- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USD Catches a Bid, AUD outperforms ahead of RBA, JPY struggles

- Home

- News & Analysis

- Forex

- FX Analysis – USD Catches a Bid, AUD outperforms ahead of RBA, JPY struggles

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USD Catches a Bid, AUD outperforms ahead of RBA, JPY struggles

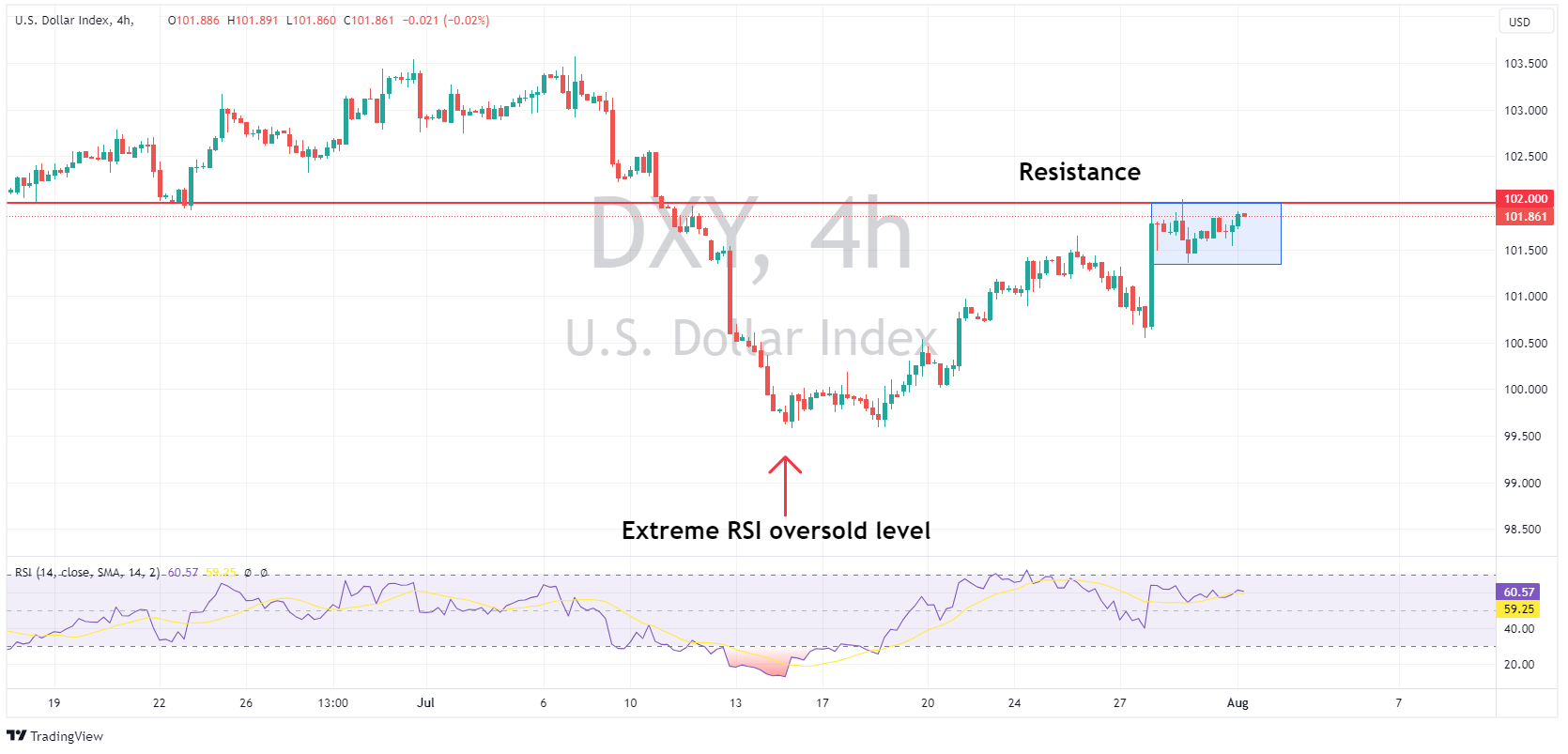

1 August 2023 By Lachlan MeakinUSD rallied modestly into month end with DXY pushing to the top of its recent range to again test the big 102 resistance level. The data highlight out of the US was the Chicago PMI figure which rose from the prior 41.5 to 42.8, but missing expectations of 43.3. in FedSpeak, Governor Goolsbee added little new from the FOMC statement last week stating he is “not sure when the Fed will be done raising rates and they are making good progress but will let the data guide them” and they may or may not hike in September.

EUR was weighed on by the Dollar strength with EURUSD dipping below the psychological 1.10 level early in the session before finding support at the lower trend line. A bounce on hot inflation data and a strong GDP out of the Eurozone saw EURUSD reclaim the 1.10 level, albeit unconvincingly. Currently, markets are pricing in around a 25-30% probability of a 25bp hike in September, with the ECB being “data dependant” any and all news regarding inflation out of the EU should see an impact on EUR.

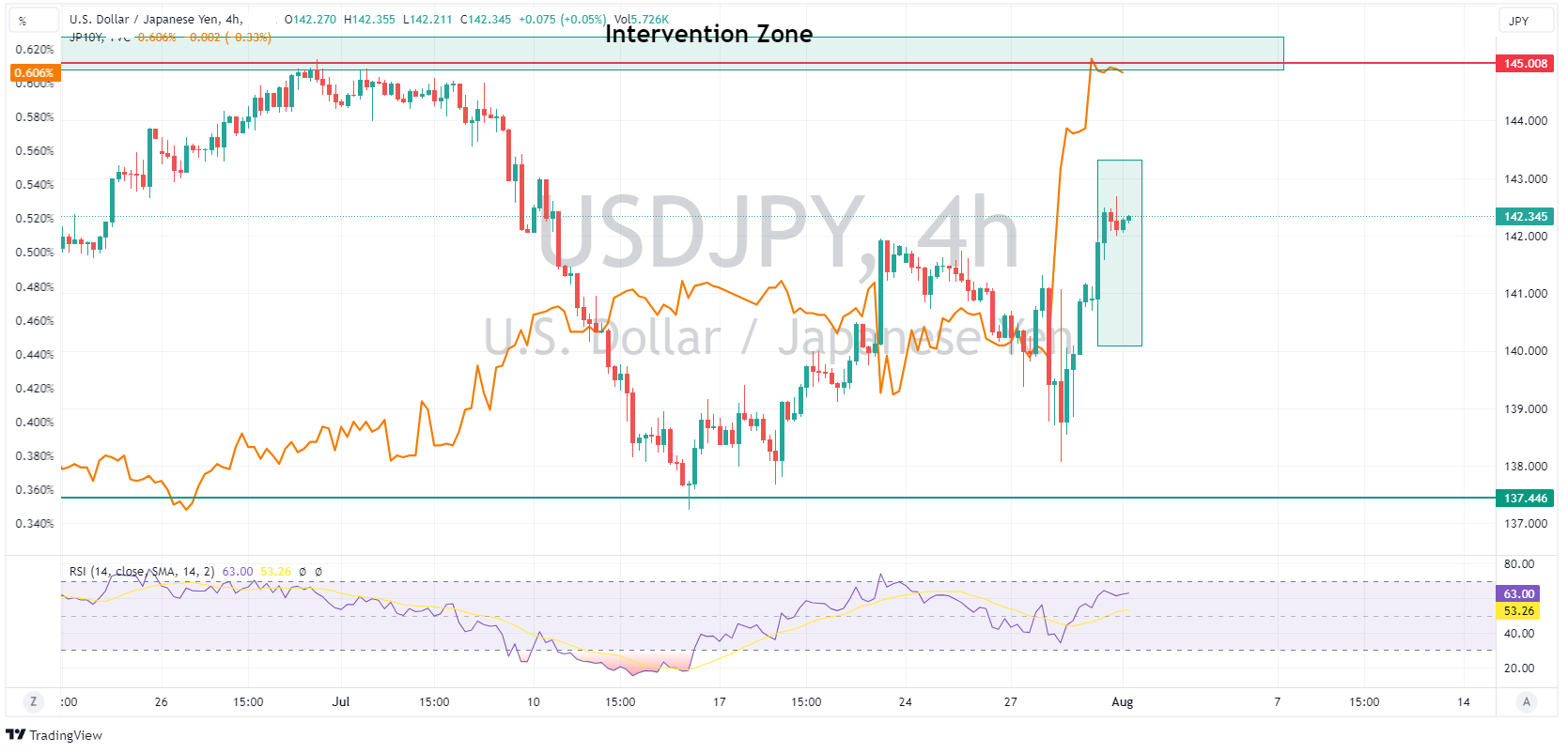

JPY was markedly weaker to start the week following on from the BoJ meeting on Friday. During the Asian session yesterday, the BoJ offered to buy an unlimited amount of JGBs at a fixed rate in an unscheduled announcement in an effort to defend their new “flexible” yield control limits, a feeling of panic at the Japanese Central Bank saw selling in JPY, with USDJPY heading above 142, looking likely to test the BoJ resolve at the “intervention” zone of 145 in the near future.

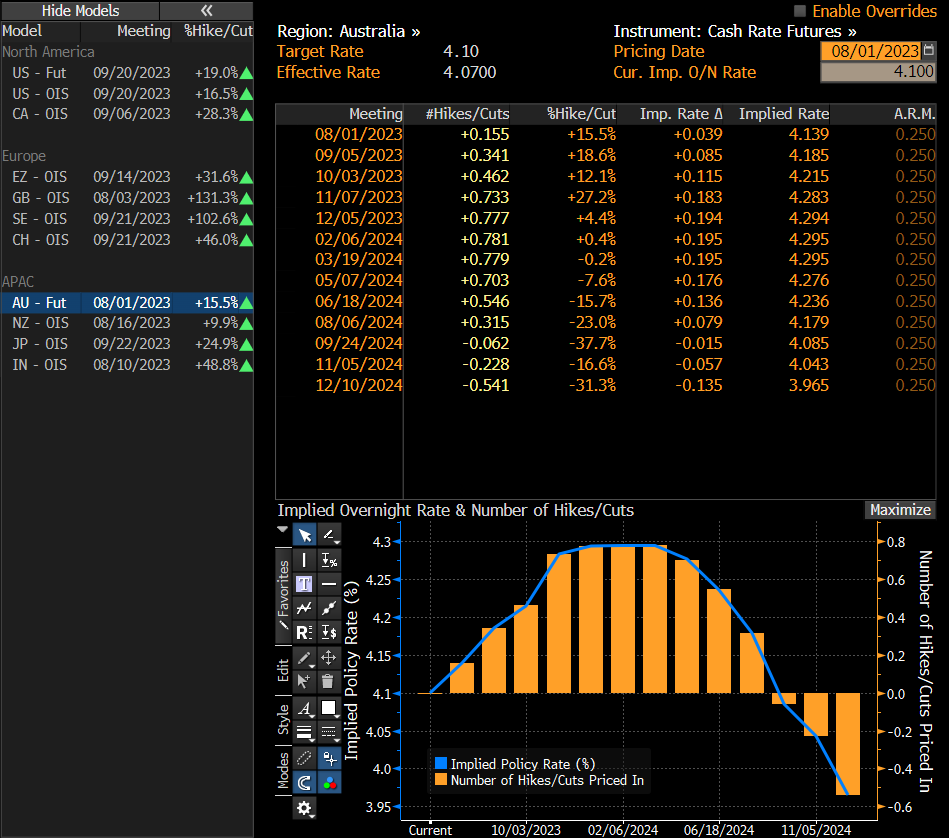

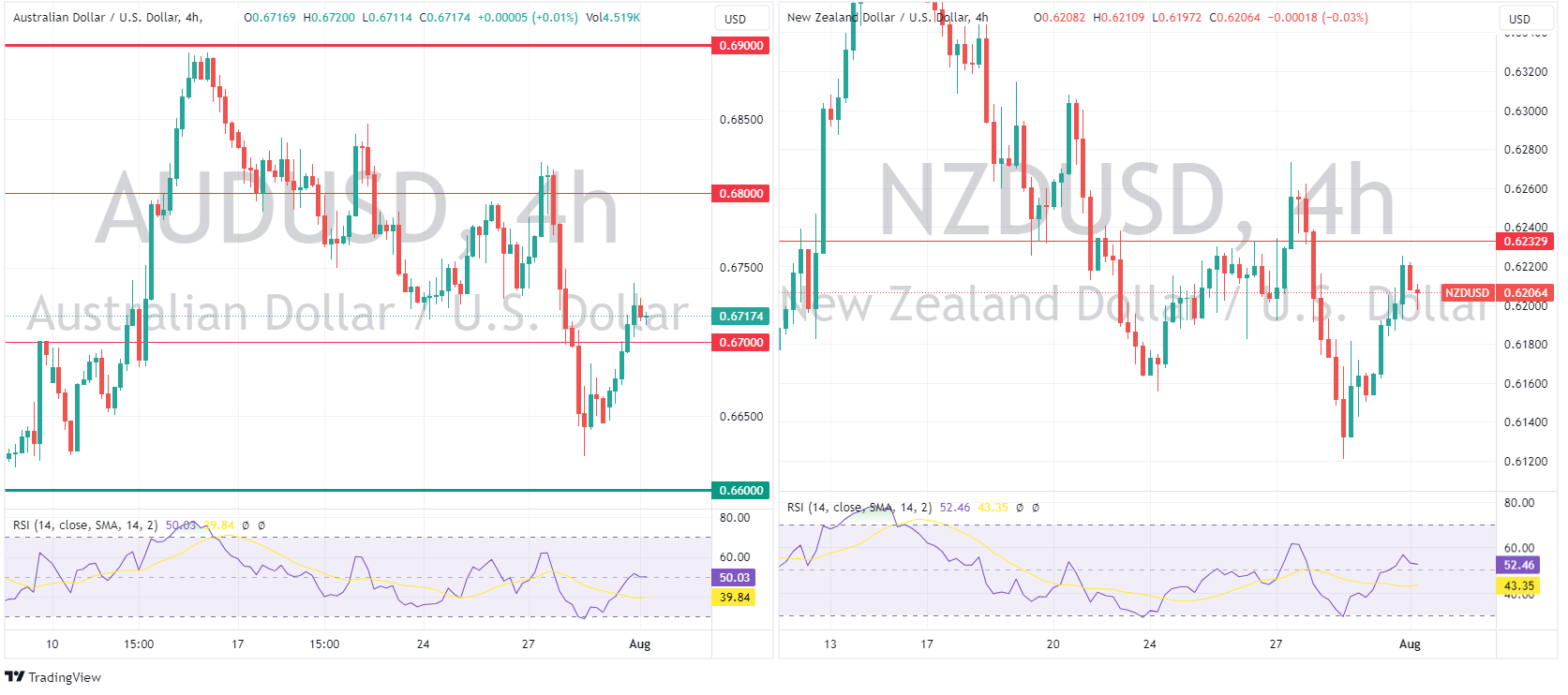

AUD and NZD predominantly outperformed, with AUD bring the clear winner on more talk from China regarding future stimulus, with AUDUSD rising through and holding the big figure at 0.6700. AUD traders also positioning for the RBA policy decision due today at 14:30 AEST, markets are currently split between a hike or hold following the lower than expected Aussie CPI data last week, with futures showing a 15.5% of a hike, but economists polled have it as much closer odds so could be an exciting meeting.

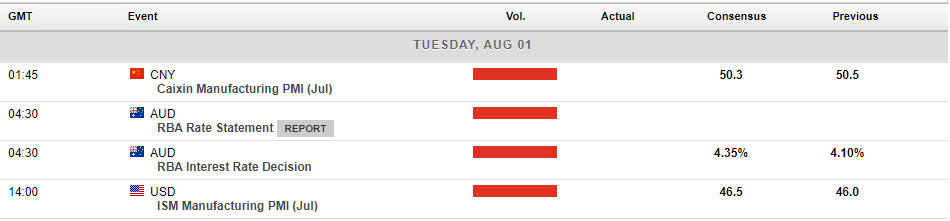

Todays Calendar below:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Nasdaq cements its best start to a year since 1975

The Nasdaq Composite Index has kicked off 2023 with a historic performance, achieving its most impressive start since 1975. Despite concerns about a potential recession, the index has displayed remarkable resilience, surging over 37% year-to-date as of the end of July. The upward trend has been consistent, with green months recorded in 6 out of ...

August 2, 2023Read More >Previous Article

FX analysis – USD up on rising yields, EUR down on dovish ECB, JPY surges ahead of BoJ

US equity markets snapped a record-breaking run of up sessions in Thursdays trading, with the Dow Jones looking set to close in the green for a 14th s...

July 28, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.