- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- NZDJPY – Kiwi Gathers Momentum Eyeing 77.88

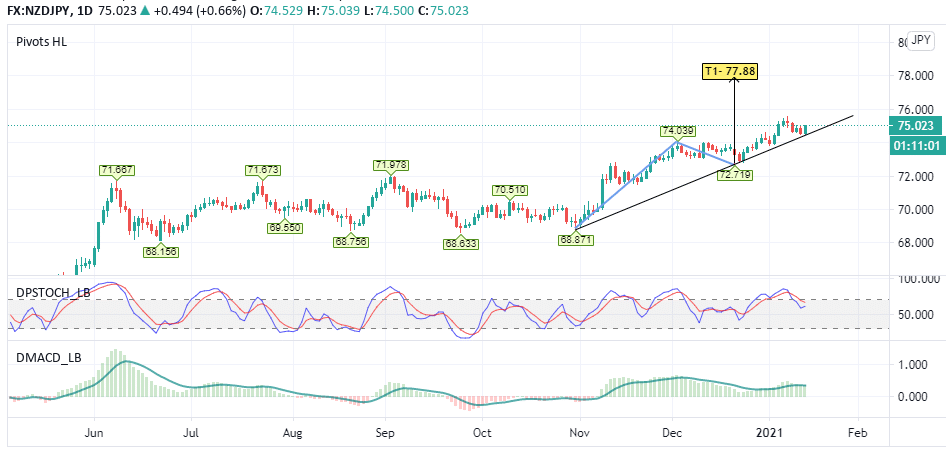

News & AnalysisNZDJPY- Daily

NZDJPY-

The Japanese Yen finally regained some ground against the US Dollar during this afternoon’s London session but continues to display weakness against many of its counterparts. In particular, the NZDJPY and AUDJPY crosses remain technically bullish in the short-term.

Looking at the NZDJPY daily trend, we see a validated bullish trendline that began in November last year following many months of extended consolidative activity. Another point to consider concerning the direction is the divergence between the Stochastic indicator and MACD. Notice we had a recent sell signal on the fast stochastic line, yet the MACD remains bullish. It suggests some potential buying opportunities as the market produces some corrective price action or perhaps even short-term profit-taking.

Regarding upside targets on the daily chart, the primary one is 77.88, which the NZDJPY pair last visited in December 2018. This price is based on the DiNapoli levels (68.67 / 74.03 / 72.71 ) as shown. The area of 72.71 may also become an area of support should the current trend breakdown and develop bearish tendencies.

Note: Click on charts to enlarge.

Sources: Go Markets, Meta Trader 5, TradingView, Bloomberg

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Week Ahead: Equity markets take a breather, US dollar strength and Crypto pullback

Major Indices took a breather last week, with US equity markets closing down more than 1% after posting record highs the week prior. In economic news, the incoming US administration announced a $1.9 USD trillion fiscal-stimulus plan that aims to counter the effects of COVID-19 and support markets as recent weak economic figures are indicating the...

January 18, 2021Read More >Previous Article

Electric Car Stocks on the Move

2020 was a good year for electric car space. We have seen shares of most electric car makers surge considerably and take steps to take the industry...

January 13, 2021Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.