- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Central Banks

- Bank of England Decision could send the Pound Lower

- Home

- News & analysis

- Central Banks

- Bank of England Decision could send the Pound Lower

News & analysisNews & analysis

News & analysisNews & analysisSince March 2023, the GBPUSD had been trading higher as the US Federal Reserve and the Bank of England (BoE) maintained along their path to continue raising rates, as they battled to bring inflation down to their 2-3% target level.

As the DXY recovered in strength, this led the GBPUSD to reverse from the high of 1.3130, trading down toward the lower bound of the bullish channel, along the 1.28 price level. Although the Consumer Price Index (CPI) data in July had a signaled a slowdown of inflation growth to 7.9%, this is still well above the BoE’s target level and significantly higher, compared to the other major economies.

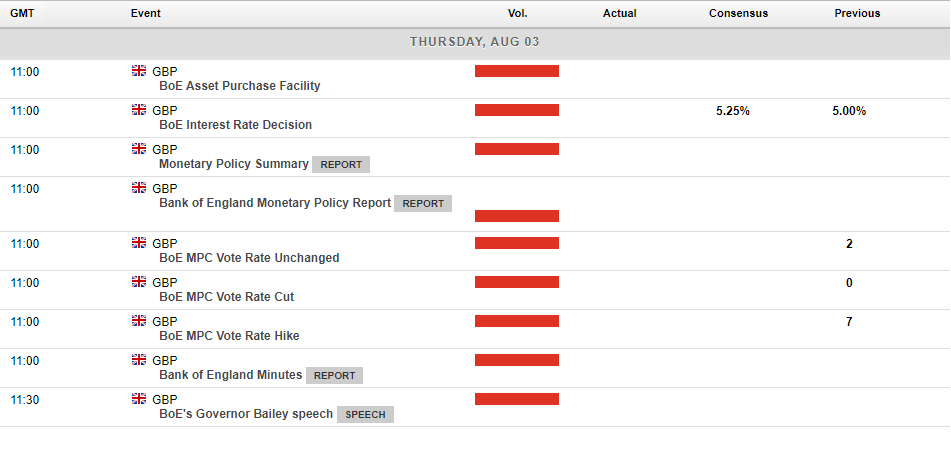

At the upcoming meeting on 3rd August, the BoE is expected to raise rates by 25bps, a fourteenth successive tightening, taking rates to 5.25% the highest since December 2007. However, it cannot be ruled out that the BoE could further surprise markets with a 50bps rate hike, similar to its actions in June.

At the upcoming meeting on 3rd August, the BoE is expected to raise rates by 25bps, a fourteenth successive tightening, taking rates to 5.25% the highest since December 2007. However, it cannot be ruled out that the BoE could further surprise markets with a 50bps rate hike, similar to its actions in June.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Averaging down: A Risky Move or a Smart Strategy?

Averaging down is an investment strategy in which an investor purchases additional shares or other assets at a lower price than their initial purchase price. This strategy is employed when the price of the asset has declined after the investor's initial purchase. Through buying more of the asset at a lower cost, the average cost per unit or share d...

August 3, 2023Read More >Previous Article

Nasdaq cements its best start to a year since 1975

The Nasdaq Composite Index has kicked off 2023 with a historic performance, achieving its most impressive start since 1975. Despite concerns about a p...

August 2, 2023Read More >Please share your location to continue.

Check our help guide for more info.