- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Market Analysis – USD slides, AUD hits key level, Gold rallies

- Home

- News & Analysis

- Forex

- Market Analysis – USD slides, AUD hits key level, Gold rallies

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisMarket Analysis – USD slides, AUD hits key level, Gold rallies

22 December 2023 By Lachlan MeakinRisk on returned to global markets in Thursdays session with equities rebounding strongly on weak US data that refuelled hopes of a faster pace to the Feds rate cutting cycle come 2024.

USD sold off sharply partly due to month-end flows ahead of the holidays but accelerated by a bis miss in Q3 US GDP which came in at 4.9% vs the expected 5.2%. This saw rate cut odds in March push above the 80% mark with yields and the Dollar tumbling as a result.

The Dollar Index (DXY) pushing below last weeks trough to new 5-month lows, also losing the 102 handle in the process.

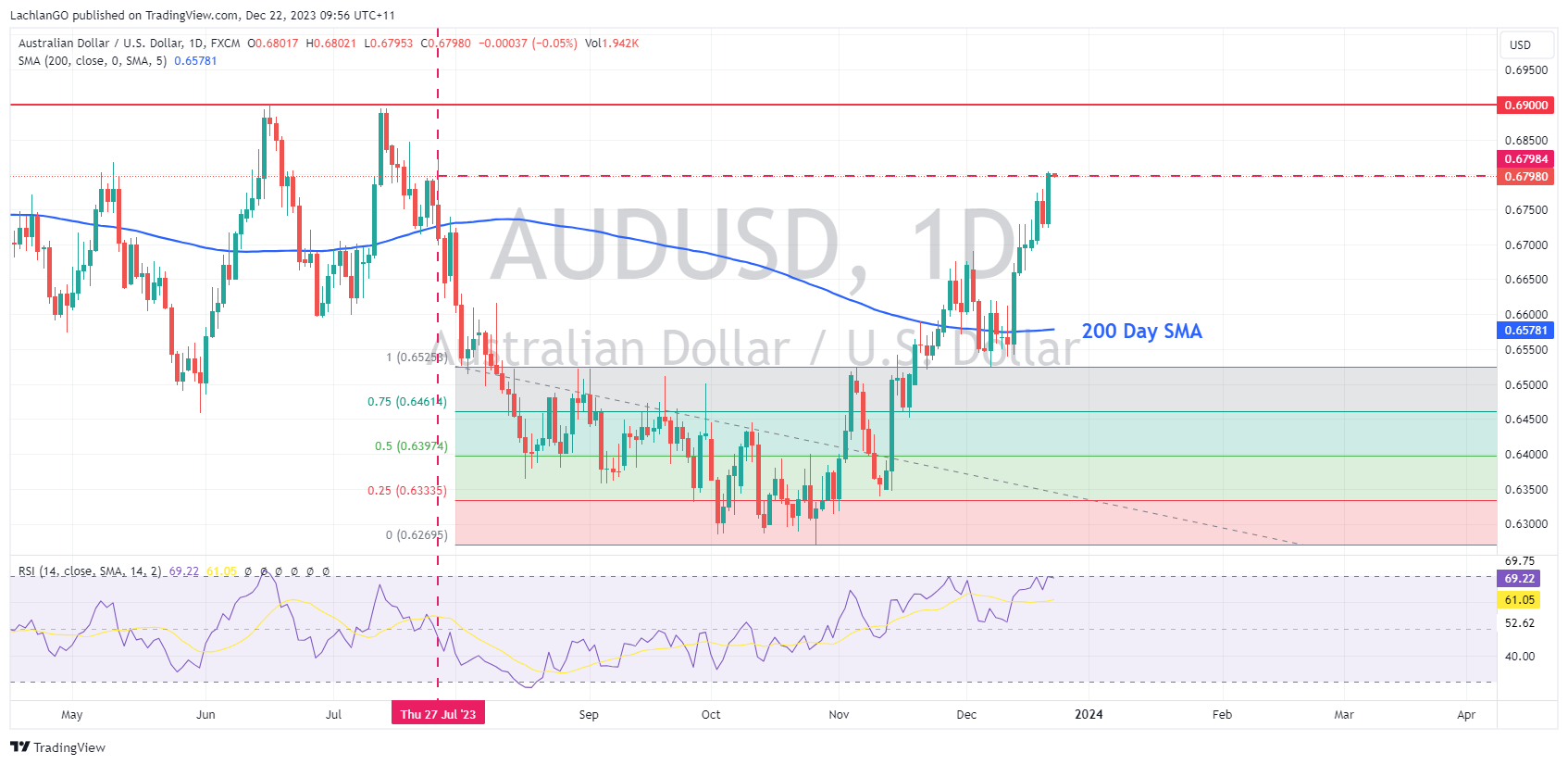

AUD outperformed after the weaker than expected US GDP reading and an upbeat market risk sentiment. AUDUSD poking its head above the psychological 0.68 for the first time since July before finding some resistance at the big figure. The major resistance at 0.6900 the next big test to the upside if this rally continues.

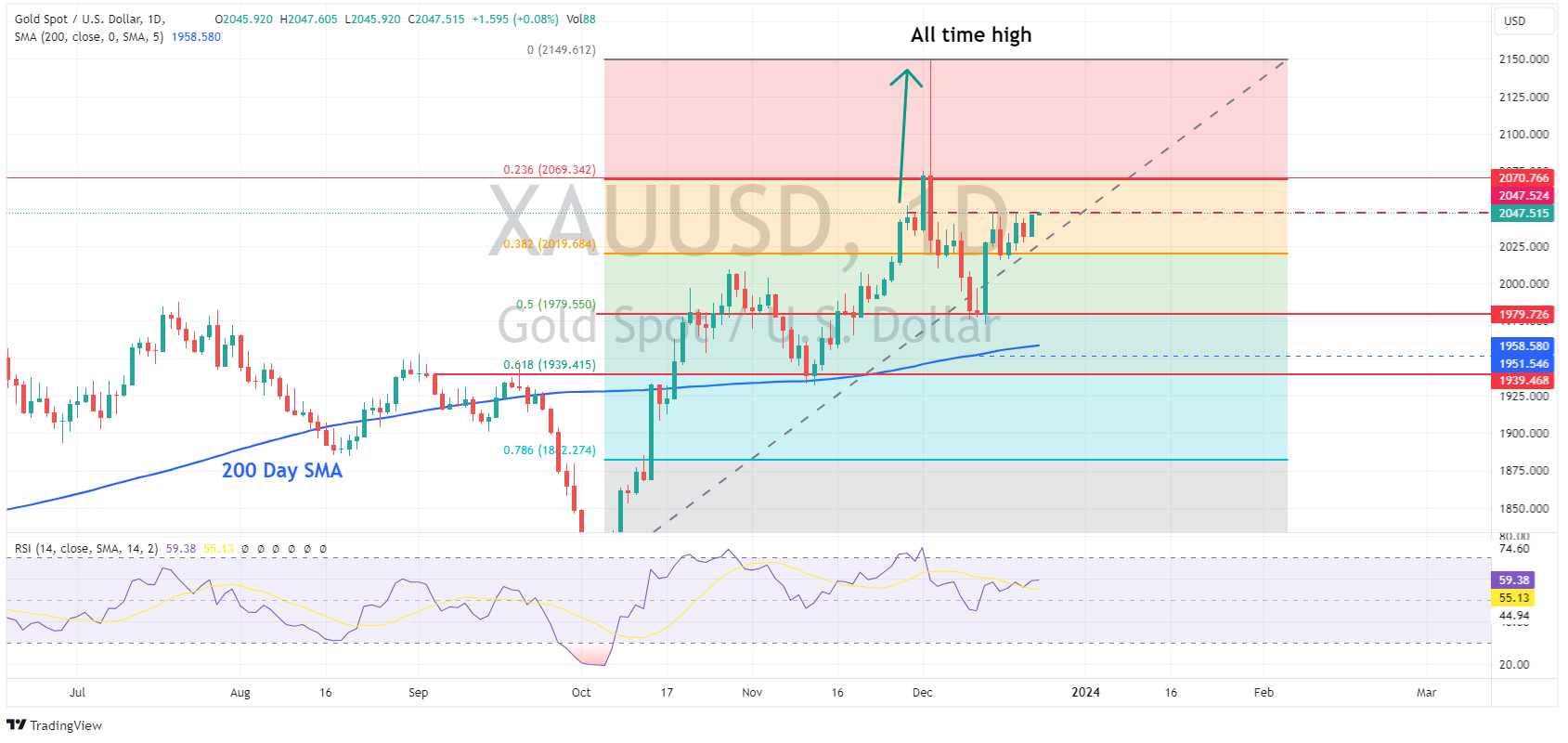

Gold pushed higher on the weaker USD and falling yields, XAUUSD again testing the resistance at 2047. The last break out of this level took gold to all-time highs a couple of weeks ago, making it a key level to watch for gold traders.

Ahead today the Feds preferred inflation gauge, the PCE price index will be the main risk event for FX traders.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – AUDUSD, XAUUSD – Testing Key Levels

The US Dollar has continued its year end decline after the holiday break in thin volume. Traders still holding onto the view of a dovish Fed come 2024 seeing yields also drop creating a headwind for the Greenback. AUDUSD The Aussie pushed has pushed higher this week, taking advantage of a weak USD and a risk on environment. AUDUSD breaking th...

December 27, 2023Read More >Previous Article

Paychex results announced – the stock is down

US professional services company, Paychex Inc. (NASDAQ: PAYX), released financial results for second quarter of fiscal 2024 before the market open on ...

December 22, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.