- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- AGL and The Mike Cannon-Brookes Take Over. Part 2.

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- AGL and The Mike Cannon-Brookes Take Over. Part 2.

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

Continuing from my previous article on Mike Cannon-Brookes and the take over of AGL, there has been some very important breaking news from the Australian giant and the country’s biggest polluter, AGL Energy. To give you some background information; Mike Cannon-Brookes (MCB) had launched a takeover of the company as he felt he could change the company’s strategy to become more emission friendly and to stop the company from a demerger that is likely to cause more harm to the environment and its employees. If you like to have a deep dive, please read my previous article here.

The company’s surprising U-turn comes after Atlassian co-founder Mr Cannon-Brookes has been the figurehead of the push to direct AGL away from producing coal-fired power, a practice the energy firm was keen to keep doing by splitting its heavy-polluting assets out into a new company. In a statement to the Australian Securities Exchange on Monday morning, AGL said it was withdrawing the plan, despite the board believing the demerger was the “best way forward”. It was clear that the proposal would not secure the necessary 75% of shareholders at a scheduled 15th June vote to win approval, which has now been cancelled and will be revisited later in the year. The utility aims to report to shareholders in September and will provide an update on progress with its earnings results, it said.

In the wake of the decision, AGL said its chairman, Peter Botten, would resign from the company’s board upon the appointment of an independent replacement. Graeme Hunt will also exit as Chief Executive and Managing Director once a replacement has been appointed. Two other board members, Jacqueline Hey and Diane Smith-Gander, will depart, with Hey leaving on Monday and Smith-Gander to resign in August.

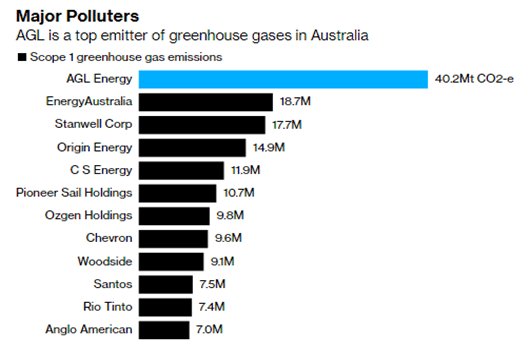

This shows the company feels that for them to move ahead with a new vision, they must first rid themselves of the influence that has driven them to this point thus far and implement, new people in management that are happy and driven to help the company to a good level of decarbonisation. As it is, AGL supplies about a third of Victoria’s power, and its gas and coal power stations are the biggest greenhouse gas emitters in the country, accounting for about 8 per cent of Australia’s carbon footprint. Below you can see the effect of the firm in Australia and an insight into why this is so important to MCB.

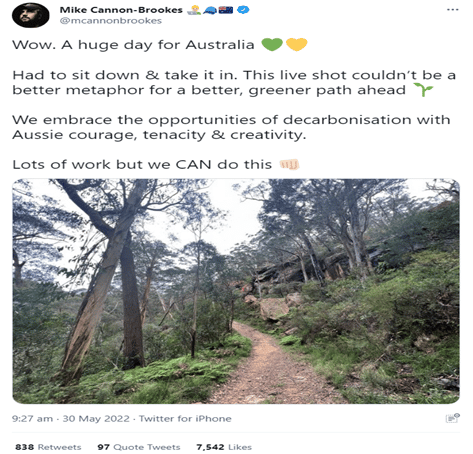

The move has been praised by various groups, starting with MCB Grok Ventures who said, “the sensible decision by AGL to abandon its value destructive demerger plan and renew its board”. Mike Cannon-Brookes followed by Tweeting below:

Environmental groups such as Greenpeace Australia cheered Monday’s news and said the failure of AGL’s demerger represented the failure of its old leadership team. “AGL’s humiliating demerger backflip has to go down as one of the most bungled and misguided attempts at a corporate restructure in Australian history,” Greenpeace senior campaigner Glenn Walker said.

The company’s share price fell at the release of the news to as low as $8.42 per share but it has rebounded since, to end higher than the end of last month’s figure at $8.72, showing that there is still faith in the company’s new direction from investors.

Source: Australia’s Clean Energy Regulator. Chart shows latest data, from 28th Februry 2022, Bloomberg, news.com.au, The Sydney Morning Herald, The Guardian

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

What’s an EA: Expert Advisor

Expert Advisors are programs which are configured to execute trades or read market price movements. When a parameter is met or triggered, it commands the EA to open or close trades on your behalf whilst you are otherwise engaged or sleeping. EAs are compatible to be used on the Metatrader 4 and 5 systems. Algorithmic trading is a method of ...

June 2, 2022Read More >Previous Article

How to trade the Volatility Contraction Pattern

The Volatility Contraction Pattern, (VCP) is a famous trading pattern identified and dissected by Market Wizard, Mark Minervini. The premise of the pa...

May 11, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.