- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Moderna gets a boost

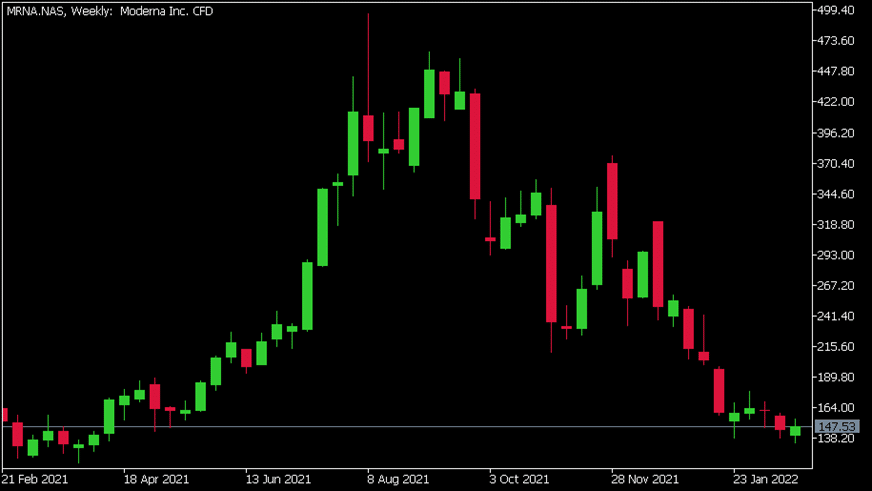

- 1 Month: +0.18%

- 3 Month: -45.54%

- Year-to-date: -41.38%

- 1 Year: +0.34%

News & AnalysisModerna Inc. (MRNA) reported it latest financial numbers before the opening bell in the US on Thursday.

The pharmaceutical company reported results that beat Wall Street estimates, sending the stock price higher on the day.

Total revenue reported at $7.211 billion in the fourth quarter vs. $6.798 billion expected.

Earnings per share at $11.29 per share vs. estimate of $9.96 per share.

Stéphane Bancel, CEO of Moderna commented on the last year’s performance following the latest results: “In 2021, we delivered 807 million doses with approximately 25% of those doses going to low- and middle-income countries, and we will continue to scale in 2022 to help end the COVID-19 pandemic. Moderna has experienced exponential growth and we have more than doubled the size of our team over the last year with a global team of 3,000. We also have announced plans to scale to 21 commercial subsidiaries across the world, including four new locations in Asia and six new locations in Europe. We continue to expand and advance our industry-leading mRNA pipeline with 44 programs in development. We look forward to clinical readouts from our therapeutics development candidates later in 2022 in rare genetic diseases and oncology. We are entering 2022 with a remarkable team and strategic priorities to continue advancing mRNA vaccines and therapeutics to impact human health.”

Moderna Inc. (MRNA) chart (Weekly)

Share price of Moderna surged by over 10% during Thursday, trading at $147.53 per share.

Here is how the stock has performed in the past year –

Moderna Inc. is the 274th largest company in the world and 21st largest pharmaceutical company with a total market cap of $59.54 billion.

You can trade Moderna Inc. (MRNA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Moderna Inc., TradingView, MetaTrader 5, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

GOLD and how it moves in times of crisis

For years, gold has been considered a store of value. As a physical commodity, it cannot be printed like money, and its value is not impacted by interest rate decisions made by a government. Because gold has historically maintained its value over time, it serves as a form of insurance against adverse economic events. When an adverse event occur...

February 25, 2022Read More >Previous Article

How to identify key resistance levels

A resistance level is a key tool in technical analysis, indicating when an asset has reached a price level that market participants are unwilling to s...

February 8, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.