- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Australian Employment Beats Expectation – AUDUSD Reaction and Analysis.

- Home

- News & Analysis

- Forex

- Australian Employment Beats Expectation – AUDUSD Reaction and Analysis.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAustralian Employment Beats Expectation – AUDUSD Reaction and Analysis.

16 November 2023 By Lachlan MeakinAustralian employment change for October was released today and showed a decent beat of +55k jobs added vs an expected 22.8k while the unemployment rate ticked up to 3.7% in line with expectation.

AUDUSD reaction was muted, with markets still convinced that we have seen the peak in the RBA rate cycle with futures barely moving the needle on rate hike odds for the RBA December meeting.

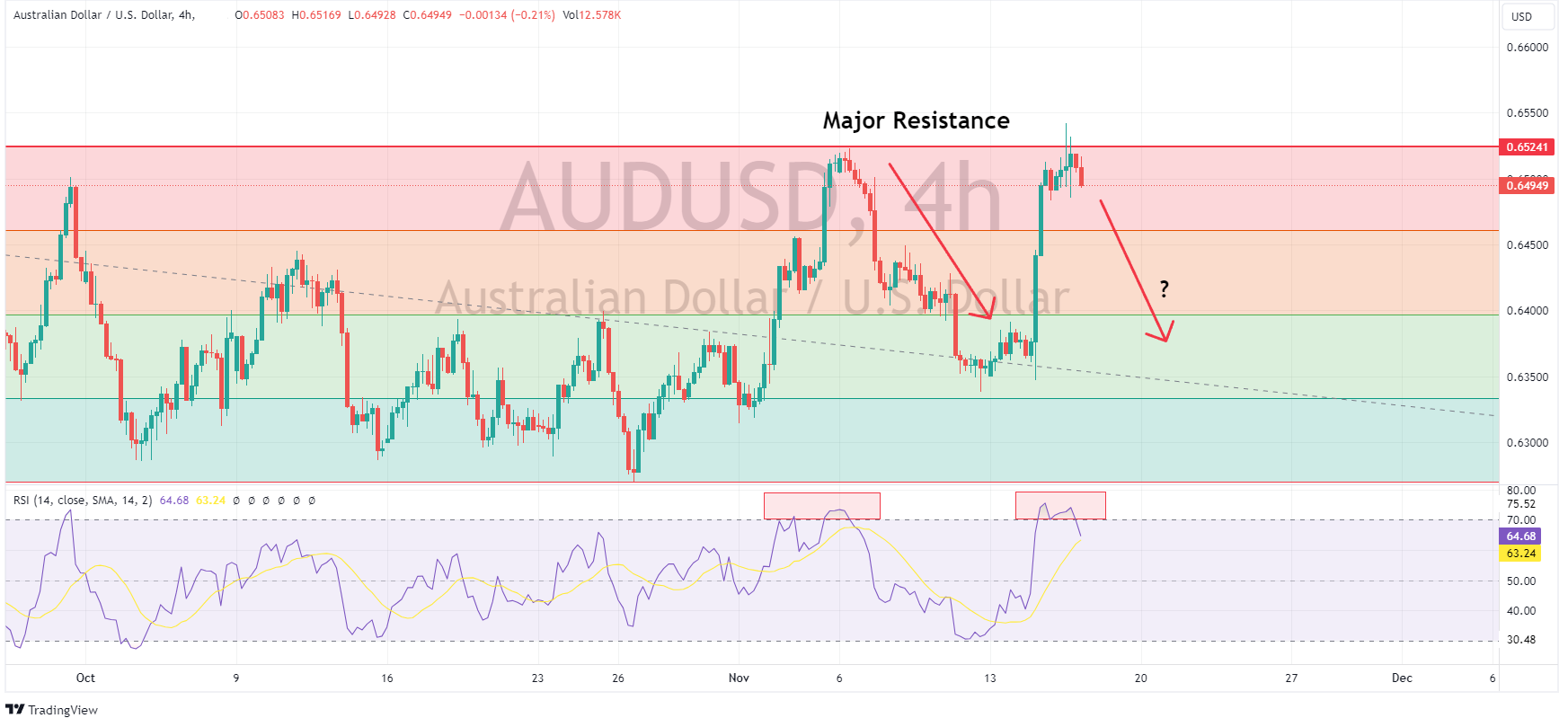

We did see a small pike higher of around 12 pips on the release, but it seems the resistance above 0.6500 for this pair is going to be tough to crack and the cross rate quickly retraced to a level below when the reading was released.

Looking at the AUDUSD 4-hour chart a double top of testing the major resistance level is forming with both tops entering the extreme RSI overbought level. A repeat of the AUDUSD sell-off back to the range mid-price of 0.6400 is looking a possibility for this pair unless we see another sell-off of the US Dollar. The sole tier 1 news release out of the US for the remainder of this week is weekly unemployment claims, so that will be the one to watch.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Walmart earnings results announced

The world’s largest supermarket chain Walmart Inc. (NYSE: WMT) released third quarter earnings results before the market opened in the US on Thursday. Walmart beat Wall Street estimates for both revenue and earnings per share (EPS). Company overview Founded: July 2, 1962 Headquarters: Bentonville, Arkansas, United States Number of e...

November 17, 2023Read More >Previous Article

Target tops estimates – the stock is soaring

Target Corporation (NYSE: TGT) released Q3 financial results before the market open in the US on Wednesday. The US retail giant beat both revenue a...

November 16, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.