- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrency

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrency

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Trading Strategies, Psychology

- Imposter Trader Syndrome: Why Confidence Matters as Much as Analysis

- Home

- News & Analysis

- Articles

- Trading Strategies, Psychology

- Imposter Trader Syndrome: Why Confidence Matters as Much as Analysis

- Doubting your analysis and execution in both entry and exit decision-making

- Assuming good results are not attributed to knowledge and skill, but rather luck or the market gods smiling on you for a while.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisImposter Trader Syndrome: Why Confidence Matters as Much as Analysis

20 June 2025 By Mike SmithHave you ever stared at your charts, perfectly certain your setup is valid, then right when you are ready to press the entry button, you freeze, tweak the setup, or abandon it altogether?

If so, then you have probably experienced what I call the ‘Imposter Trader Syndrome’.

Irrespective of trading experience or the evidence-based nature of your trading plan, it can show up as a nagging self-doubt that makes you second-guess your method, ignore your tested plan, or jump in or out of trades for reasons you’d never put in your strategy rules.

The outcome is that you move away from what you had planned to do. It eats away at both your consistency and confidence, and consequently impacts negatively on your account balance.

What Is Imposter Trader Syndrome?

Many of you will recognise the term ‘imposter syndrome’ from professional life, which is used to describe a sinking feeling that you are somehow not good enough or that you’ll be “found out” as a fraud — despite all evidence to the contrary.

In a trading context, it can show up in two dangerous ways:

Carrying these around with you may fuel indecision, constant tweaking, or abandoning your plan altogether, moving you away from consistency and confidence.

Why Does This Happen?

During many coaching hours spent with traders, there are a few common themes considered root causes of imposter trading syndrome:

1. Comparing Yourself to Others:

It is very easy to look at another trader’s highlight reel on social media (read ego-driven rambling) and assume they never hesitate or lose. You don’t see their losing trades because that is not what it is about for them. Rather, the only losing trades you will often see are just your own.

2. Recency Bias

If your last few trades were losers, it is tempting to conclude you have “lost your touch,” ignoring the fact that any system can have drawdowns. Consecutive losses within a profitable year are normal, and challenging market conditions were perhaps contributory to more difficult trading conditions. This focus on the last few rather than the big picture can result in behaviours that move away from established systems.

3. The Chase For Perfection

Many traders want a system that gives zero losses and a 100% win rate. Here is a reality check — it does NOT exist. It is an impossible standard that can paralyse rational thinking. You may begin to fear making ‘a mistake’ (any loss at all) so much that you make no decision at all. Logically, a tested system that produces positive results over time will have losses. The only mistake you can make is to move away from that system. The ability to follow it consistently, irrespective of the outcome of a single trade, should be perceived as a success.

4. Lack of Trust in Your Data

Traders often think they have a solid plan in place, but when it lacks unambiguity, hasn’t been stress-tested properly, or has only traded a handful of times in a live environment, it is difficult to develop trust in it. We know that confidence in your system is probably the number one contributor to the ability to exercise execution discipline. Unless you address this, there is a good chance that doubts will creep into your decisions more and more.

What Imposter Trader Syndrome Looks Like

Closing trades too early: Your trade has gone in your desired direction, but you don’t trust the trade to reach your planned target, so you bank profit “just in case”, only to see it hit your original profit target without you in the market.

Skipping valid setups: You see the signal, but the voice says, “I have lost on the last two trades, what if I’m wrong again?” So you let it go without you and watch the price fly exactly to the set-up point you had originally planned for.

Over-tweaking your plan: Constantly adding new filters, changing indicators, or modifying rules mid-week, or in the middle of a session, to “fix” something that wasn’t actually broken. I have lost count of the number of times I have seen charts with lines and colours that would look more at home in your local art gallery rather than as part of a well-thought-out trading system. Too many times, many of the things on charts either replicate another indicator, or even worse, there are things on there that the trader does not know what it is telling them at all.

Revenge trading: This point is a little more ambiguous than the others, but I feel it is important to include it. Wanting to get your money back to where it was before, or trying to prove that you are a good trader when a couple of trades have gone against you, can also be a sign of imposter trader syndrome. Some suggest it can also be a form of self-sabotage, where one loss feels like proof you aren’t good enough, so you overtrade to prove yourself right.

Why Confidence Matters as Much as Analysis

More often than not, it is a failure in execution rather than a failure in system that is the cause of imposter trading syndrome.

Analysis can mean very little without the confidence to follow through on it religiously. Even a flawless system fails if the trader hesitates, exits too soon, or overrides it out of fear.

A consistent trading edge only works when you apply it consistently, and that takes trust in yourself as a trader and trust in your system.

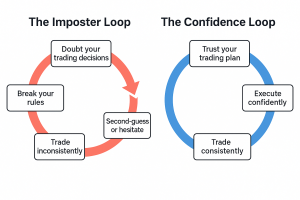

The image below summarises the difference. Which trader would you like to be?

The Imposter vs Confidence Trading loop

Six Ways to Beat Imposter Trader Syndrome

1. Own it!

Until you admit that there is something amiss with what you are doing, you will never do anything to make it better. Move past the excuses and placing blame, and accept that you can do things that are in your control to move to the next level.

2. Prove It to Yourself with Data

Backtest your setup, find someone to help with this if you need to, then forward test with small positions. Keep a journal tracking whether you stuck to the plan you have invested time and effort in creating. Test out “what if” analysis of the trades you know moved away from the plan to see what would have happened if you exercised discipline in the action. Your confidence in your system will grow instantly when you see that following your rules beats not doing so.

3. Focus on Process Over Outcome

Reward yourself mentally for following the plan, not just for winning. Success in trading is usually a result of consistency in action. A well-executed loss is still a win for you in the journey towards becoming a confident, disciplined trader.

4. Use Pre-Trade and Post-Trade Checklists

A simple “Did I follow my entry rules? Did I place my stop and target correctly?” routine keeps you anchored to the process. There are lots of examples of such checklists available online, and it is a common theme covered on the education webinars we run at GO Markets.

5. Trade Smaller When Doubt is High

When moving toward where you need to be, conviction is key. Reducing size while rebuilding your trading self-esteem takes the pressure off. Better small, consistent execution than large emotional missteps in your recovery from perhaps months or even years of not achieving what you can.

6. Limit Noise

Avoid bouncing between ten different trading ‘gurus’ and strategies. Pick the lane that best resonates with your trading style and flexibility, and commit long enough to learning and refining your best-fitting system to give it a chance to see real results.

Summary

Feeling like a ‘trading imposter’ is more common than most would care to admit. Unless you begin to own that it could be you, then it is likely to slowly erode your consistency and trading self-esteem.

Note the signs and symptoms and commit to doing the things that build confidence in your system as well as yourself. Remember, you are not competing with other traders’ highlights, nor some of the outlandish claims of outrageous results that some may make.

You are aiming to become the best trader you can be — build your own sustainable results with a system backed by evidence that fits your trading style, personal trading objectives, and financial situation.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Scaling In and Scaling Out: Advanced Position Management for Every Market

Position management is one of the most overlooked skills in trading. The shiny new entry setups seem to proliferate our social media channels, while position management receives little airplay. Yet it can be what separates a trader who rides price moves with clarity on when to take action, from one who repeatedly watches their unrealised profits...

June 23, 2025Read More >Previous Article

The CFD Trader’s Guide to Corporate Actions

Ignoring corporate actions is a common pitfall many CFD traders fall into. Longing or shorting the underlying share is rooted in technical and fundame...

June 19, 2025Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.