- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – markets turn risk-off on weak Chinese data, Moody’s downgrade – USD bid, AUD sinks

- Home

- News & Analysis

- Forex

- FX analysis – markets turn risk-off on weak Chinese data, Moody’s downgrade – USD bid, AUD sinks

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX analysis – markets turn risk-off on weak Chinese data, Moody’s downgrade – USD bid, AUD sinks

9 August 2023 By Lachlan MeakinGlobal markets were buffeted by a risk-off catalysts in Tuesdays session. Weak Chinese trade data, hawkish Fed-speak and a Moody’s downgrade of US regional banks saw stocks and yields tumble

FX Markets

USD was firmer Tuesday in a session that was firmly risk-off following the Chinese trade data and Moody’s downgrade. Later in the session we also had the Fed’s Harker who said barring any “alarming” new data by mid-September he believed “we may be at the point where we can be patient and hold rates steady”, dashing traders hops of a Fed pivot anytime soon. DXY printed a high of 102.800, falling just short of the July 3rd high of 102.84 where it found resistance just under the round 103 figure and it’s June/July trendline.

Risk sensitive AUD and NZD were the G10 underperformers, with NZD performing mildly worse than its AUD counterpart. Both NZD and AUD were weighed on by the aforementioned risk-off tone and dismal Chinese trade data. AUDUSD hit a low of 0.6497, briefly breaking the major support at the 0.65 big figure before finding some bids, 0.6500 looking to be a key level. NZDUSD bottomed out at 0.6035 ahead of the closely watched New Zealand inflationary forecasts today.

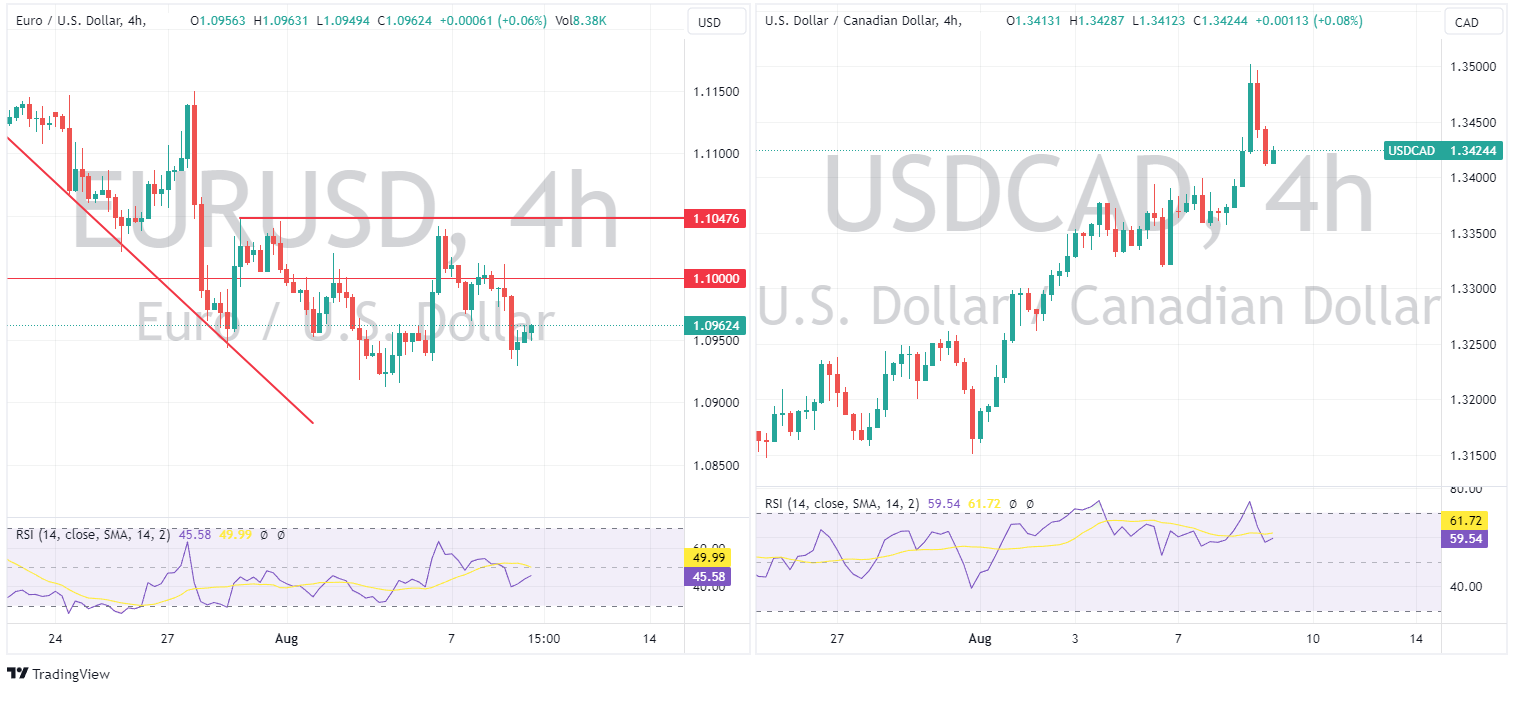

EUR, CAD, and GBP were all weaker to varying degrees against the USD due to the risk-averse trading conditions and the general USD strength as opposed to anything currency specific. USDCAD traded up to 1.3501 until paring gains as a rally in crude oil lent the CAD some support. EUR saw little reaction to the ECB June Consumer Inflation Expectations survey which downgraded the 12-month and 3-year inflation forecasts. EURUSD losing hold of the psychological 1.10 handle , hitting a low of 1.0930 before recovering modestly.

JPY weakened with USDJPY continuing its march to the 145 “intervention” zone. JPY’s haven demand offset by BoJ doubts after Japanese wage data suggested the BoJ has less scope to reduce its easy policies. USDJPY trading to a high of 143.49, testing its August highs.

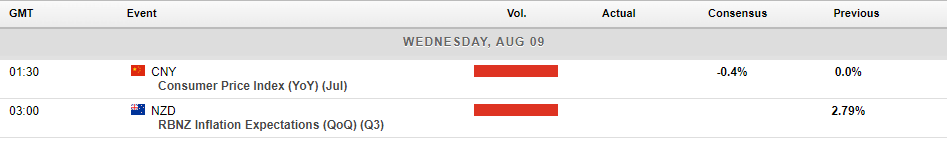

Today’s calendar:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Share Buybacks: A Double-Edged Sword for Investors?

Share buybacks refer to the practice where a company purchases its own shares from the open market or directly from its shareholders. In practice this results in a reduction in the number of outstanding shares available in the market, and so buybacks can also have an impact on the stock's price, as the reduction in supply can drive up demand a...

August 14, 2023Read More >Previous Article

$APPL: Apple finds key support after August sell-off.

Apple has had a spectacular start to 2023, locking in 7 consecutive positive months and putting in an increase of 52.16% year to date at its peak. ...

August 9, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.