- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – Yen surges on hawkish BoJ, Gold holds key level, AUDUSD bounces off key support

- Home

- News & Analysis

- Forex

- FX Analysis – Yen surges on hawkish BoJ, Gold holds key level, AUDUSD bounces off key support

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – Yen surges on hawkish BoJ, Gold holds key level, AUDUSD bounces off key support

8 December 2023 By Lachlan MeakinEquities were green across the board in Thursday’s session, led by the Nasdaq which was up almost 200 points on renewed AI optimism after Google unveiled its newest AI model, Gemini. But it was the FX space where the big moves happened.

JPY surged to have its best day of 2023 on the back of hawkish commentary from Bank of Japan Governor Ueda hinted at the end of the Central banks easy money policies, this saw a flash crash in USDJPY to 141.60 before the pair found some support at the 200 Day MA. A big driver of this pair has been the carry trade, traders cashing in the difference between US and Japanese yields, so talk of a hike in rates in Japan will be a big factor in where this pair goes next.

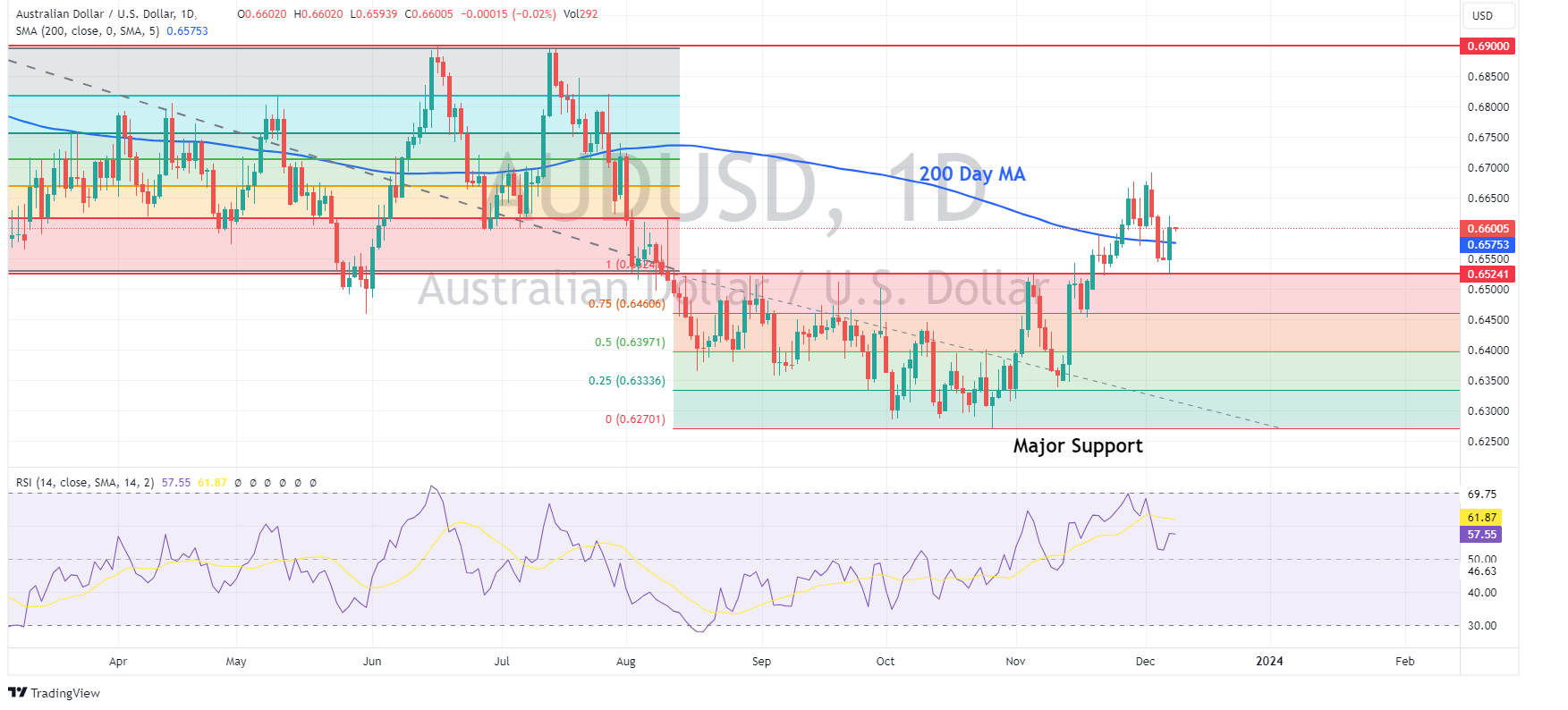

The move in USDJPY also rippled across other USD crosses with AUDUSD performing particularly well on the Dollar dip, a risk on market sentiment and a rise in Iron ore prices. AUDUSD tested the major support at the top of its Sep-Nov range before bouncing strongly through its 200 day MA to reclaim a 66 handle.

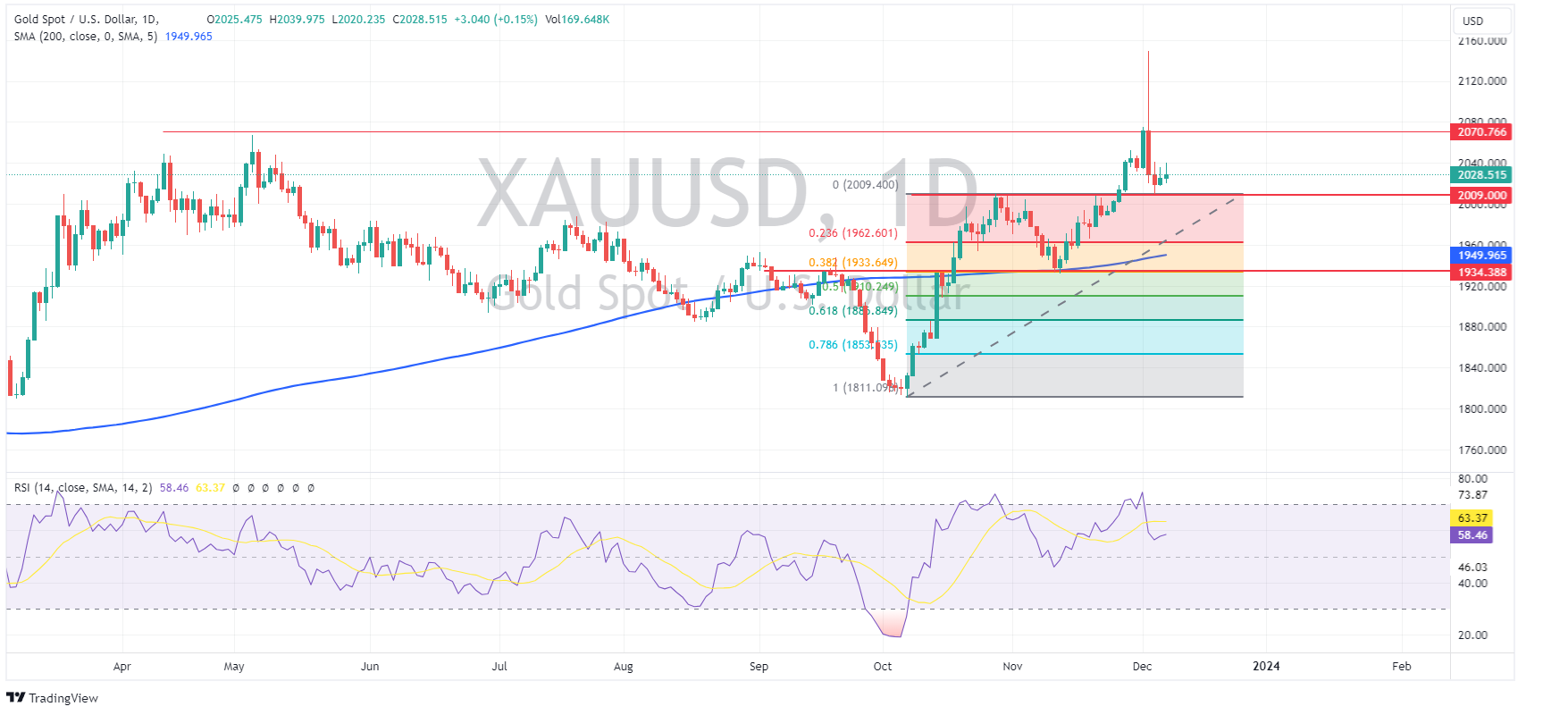

Gold continued to hold the key 2009 USD an ounce support level after a modest up session. The gold bulls may be a little disappointed with the gains though considering the drop in the USD on Thursday and will be watching this key level closely coming into today’s non-farm payroll report.

Todays NFP will be the last big figure before next weeks FOMC so expect some volatility if we get a number outside of the expected range.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The Week Ahead – FOMC, ECB, BoE – the charts to watch XAUUSD , DXY

Markets enter the new week with serious risk-on momentum, having seen US equities finishing the last 6 weeks with gains, but ahead we have a massive week in data that could put that narrative to the test. A lot of this positivity in risk assets has come on the back or markets pricing in dovish pivots from the Fed and other major central banks an...

December 11, 2023Read More >Previous Article

lululemon posts better-than-expected results

World’s second largest sporting goods company, lululemon athletica inc. (NASDAQ: LULU), released Q3 2023 financial results after the closing bell on...

December 8, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.