- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Deere & Co. results announced

22 August 2022Deere & Co. (DE) reported its financial results on Friday for the third quarter ended July 31, 2022.

The American manufacturer of farm machinery and industrial equipment reported revenue of $13 billion for the quarter, slightly above analyst estimate of $12.927 billion.

Earnings per share fell short of estimates at $6.16 per share vs. $6.65 per share expected.

”We’re proud of the extraordinary efforts by our employees to increase factory output and get products to customers under challenging circumstances,” said John C. May, CEO of Deere & Co.

”At the same time, our results reflected higher costs and production inefficiencies driven by the difficult supply-chain situation.”

”Looking ahead, we believe favorable conditions will continue into 2023 based on the strong response we have experienced to early-order programs.”

”We are working closely with our factories and suppliers to meet higher levels of customer demand next year. Additionally, we are confident the company’s smart industrial strategy and leap ambitions will continue unlocking new value for customers through Deere’s advanced technologies and solutions,” May concluded.

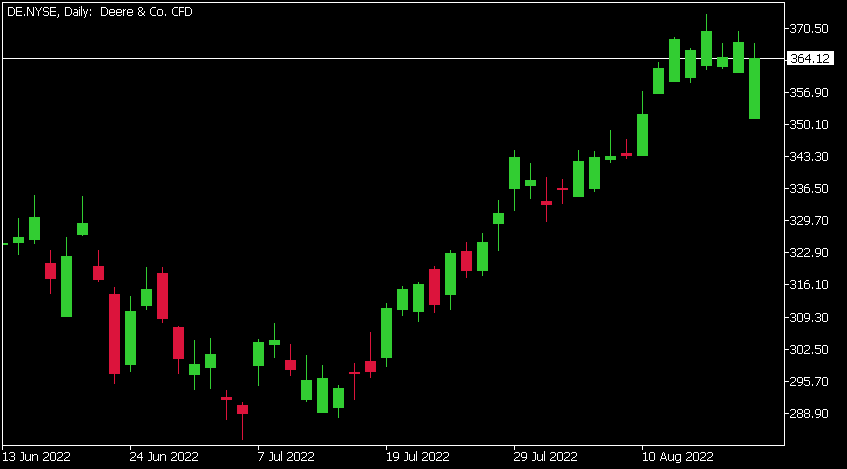

Deere & Co. (DE) chart

The stock was down by around 1% at the open on Friday at $364.12 per share.

Here is how the stock has performed in the past year:

- 1 month +17.85%

- 3 months +45%

- Year-to-date +32%

- 1 year +71%

Deere & Co. price targets

- JP Morgan: $325

- Citigroup: $340

- Deutsche Bank: $388

- Barclays: $400

- Credit Suisse: $472

Deere & Co. is the 113th largest company in the world with a market cap of $112.47 billion.

You can trade Deere & Co. (DE) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Deere & Co., TradingView, MarketWatch, Benzinga, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Zoom reports Q2 results – the stock dips

Zoom Video Communications Inc. (ZM) reported its latest financial results after the market close on Wall Street on Monday. The US communications technology company reported revenue of $1.10 billion for the second quarter (up by 8% year-over-year), falling short of $1.117 billion expected. Earnings per share reported at $1.05 per share vs. $0....

August 23, 2022

Read More >

Previous Article

Qantas outlook report

Overview Qantas is Australia’s national carrier and the largest and oldest airline in the country. With the Qant...

August 19, 2022

Read More >