- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Lennar exceeds expectations

- Founded: 1954

- Headquarters: Waterford District, unincorporated Miami-Dade County, Florida (Miami, Florida postal address)

- Number of employees: 12,012 (2022)

- Industry: Construction

- Key people: Stuart Miller (Executive Chairman, co-CEO), Jon Jaffe (co-CEO, President), Fred Rothman (COO)

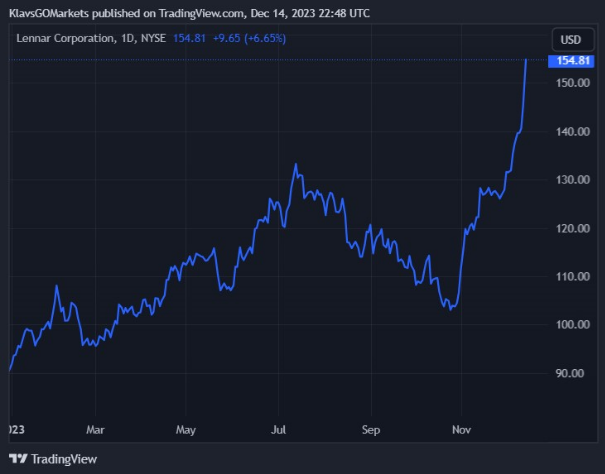

- 1 month: +21.22%

- 3 months: +30.88%

- Year-to-date: +70.22%

- 1 year: +63.38%

- Barclays: $165

- Jefferies Financial Group: $117

- Wells Fargo: $130

- JP Morgan: $135

- JMP Securities: $150

- Citigroup: $139

- Royal Bank of Canada: $114

- UBS Group: $159

- Evercore ISI: $164

- Wedbush: $123

- Goldman Sachs: $142

- Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours

- Reduce your risk and hedge your existing positions ahead of a new trading day

- Extended trading hours on popular US stocks means extended opportunities

News & AnalysisWorld’s 4th largest construction company, Lennar Corporation (NYSE: LEN), released its fourth quarter and full-year of fiscal 2023 financial results after the market close on Wall Street on Thursday.

Company overview

The results

The US company reported revenue of $10.968 billion (an increase of 7.8% year-over-year) vs. $10.228 billion expected.

Earnings per share (EPS) reached $4.82 per share for the quarter that ended on 30/11/2023 vs. $4.592 per share estimate. EPS was up by 5.93% from the same period the year prior.

Total revenue reached $34.2 billion for the fiscal year 2023 – up by 1.67% year-over-year.

EPS was reported at $13.73 per share – down by 12.65% from 2022.

CEO commentary

“We are pleased to report another strong quarter and year end, against the backdrop of evolving, though constructive, market conditions. During our fourth quarter, the economic environment shifted as interest rates rose for most of the quarter, and then subsided. Higher interest rates tested homebuyer sentiment, although purchasers remained responsive to incentives that enabled affordability. The well documented production deficit and chronic supply shortage continued to result in housing demand outweighing short supply. These conditions remained constructive for our overall operating strategy of focusing on production and sales pace over price, generating strong cash flow, increasing returns on equity and assets, and driving a strong bottom line,” co-CEO of Lennar commented on the latest results in a letter to investors and challenges for the company.

Jon Jadde, co-CEO of the company pointed out some of the achievements from the fourth quarter and looked ahead of what the company expects to achieve moving forward: “Operationally, our starts in the fourth quarter were 18,378, up 43% year over year, our new orders were 17,366, up 32%, and our deliveries of 23,795 were up 19%. We are clearly moving closer to an even flow operating model as we are now expecting approximately 18,500 starts, 18,000 new orders, and 17,000 deliveries in the first quarter of 2024. We expect more consistent results through the year as our cycle time is normalizing and was down 24% year over year as the improving supply chain and labor market positively impacted our production times and our inventory turn improved to 1.5 times reflecting broader efficiencies. Concurrently, the Lennar Machine continued to carefully match sales pace using our digital marketing and dynamic pricing models to keep production pace and sales pace closely matched.”

Stock reaction

Shares of Lennar were up by 6.65% at the end of the trading session on Thursday, trading at $154.81 a share.

The stock price dipped by around 2% in the after-hours trading as the results were announced.

Stock performance

Costco stock price targets

Lennar Corporation is the 29th largest company in the world with a market cap of $281.37 billion.

You can trade Lennar Corporation (NYSE: LEN) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

GO Markets now offers pre-market and after-market trading on popular US Share CFDs.

Trade the pre-market session: 4:00am to 9:30am, normal session, and after-market session: 4:00pm to 8:00pm, Eastern Standard Time.

Why trade during extended hours?

Sources: Lennar Corporation, TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Costco posts solid results

American wholesale chain, Costco Wholesale Corporation (NASDAQ: COST), announced financial results for the first quarter of fiscal year 2024 after the closing bell in the US on Thursday. Company overview Founded: September 15, 1983 Headquarters: Issaquah, Washington, United States Number of employees: 316,000 (2023) Industry:...

December 15, 2023Read More >Previous Article

Adobe beats estimates and reaches $5 billion quarterly revenue for the first time

US software giant, Adobe Inc. (NASDAQ: ADBE), reported Q4 and fiscal year 2023 financial results after the market close in the US on Wednesday. Com...

December 14, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.