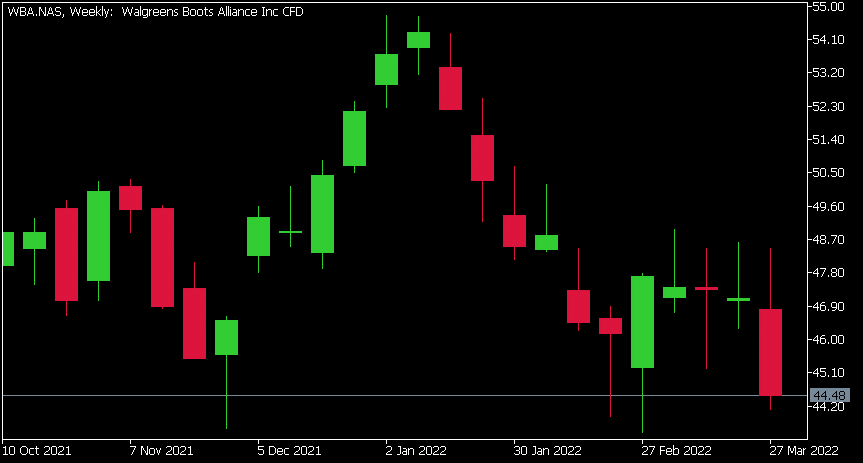

Walgreens Boots Alliance Inc. chart

Shares of Walgreens Boots Alliance were down by 6% during the trading day on Thursday at $44.48 per share.

Here is how the stock has performed in the past year –

- 1 Month: +1.58%

- 3 Month: -8.71%

- Year-to-date: -9.01%

- 1 Year: -13.32%

Walgreens is the 453rd largest company in the world with a market cap of $40.97 billion.

You can trade Walgreens Boots Alliance Inc. (WBA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Walgreens Boots Alliance Inc., TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

NIO’s March delivery numbers have arrived

NIO Inc. (NIO) reported its latest delivery numbers for March on Friday. The Chinese electric vehicle company delivered 9,985 cars last month – an increase of 37.6% year-over-year. The deliveries in March consisted of: 1,726 ES8s – the company’s six-seater or seven-seater flagship premium smart electric SUV 5,064 ES6s – the co...

April 4, 2022

Read More >

Previous Article

State of Play for FAANG stocks

The FAANG stocks are perhaps the most well-known and well-advertised stocks in the market. The FAANG stocks are made up of META (Which used to be Face...

April 1, 2022

Read More >