- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

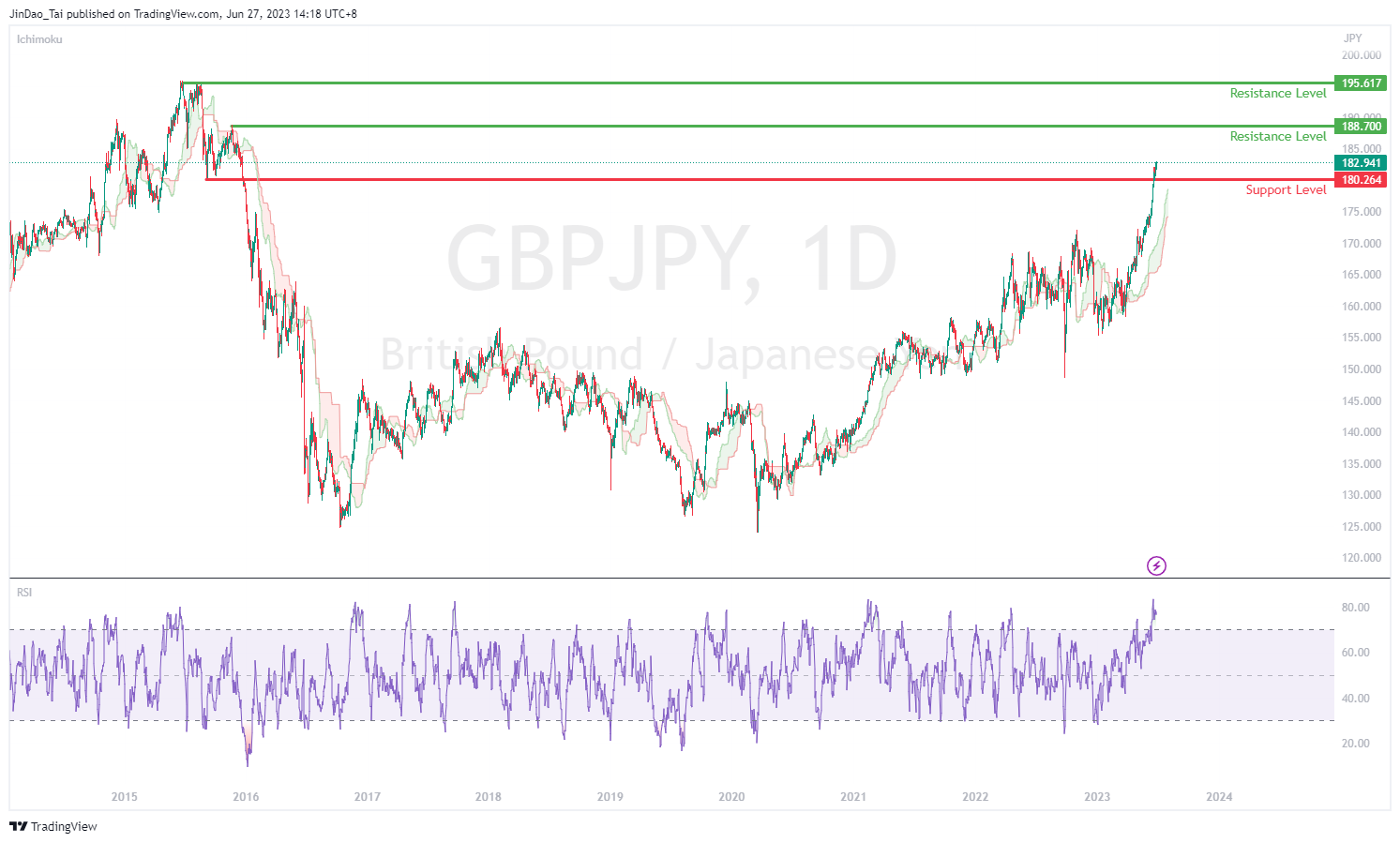

- GBPJPY Breaks Through to 2015 Levels

News & AnalysisThe GBJPY has continued to climb strongly to the upside, since the end of March 2023 and currently trades just below the 183.00 price level. This move higher is driven by a combination of the weakness of the Japanese Yen and renewed strength in the British Pound.

The Bank of Japan (BoJ) has begun to sound warning bells regarding potentially excessive moves in the Yen, and markets are speculating about the possibility of intervention from the BoJ. The previous intervention from the BoJ came when the USDJPY reached the 145 price level. The USDJPY currently trades along the 143.60 price level.

This could indicate that further upside could be anticipated on the GBPJPY before a strong correction to the downside. If the GBPJPY breaks above 183 the price could continue to climb towards the next key resistance level of 188.70, with the Ichimoku cloud providing strong support for the uptrend.

As the Relative Strength Index (RSI) is well into the overbought region, watch for a possible reversal if the BoJ intervenes, especially along the 188.70 resistance level or at the major swing high of 195.60 (last reached in June 2015)

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Aussie inflation cools with big miss in CPI print – AUDUSD dumps

Australian CPI figures today see a rapid cooling in Aussie inflation, coming in at 5.6% y/y against an expected 6.1% and a big drop from April’s 6.8% shock to the upside. This saw a rapid re-pricing of rate hike odds at the next RBA meeting on July 4th, with interbank futures signaling odds have dropped to 17% of a 25bp move, from 25% pre-CPI....

June 28, 2023Read More >Previous Article

FX wrap – GBP volatile on BoE surprise, JPY and CHF under pressure, USD follows yields up

USD was firmer on Thursday, largely due to a rally in treasury yields with the DXY tracking the 10 year yield higher to a peak of 102.470 after bounci...

June 23, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.