- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Cryptocurrency

- Short-term buying opportunity on Bitcoin

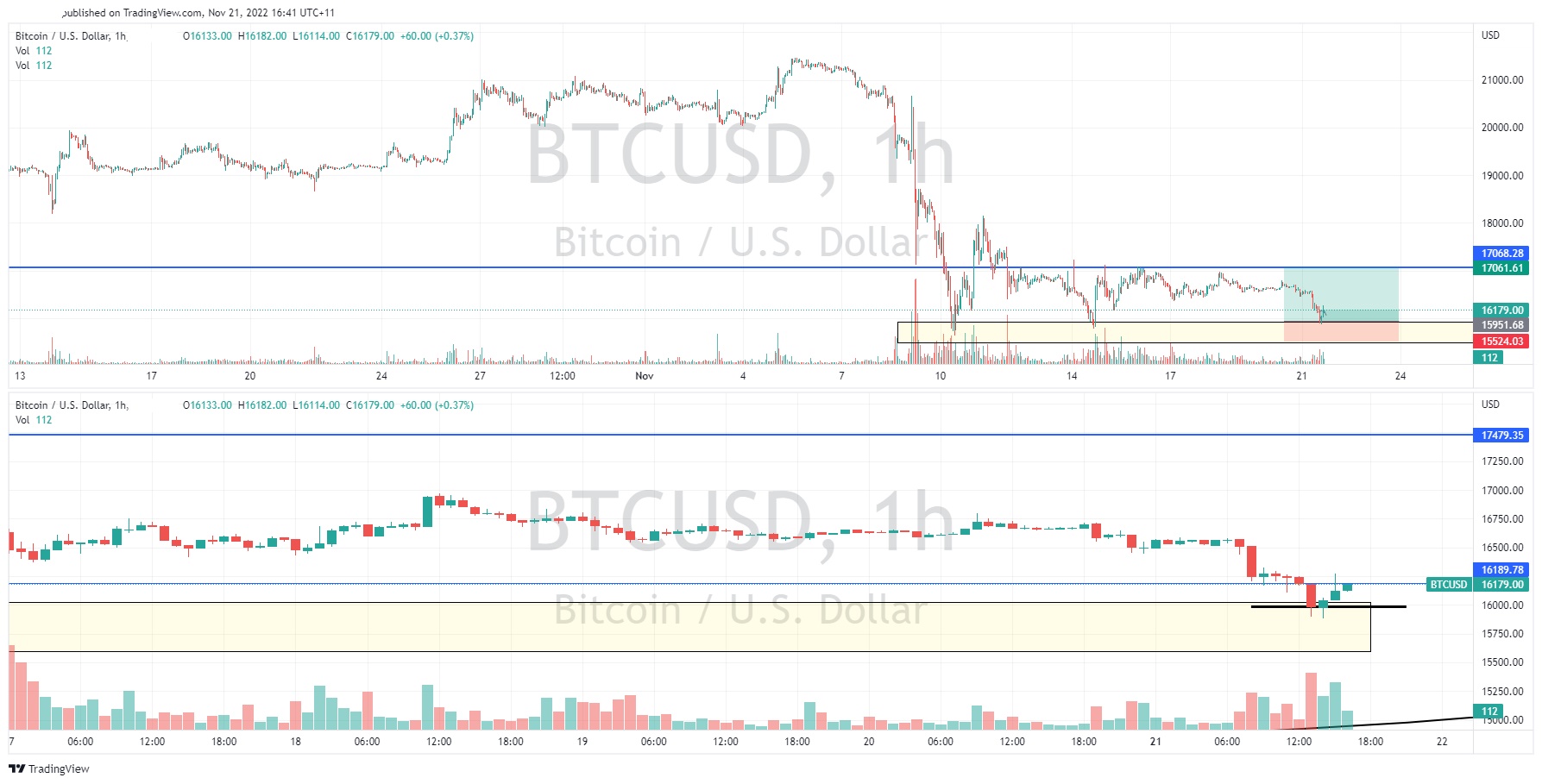

News & analysisBitcoin has recently tested the lows of its price range that it reached in the immediate aftermath of the FTX crisis. A long opportunity has been brought about after price bounced off these lows near $15,863. The hourly chart shows a potential good risk reward entry. The trigger for the entry is not just the fact that the price has bounced off the support zone but is also the strong bullish candle stick at the support level.

The selling was absorbed at the support zone by the buyers and could not close below the wicks of either candle as seen by the length of the wicks. Furthermore, the above average volume for these candles indicated that the selling was exhausted and that the buyers were willing to take on the supply. For this bounce to continue, a strong green candle that closes above the opening price of most recent red candlestick will hopefully support the breakout at $16,204. As seen on the chart, an obvious target is the $17,000 level which is the top of the recent price range.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Zoom tops Q3 estimates

Zoom Video Communications Inc. (NASDAQ: ZM) reported third quarter financial results after the market close in the US on Monday. The US communications technology company posted better-than-expected results for the quarter, topping both revenue and earnings per share (EPS) estimates. Zoom reported revenue of $1.102 billion (an increase of 5% y...

November 22, 2022Read More >Previous Article

JD.com beats expectations

JD.com Inc. (NASDAQ: JD, HKEX: 9618) reported its latest earnings results for the three months that ended September 30, 2022, on Friday. The Chines...

November 19, 2022Read More >Please share your location to continue.

Check our help guide for more info.