- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USDCAD, USDJPY, AUDUSD

News & AnalysisFX traders have some tier one data releases to look forward to today, including the last major central bank meeting in the form of the Bank of Japan. RBA monetary policy minutes and Canadian CPI also having market moving potential.

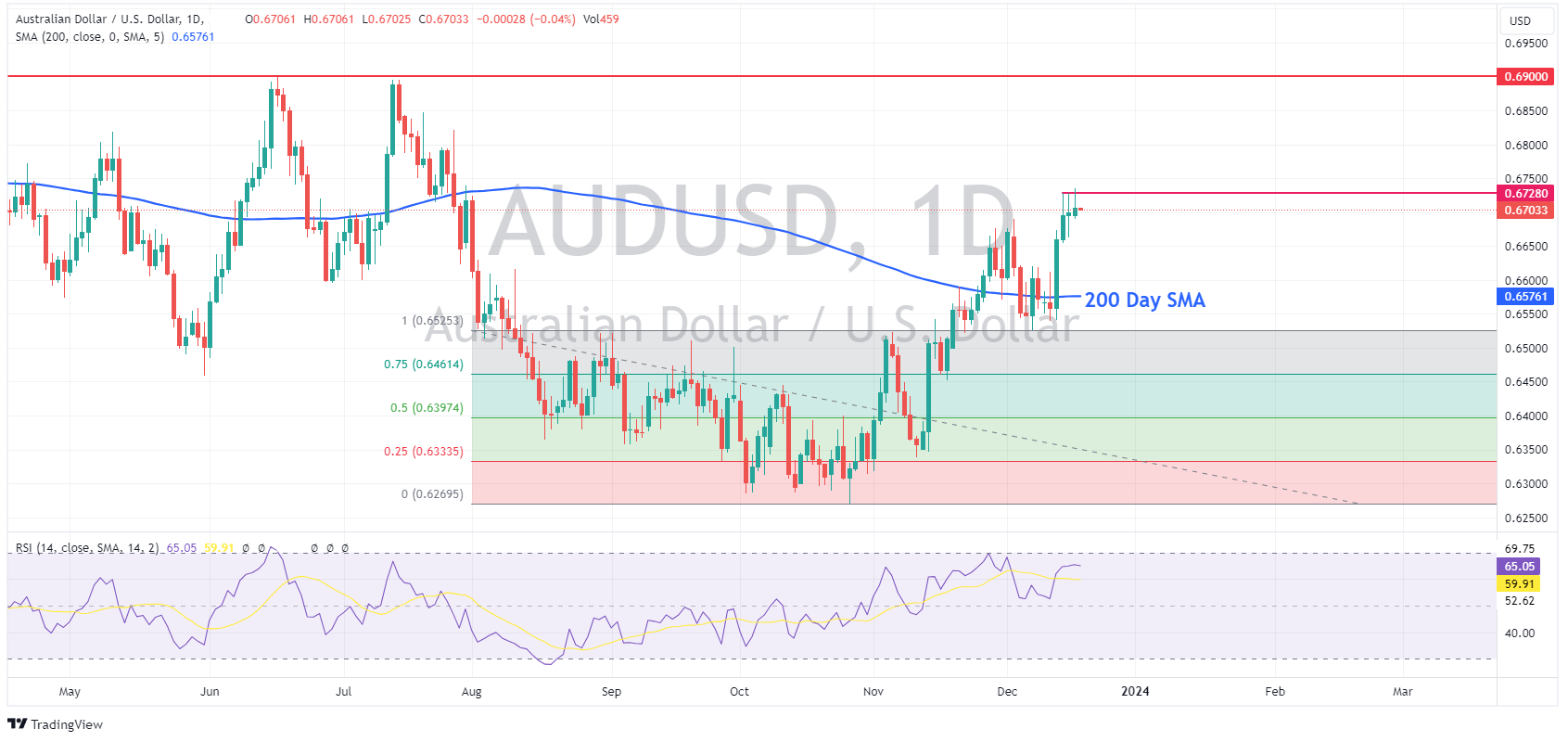

AUDUSD

The Aussie was modestly in the green in Monday’s session after initial strength that saw it outperform G10 rivals in the European morning faded later in the session. AUDUSD supported by further PBoC liquidity and a firmer Yuan fix early on. A mixed risk sentiment in the US session saw it hit resistance at the 4-monthth highs of 0.6735 and reversing course to a low of 0.6690.

RBA minutes released at 11:30 AEDT have the potential to see an RBA pushback against the market’s view that rates have definitely peaked, lending a tailwind to the Aussie.

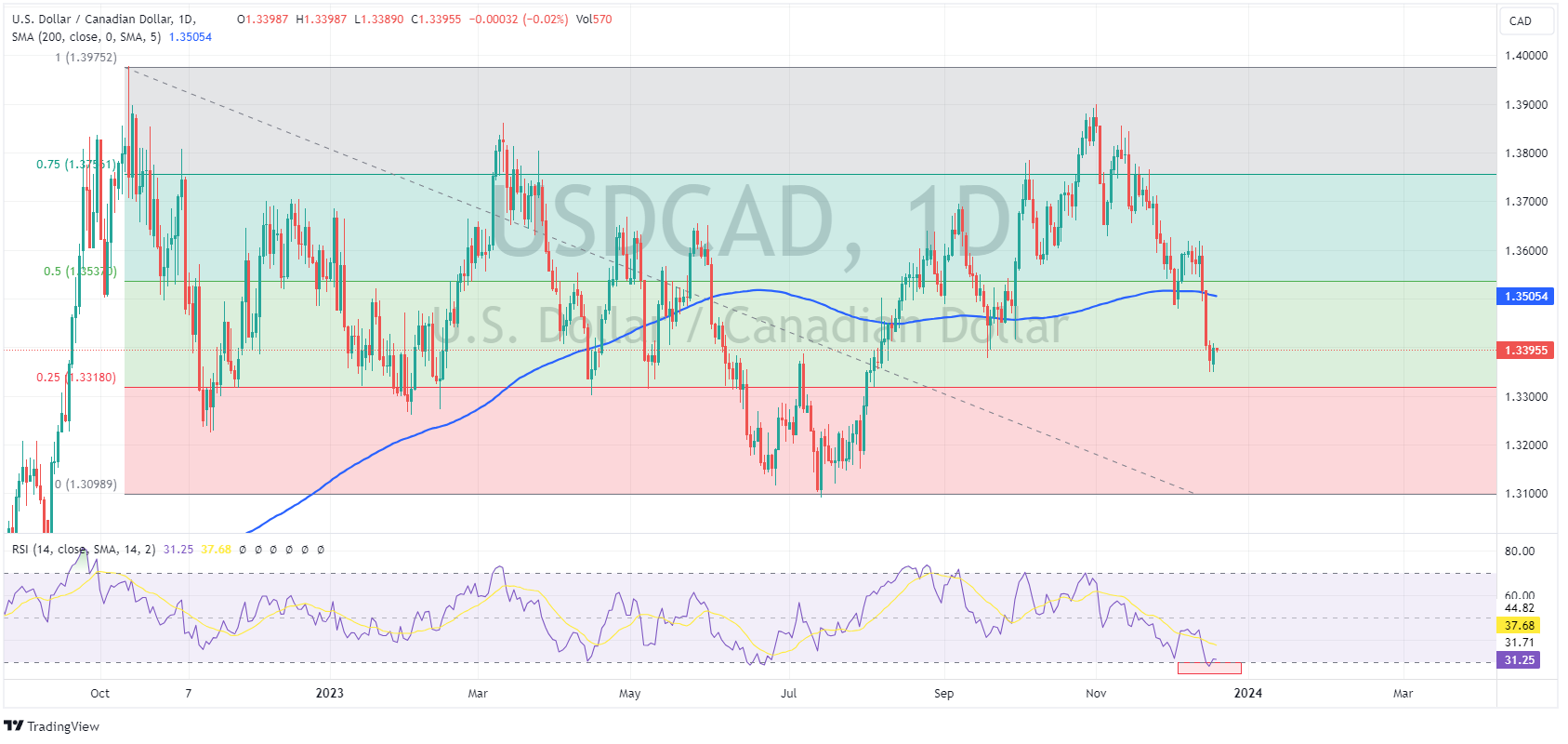

USDCAD

USDCAD edged higher in Monday’s session but held near its it four month lows, rising oil prices amid heightened Red Sea tensions tempering losses in CAD with traders awaiting today’s CPI inflation data. Economists expect the Canadian CPI to show inflation slowing to an annual rate of 2.9% in November from 3.1% in October. The Bank of Canada has left the door open to further rate hikes, so this reading will be a pivotal one to test that narrative.

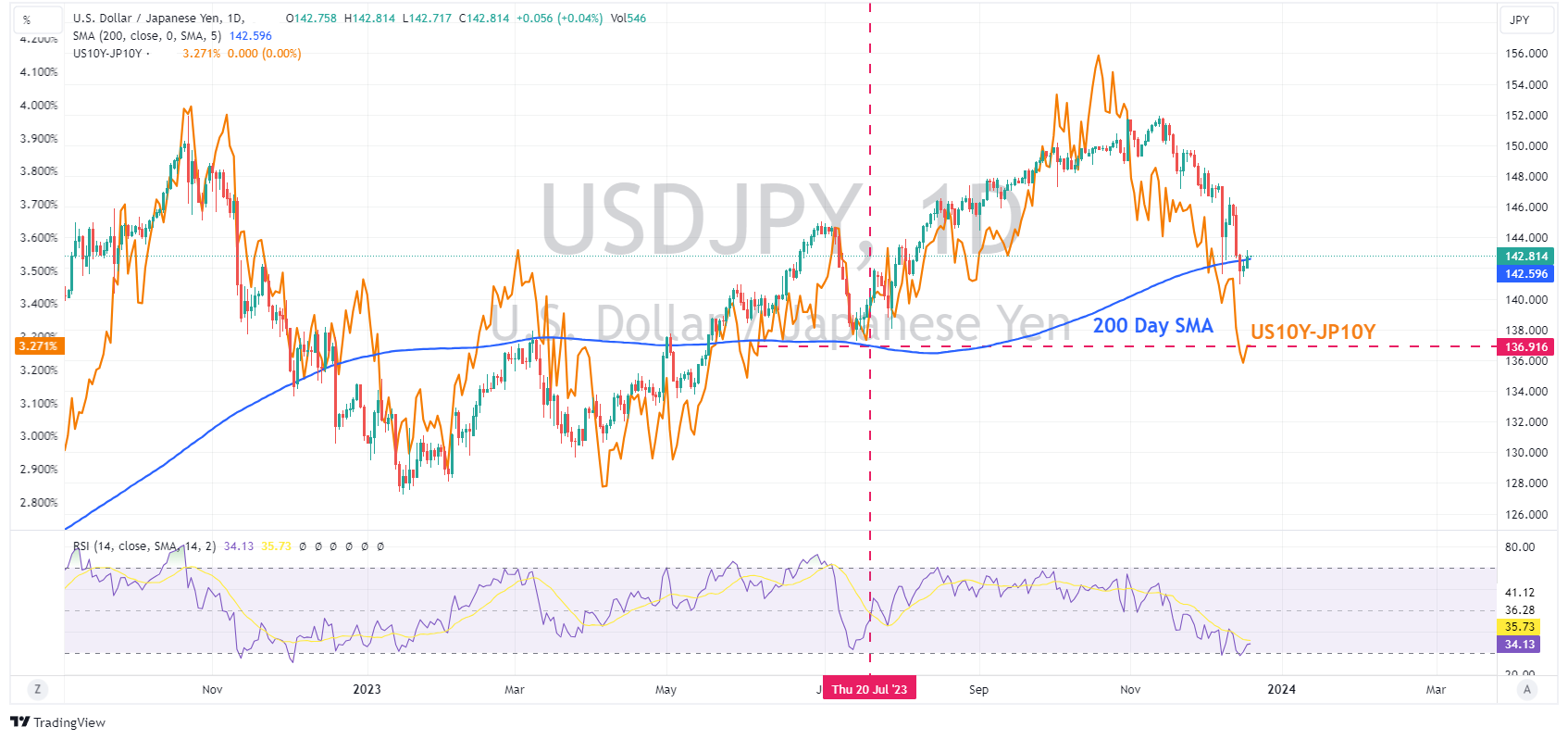

USDJPY

The much anticipated Bank of Japan could see some big swings in JPY as investors look for clues as to when the central bank foresees the end to its easy money policies. Bank officials have recently pushed back against rate hike expectations for this meeting. But with traders pricing in the end of negative rates in January, the language at this meeting will be key for the short-term performance of the yen. A hawkish surprise could push USDJPY towards the 140 handle, an unchanged message could bring the cross back up to the 145 level.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – DXY, USDJPY, USDCAD, AUDUSD

USD was offered in Tuesdays session, with the US Dollar Index (DXY) printing a low of 102.060 ahead of the last major economic release for the year in Fridays Core PCE reading. Hawkish leaning comments from the Feds Bostic that he only sees two Fed rate cuts in 2024, less than the Fed median of three and well under the market pricing of six, fa...

December 20, 2023Read More >Previous Article

NIO gets a boost from the Middle East

It was positive start to a new week for the Chinese electric vehicle company, NIO Inc. (NYSE: NIO), after it announced a $2.2 billion strategic invest...

December 19, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.