- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & Analysis

- Forex

- FX analysis – Gold hits new closing high, USDJPY holds above 150, DXY flat despite rising yields

- Home

- News & Analysis

- Forex

- FX analysis – Gold hits new closing high, USDJPY holds above 150, DXY flat despite rising yields

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX analysis – Gold hits new closing high, USDJPY holds above 150, DXY flat despite rising yields

5 March 2024 By Lachlan MeakinGold surged again in Monday’s session despite a rise in US Treasury yields and setting a new closing high. There was little fundamental news to drive the rally though a comparable surge in the Crypto markets has seemingly given the other “alternative” currency a tailwind. This is four up sessions for gold and with momentum behind it is eyeing the all-time intraday high set back in December of 2049 USD an ounce, though XAUUSD is trading at extreme overbought levels on the RSI.

The US Dollar index was modestly lower in a slow news day with no US data released. DXY trading between its 100- and 200-day SMA with a range of 103.72 and 103.96. The “highlight” was remarks from the Fed’s Bostic, who pushed back somewhat on rate cut expectations, saying there was no urgency to cut rates given the US economy’s strength and when rate cuts start they would not be back to back, this saw yields rise but failed to lift USD.

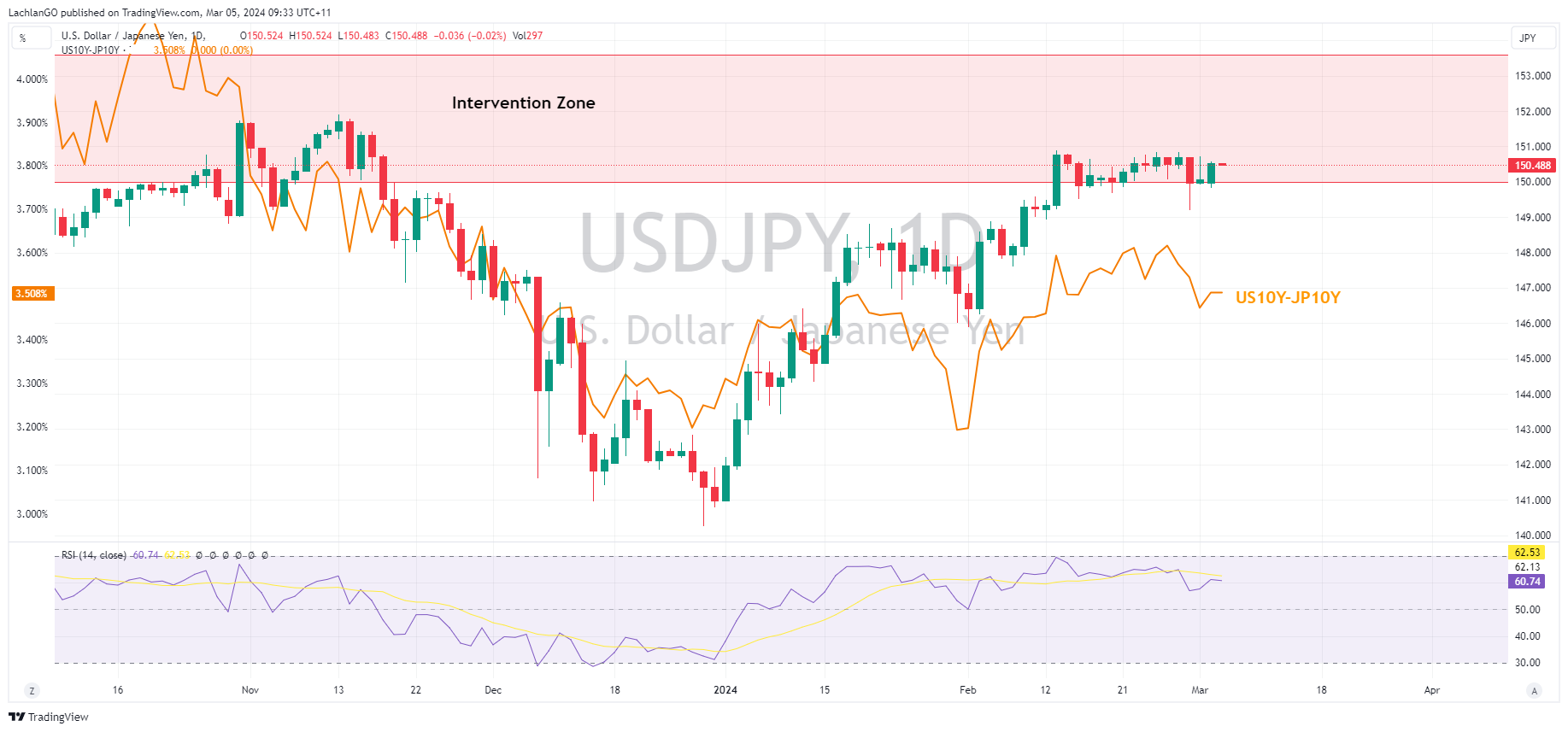

The Dollar did rally against the Yen though, with rising US Treasury yields ahead of Tokyo CPI today seemingly the main driver. For Yen watchers, BoJ Governor Ueda is also due to speak later in the APAC session in Tokyo and cause some volatility in Yen crosses.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Target stock rallies as earnings exceed expectations

American supermarket chain Target Corporation (NYSE: TGT) announced the latest earnings results before the opening bell on Wall Street on Tuesday. Target reported revenue of $31.919 billion for the previous quarter vs. $31.827 billion expected. Earnings per share (EPS) also topped estimates at $2.98 vs. $2.416 per share expected. Revenue a...

March 6, 2024Read More >Previous Article

NIO deliveries fall year-over-year

NIO Inc. (NYSE: NIO) has had a terrible start to 2024 with the stock plummeting by over 35% year-to-date. On 23/2/24, JP Morgan Chase & Co. dow...

March 4, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.

- Trading