- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Articles

- Central Banks

- Australian CPI figures increase to 6.1%

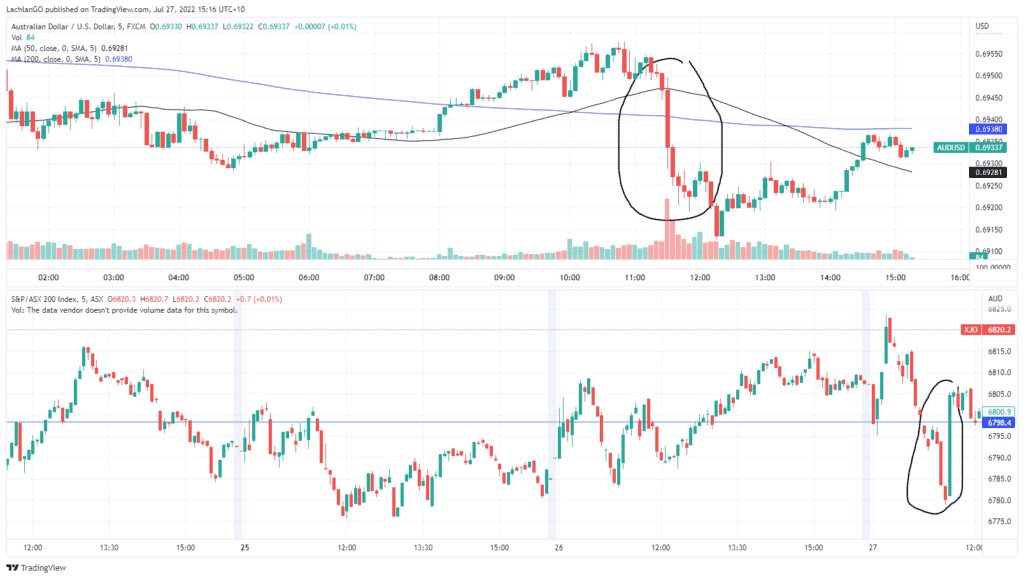

News & analysisThe Australian Consumer data was released today with Consumer Price Index rising to 6.1% over the past 12 months. For the quarter, the CPI rose by 1.8% which was 0.1% lower then what analysts expected the figure to be. This was also lower then the 2.1% jump seen in the previous March quarter. The most significant contributors to the increase were new dwellings, +5.6%, and automotive fuel +4.2%. Whilst the overall numbers were only slightly off what was expected, the update provided some small relief to a market that has been dealing with record high-inflation.

Australian Treasurer, Jim Chalmers stated that “Inflation is high and rising. It will get tougher before it gets easier.” In response the XJO, (ASX200) saw a big spike, shooting up by 0.36% in the 5-minutes post the announcement. Conversely, the AUDUSD dropped from $0.6946 to $0.6913 in the half hour after the announcement as the market adjusts the value of the AUD to the likely lower interest rates.

Bond Market responds

The bond market responded by lowering its predicted interest rate hike next Tuesday by the Reserve bank of Australia. The interbank futures were implying a 16% chance for a 75-basis point shift before the announcement. However, now the bond market is pricing in a 92% chance of 50 basis point move. Commonwealth Bank of Australia has also confirmed its expectation of a 50-point hike at the next meeting. The bond futures market is also adjusted its prediction of a cash rate of 3.18% by the end of the year against the 3.38% that was forecast before the meeting.

With important data to come out of the USA tonight including Q/Q advance GDP figures as well as the Federal Reserve’s Cash Rate announcement, the end of the week may very well continue to be volatile.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Meta earnings results are in – the stock falls in the after-hours

Meta Platforms (META) announced its Q2 financial results after the closing bell in the US on Wednesday. The social media giant fell short of analyst expectations for the quarter. Revenue reported at $28.822 billion in Q2 (down by 1% year-over-year), vs. analyst estimate of $28.908 billion. Earnings per share at $2.46 per share (down by 32%...

July 28, 2022Read More >Previous Article

Wheat Trading Opportunities

Wheat Trading Opportunities Wheat is a well-known soft commodity that is vital for any kind of bread product. It also has important uses fo...

July 26, 2022Read More >Please share your location to continue.

Check our help guide for more info.