- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Cintas exceeds estimates and raises guidance – the stock reaches a new all-time high

- Home

- News & Analysis

- Shares and Indices

- Cintas exceeds estimates and raises guidance – the stock reaches a new all-time high

- Founded: 1929

- Headquarters: Mason, Ohio, United States

- Number of employees: 44,500 (2023)

- Industry: Service

- Key people: Todd Schneider (CEO), Scott D. Farmer (Executive Chairman), Mike Thompson (Executive Vice President and CAO)

- 5 day: +8.56%

- 1 month: +9.29%

- 3 months: +13.71%

- Year-to-date: +14.38%

- 1 year: +48.20%

- Barclays: $700

- Truist Financial: $660

- Stifel: $585

- Royal Bank of Canada: $645

- JP Morgan Chase & Co.: $640

- Deutsche Bank: $590

- Citigroup: $530

- Robert W. Baird: $540

- Bank of America: $565

- Wells Fargo & Company: $500

- UBS Group: $575

- Morgan Stanley: $441

- Argus: $540

- Jefferies Financial Group: $487

- Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours

- Reduce your risk and hedge your existing positions ahead of a new trading day

- Extended trading hours on popular US stocks means extended opportunities

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisCintas exceeds estimates and raises guidance – the stock reaches a new all-time high

28 March 2024 By Klavs ValtersQ1 earnings season is nearly finished but there are still a few companies expected to release their latest results for the previous quarter.

On Wednesday, Cintas Corporation (NASDAQ: CTAS) announced their latest financial results.

American company that specializes in the manufacturing and sale of workwear and uniforms achieved revenue of $2.406 billion in fiscal 2024 third quarter, which was above analyst estimate of $2.39 billion.

Earnings per share (EPS) also topped estimates at $3.84 vs. $3.576 per share expected.

Revenue and EPS were up by 9.9% and 22.3% year-over-year respectively.

Company overview

CEO commentary

“Our third quarter results reflect the outstanding dedication and execution of our employees, whom we call partners. Each of our operating segments continue to execute at a high level, which led to robust revenue growth of 9.9%, record high gross margin of 49.4%, record high operating margin of 21.6% and diluted EPS growth of 22.3%,” Todd Schneider, CEO of Cintas said in a statement to shareholders.

Schneider also announced that the company is raising its guidance for 2024: “Based on our third quarter results, we are increasing our full fiscal year financial guidance. We are raising our annual revenue expectations from a range of $9.48 billion to $9.56 billion to a range of $9.57 billion to $9.60 billion and our diluted EPS from a range of $14.35 to $14.65 to a range of $14.80 to $15.00.”

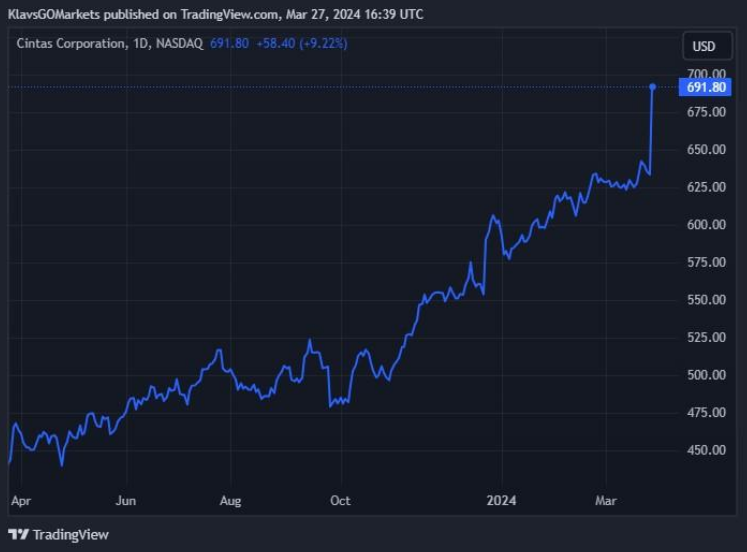

Stock reaction

The stock was up by over 9% on Wednesday, trading at above $700 level for the first time ever during the trading session.

Stock performance

Cintas stock price targets

Cintas Corporation is the 261st largest company in the world with a market cap of $69.82 billion, according to CompaniesMarketCap.

You can trade Cintas Corporation (NASDAQ: CTAS) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to “Trading” then select “Share CFDs”.

GO Markets offers pre-market and after-market trading on popular US Share CFDs.

Why trade during extended hours?

Sources: Cintas Corporation, TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX analysis – USDJPY hits 34 year highs, Gold surges

Thin trading in FX markets continued in a holiday shortened week with G10 FX mostly flat against the USD in Wednesday’s session also looking like traders are waiting for Fridays key US PCE inflation reading. The highlights were: USDJPY pushed past its November 2023 high hitting 151.97 which is the highest level this pair has reached since 1990...

March 28, 2024Read More >Previous Article

FX Analysis – USD weaker, AUD , NZD up on firm Yuan fix, JPY jawboning

USD was slightly lower on Monday with DXY hitting a low of 104.140, holding above the 104 support level. News was light with only New Home Sales of an...

March 26, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.