- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Carnival sets records and beats expectations – the stock is up

- Home

- News & Analysis

- Shares and Indices

- Carnival sets records and beats expectations – the stock is up

- Founded: 1972 (as Carnival Cruise Line, now a subsidiary), 1993 (as Carnival Corporation), 2003 (as Carnival Corporation & plc)

- Headquarters: Miami, Florida, United States (Operations: Doral, Florida) and Southampton, United Kingdom

- Number of employees: 150,000 (2022)

- Industry: Hospitality, tourism

- Key people: Josh Weinstein (CEO)

- 1 month: +32%

- 3 months: +32.18%

- Year-to-date: +136.97%

- 1 year: +142.39%

- Citigroup: $23

- Truist Financial: $15

- UBS Group: $20

- Morgan Stanley: $11

- Barclays: $21

- Argus: $21

- JP Morgan: $18

- Deutsche Bank: $15

- Bank of America: $20

- Wells Fargo: $9

- Credit Suisse: $18

- Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours

- Reduce your risk and hedge your existing positions ahead of a new trading day

- Extended trading hours on popular US stocks means extended opportunities

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisCarnival sets records and beats expectations – the stock is up

22 December 2023 By Klavs ValtersBritish-American cruise line company, Carnival Corporation (NYSE: CCL), reported fourth quarter and full year 2023 earnings results on Wednesday.

Carnival reported revenue of $5.397 billion Q4 (a new quarterly record) vs. $5.295 billion expected.

The company reported loss per share of -$0.07, which was less than -$0.126 loss per share expected.

Full year revenue reached $21.6 billion – a new all-time record high.

Company overview

CEO commentary

“We ended the year on a high note with another record-breaking quarter that exceeded expectations and achieved positive full year adjusted net income. In fact, we consistently outperformed in all four quarters of the year, buoyed by a strengthening demand environment across all our brands,” Josh Weinstein, CEO of the company commented on the solid results in a press release.

“Thanks to a strong second half of 2023, we are already tracking ahead of our plan to achieve SEA Change, our three-year financial targets calling for the highest adjusted ROIC and adjusted EBITDA per ALBD in nearly two decades. Based on our 2024 guidance, we expect to deliver another big step forward, positioning us more than halfway toward realizing all our 2026 SEA Change targets. With nearly two-thirds of 2024 on the books already, we are well positioned to obtain another year of record revenues and adjusted EBITDA,” Weinstein added.

Stock reaction

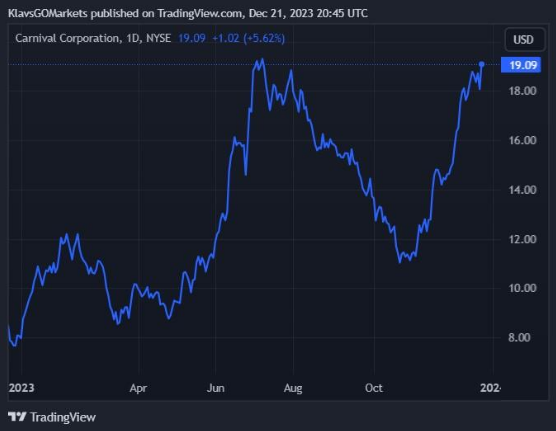

The stock rose by over 5% on Thursday, reaching its highest level since 10/7/23 at $19.09 a share.

Stock performance

Carnival stock price targets

Carnival Corporation is the 743rd largest company in the world with a market cap of $25.02 billion.

You can trade Carnival Corporation and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD.

GO Markets now offers pre-market and after-market trading on popular US Share CFDs.

Trade the pre-market session: 4:00am to 9:30am, normal session, and after-market session: 4:00pm to 8:00pm, Eastern Standard Time.

Why trade during extended hours?

Sources: Carnival Corporation, TradingView, MarketWatch, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Cintas beats estimates and raises future outlook – the stock hits record high

American company that specializes in the manufacturing and sale of workwear and uniforms, Cintas Corporation (NASDAQ: CTAS), announced the latest financial results before the opening bell in Wall Street on Thursday. Cintas reported revenue of $2.377 billion for the second quarter of fiscal 2024 vs. $2.341 billion expected. Revenue was up by 9.3%...

December 22, 2023Read More >Previous Article

Nike earnings results are here

The world’s biggest sporting goods company, Nike Inc. (NYSE: NKE), reported Q2 of fiscal 2024 after the US market closed on Thursday. Nike report...

December 22, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.