- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

FX Analysis – Gold rebounds, USDJPY whipsaw, EURUSD holds key support

14 March 2024USD saw marginal weakness on Wednesday in a quiet news day. The US Dollar Index (DXY) pushing to lows after a strong 30yr Treasury saw yields drop and DXY briefly breaking beneath Tuesdays low of 102.72. A turn around later in the session saw DXY retake the 50% Fib support level at 102.80 ahead of today’s Retail Sales, Jobless Claims, and PPI data.

EUR saw decent gains vs the Dollar, with EURUSD setting a weekly high of 1.0948. ECB member Villeroy spoke, saying the ECB is winning the inflation battle, but cuts are more likely appropriate in June rather than April. EURUSD holding the key 1.09 support so far this week, with 1.10 the next major resistance level to the upside.

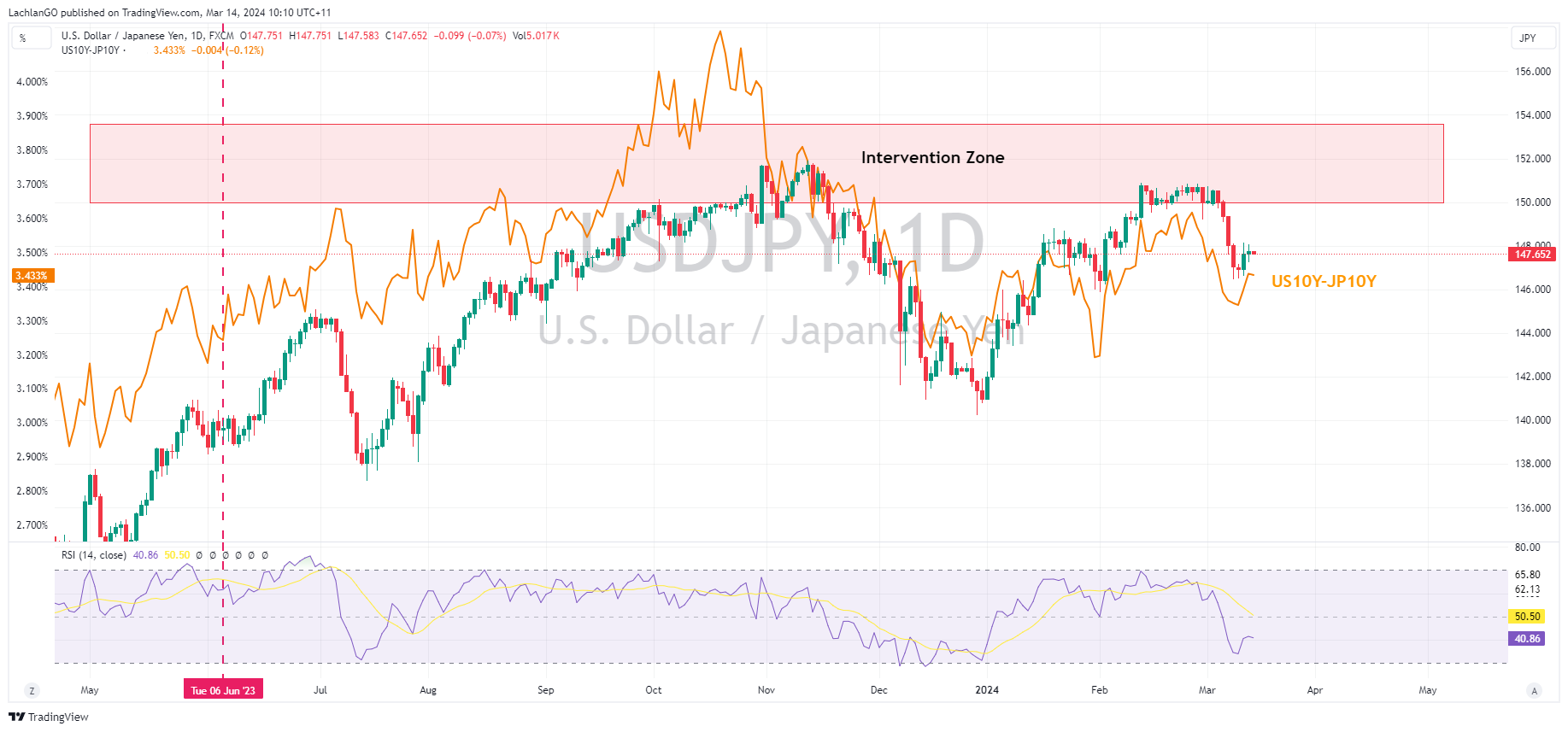

USDJPY was ultimately flat in a whipsawing session that saw USDJPY testing 148.00 to the upside. Before pairing gains as the Yen strengthened on a report from Reuters suggesting that early signs suggest a strong outcome in the annual wage talks that have heightened the chances that the BoJ will end NIRP next week.

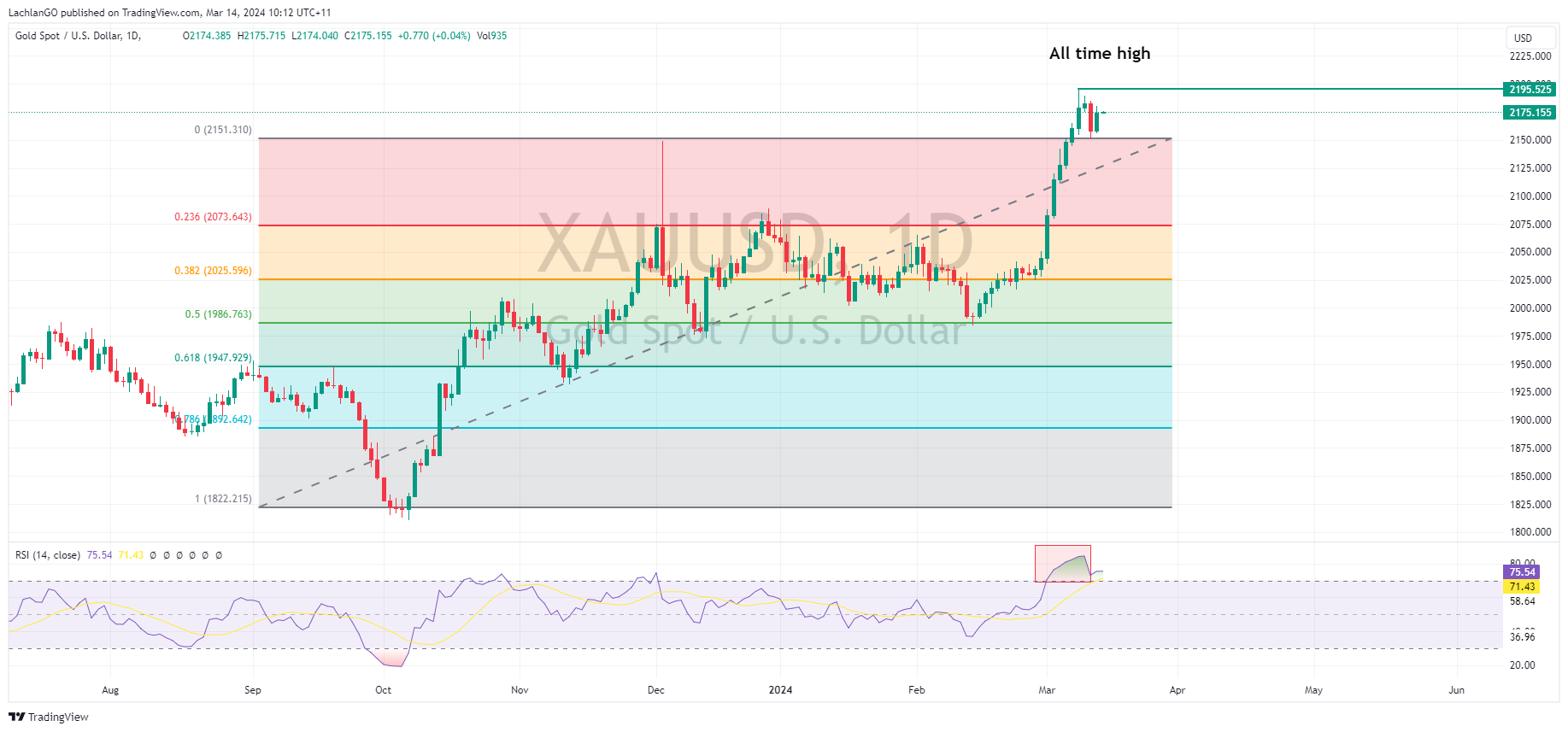

Gold popped on Wednesday, bouncing off the 2151 support level and recouping most of Tuesday’s losses to head into the APAC session at 2175 USD an ounce, with the next upside resistance the all-time high at 2195.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Adobe sets a new revenue record but the stock is falling

One of the largest software companies in the world, Adobe Inc. (NASDAQ: ADBE) announced Q1 FY2024 earnings results after the market closed in the US on Thursday. The company achieved revenue of $5.182 billion – a new record vs. $5.143 billion expected. Revenue grew by 11% year-over-year. Earnings per share (EPS) was reported at $4.48 (up fr...

March 15, 2024

Read More >

Previous Article

Lennar Q1 2024 financial results announced

Lennar Corporation (NYSE: LEN) has had a good start to 2024 with the share price up by over 11% reaching new all-time highs. On Wednesday, it was t...

March 14, 2024

Read More >