- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

How to ‘Trade the News’

6 July 2022‘Trading the news’, is a phrase that is often said, but to new traders it can be a confusing statement without much context. What does it mean to trade the news? Is it simply trading a News Company, or is it trading based on a news report, this article will explain some of the intricacies of the famous strategy of ‘trading news’.

What is it?

Trading the news is simply using an event, whether it be a global news event relating to a stock or sector news or an announcement from a company as a reason to enter a trade of a on a security or a derivative. A trader can only make money on a trade if the price of the chosen asset is moving. If the price is stagnant then there is no use trying to trade it as there will be no money to be made. This is also known as volatility. In addition, traders and investors like to trade when there is a high level of liquidity as this allows for larger position sizes and easier movement in and out of a trade.

Why do some traders ‘trade the news’?

There is multiple reason that trader will trade the new, but it is largely as news events act as catalyst for a shift in share price and increase in volatility. A general rule of the efficient market is that all information that is available is priced into the share price. However, when news/announcements are first announced, the market must evaluate the worth of the news to the share price and this can happen quickly, or it can take a few days to assess. This is where money can be made when ‘trading the news’.

Example

In this example we have a company ABC.

ABC is a publicly listed company listed on the ASX and it share price is currently $1.00. with a market capitalisation of $1,000,000

ABC is company that creates and sells bicycles.

Now imagine that this company signs a contract to sell 1000 bikes to Company DEF for $100,000

Immediately the news will be announced and the market including traders’ investors and others will have to assess how to value the contract. This will see a rush of volatility and buying/selling of the company’s shares.

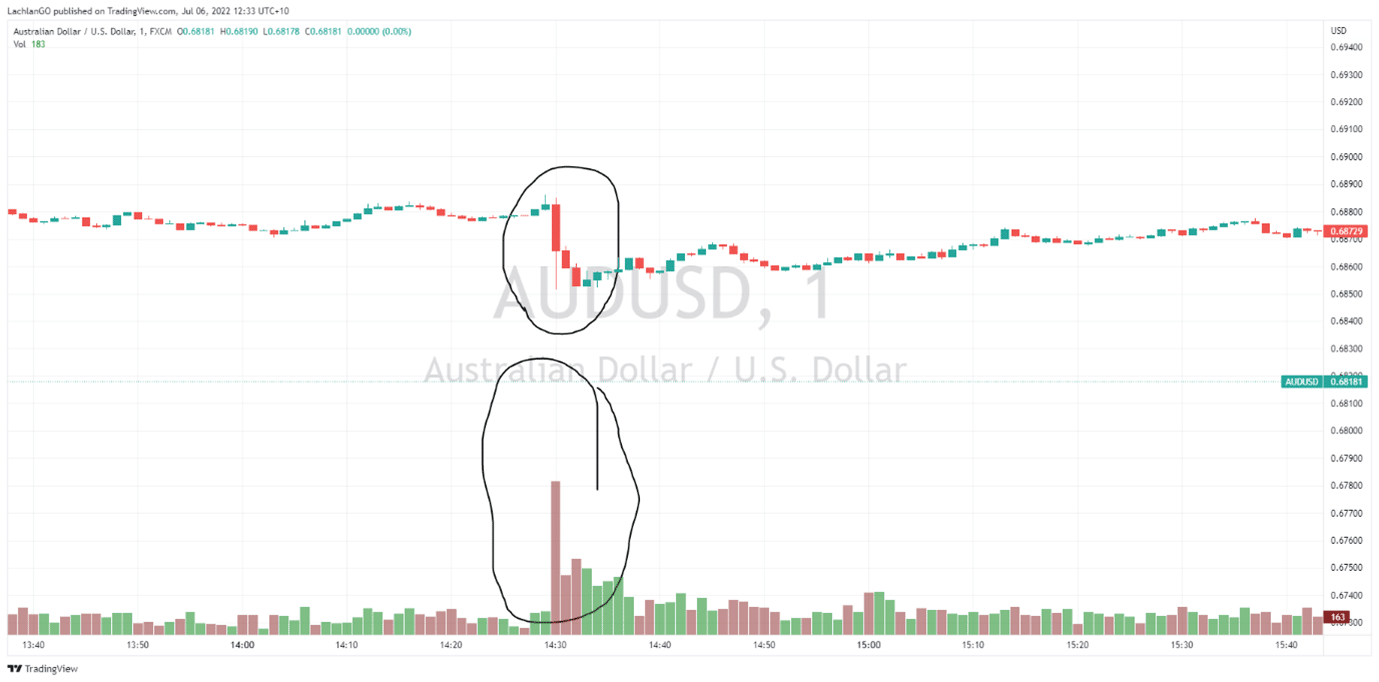

Similarly, traders can trade the news relating Foreign exchange. Specifically, news from relating to the economy or an announcement from a countries Central Bank can provide a shift to the currency which triggers traders on corresponding currency pairs. In the example below, the Reserve Bank of Australia had just announced an increase in the interest rate for the cash rate largely in line with analyst expectation. Some notable observation about the chart includes an initial influx of volume and increase in range for the candles relative to average levels.

What is ‘Selling the news?’

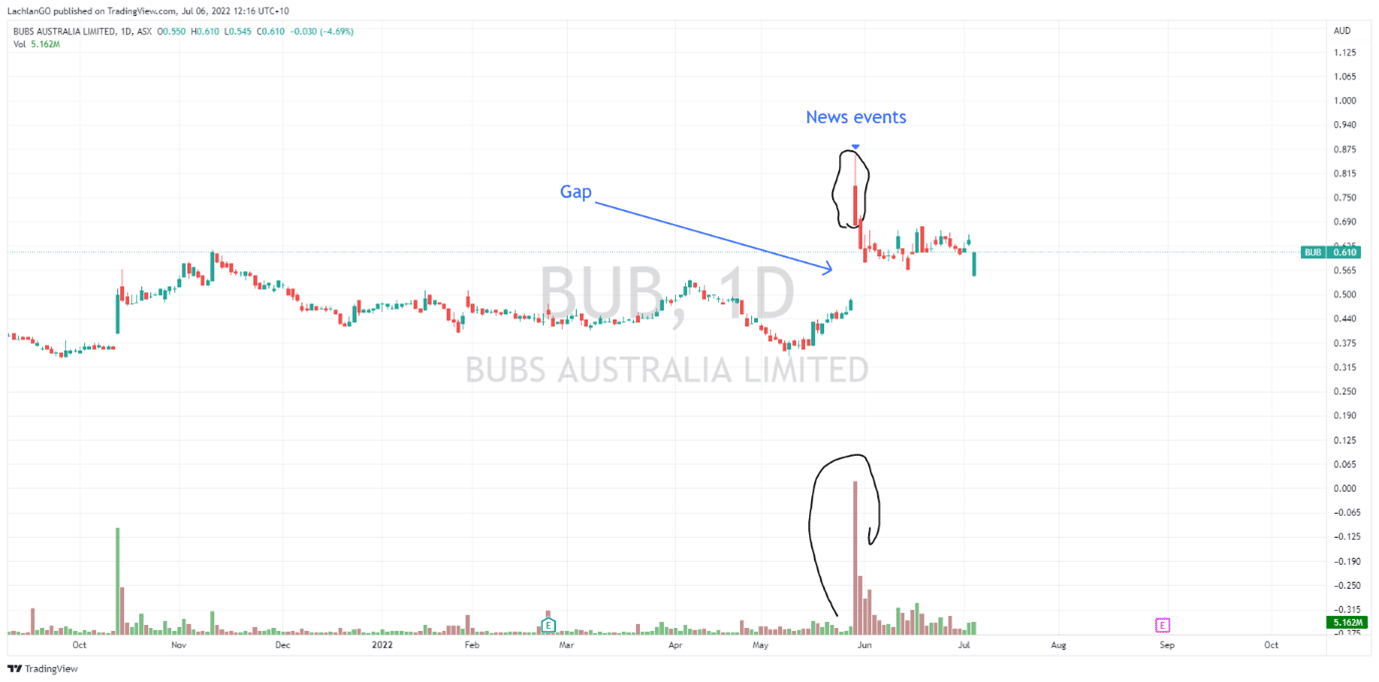

It has been established that trading the news is when traders will try and use news catalysts as a signal for volatility when trading, however sometimes a seemingly good news event creates a sell off that can often lead to confusion on the part of the trader who taken a buy position. The reason for much of this selling goes back to the first question. Why do traders trade the news? The market is trying to put a value on the announcement. Furthermore, this can be compounded by what are known as ‘trapped sellers. The concept of trapped seller is that when a stock creates a gap above a previous closing price based and that gap is above previous long terms resistance zones, sellers who have been stuck in the stock long term will sell their holding at the first opportunity. This of course creates downward pressure on the price. The downward pressure incentivises short sellers and more selling occur thus causing a ‘sell the news’ type of event.

Take the following example of ASX listed company BUB. The news events were that the company had signed a contract to supply the USA with baby formular at a time when the country was dealing with a massive shortage of the formula. As we discussed above, in this chart we can see that as the market opened.

- The price gapped form the previous close of $0.485 to $0.780 as the market opened.

- As the day wore on it became apparent that there was a great deal of long-term sellers who were using the opportunity to either take profits or cover to cover a loss.

- Subsequently the stock price kept falling for consecutive days as sellers continued to ‘sell the news’

Risks

‘Trading the news’ can be an inherently risky strategy, as an influx of volume comes into a stock the volatility often increases in volatility. This means that the momentum of. If a trader is on the wrong side of the move it can be a dangerous as the price can move very quickly. Therefore, traders should be weary and have clear stops and exits points for when a trade goes the wrong way.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Twiggy’s Beefy Winner

Andrew ‘Twiggy’ Forrest has bet on a winner in Australian Agricultural Company (AAC). The company is Australia’s largest integrated cattle and beef producer and is recognised as the oldest continuously operating company in Australia. In recent week’s key investment figure, Twiggy Forrest through his investment company Tattering, has doub...

July 6, 2022

Read More >

Previous Article

OPEC announces increase in oil production

The OPEC group has announced plans to increase production of Crude oil to reduce the panic and ease the supply crunch. However, some analysts believe ...

July 1, 2022

Read More >