- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

PayPal Q2 earnings results are here

3 August 2022PayPal Holding Inc. (PYPL) announced its latest financial results after the closing bell in the US on Tuesday.

The US financial technology company reported revenue of $6.8 billion in Q2, topping Wall Street estimate of $6.778 billion.

Earnings per share also beat analyst estimates for the quarter at $0.93 per share vs. $0.87 per share estimate.

”Our second quarter results were solid with currency neutral revenue and non-GAAP earnings growth exceeding expectations. We continue to gain share as we execute across our key strategic initiatives, even as we drive operational efficiency across our business.” Dan Schulman, President and CEO of PayPal said in a press release after the latest results.

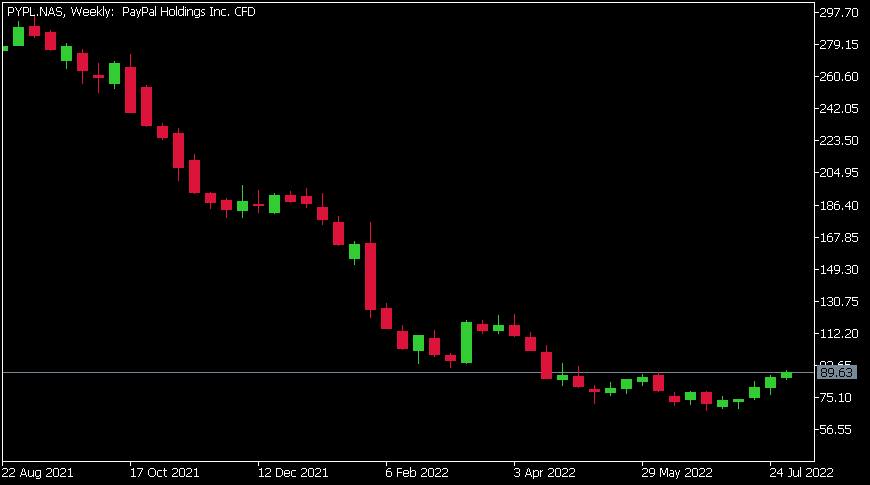

PayPal Holding Inc. (PYPL) chart

Shares of PayPal were up by 1.20% at the close of trading on Tuesday $89.63. The stock rose by around 11% after better than expected Q2 results.

Here is how the stock has performed in the past year:

- 1 Month +20.47%

- 3 Month -1.19%

- Year-to-date -52.47%

- 1 Year -67.23%

PayPal price targets

- Berenberg $145

- Oppenheimer $101

- Keybanc $100

- Wells Fargo $97

- JP Morgan $112

- JMP Securities $100

- RBC Capital $92

- Piper Sandler $93

- Truist Securities $80

- Credit Suisse $95

- Morgan Stanley $129

PayPal is the 118th largest company in the world with a market cap of $103.79 billion.

You can trade PayPal Holding Inc. (PYPL) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: PayPal Holding Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Volatile US session as risk assets decline on a Fed “re-pivot” and US-China tensions

US equities had a volatile and ultimately negative session as an early rally faded dramatically on the back as a combination of hawkish Fed member comments and geopolitical tensions saw risk assets take a dive. It was a classic risk off session that saw equities, crypto and cyclical currencies take a hit and the safe haven USD rally strongly. Bo...

August 3, 2022

Read More >

Previous Article

Reserve Bank of Australia hikes Cash Rate by 0.50%

The Reserve Bank of Australia, (RBA) has increased the Country’s cash rate by half a percent to combat the rising inflation in i...

August 2, 2022

Read More >