- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX Analysis – USD drifts lower, AUD outperforms after RBA, Gold and JPY push higher

- Home

- News & analysis

- Forex

- FX Analysis – USD drifts lower, AUD outperforms after RBA, Gold and JPY push higher

News & analysisNews & analysis

News & analysisNews & analysisFX Analysis – USD drifts lower, AUD outperforms after RBA, Gold and JPY push higher

7 February 2024 By Lachlan MeakinUSD drifted lower in Tuesday’s session, the US dollar index retracing a good chunk of Mondays gains. Regional bank fears were at the fore, with NYCB continuing its steep decline in an otherwise quiet session news wise. This saw the haven of bonds bid, sending yields lower and dragging the USD down with them. DXY dipping back below its 100 Day SMA.

AUD outperform after a hawkish hold from the RBA in their February meeting on Tuesday. The Aussie Central Bank left rates unchanged as expected, but in a break with other major central banks, that have recently removed their tightening bias messaging, stated that further rate hikes cannot be ruled out. AUDUSD pushing up to test the Support/Resistance level of 0.6525 which will be a key level to watch in the week ahead.

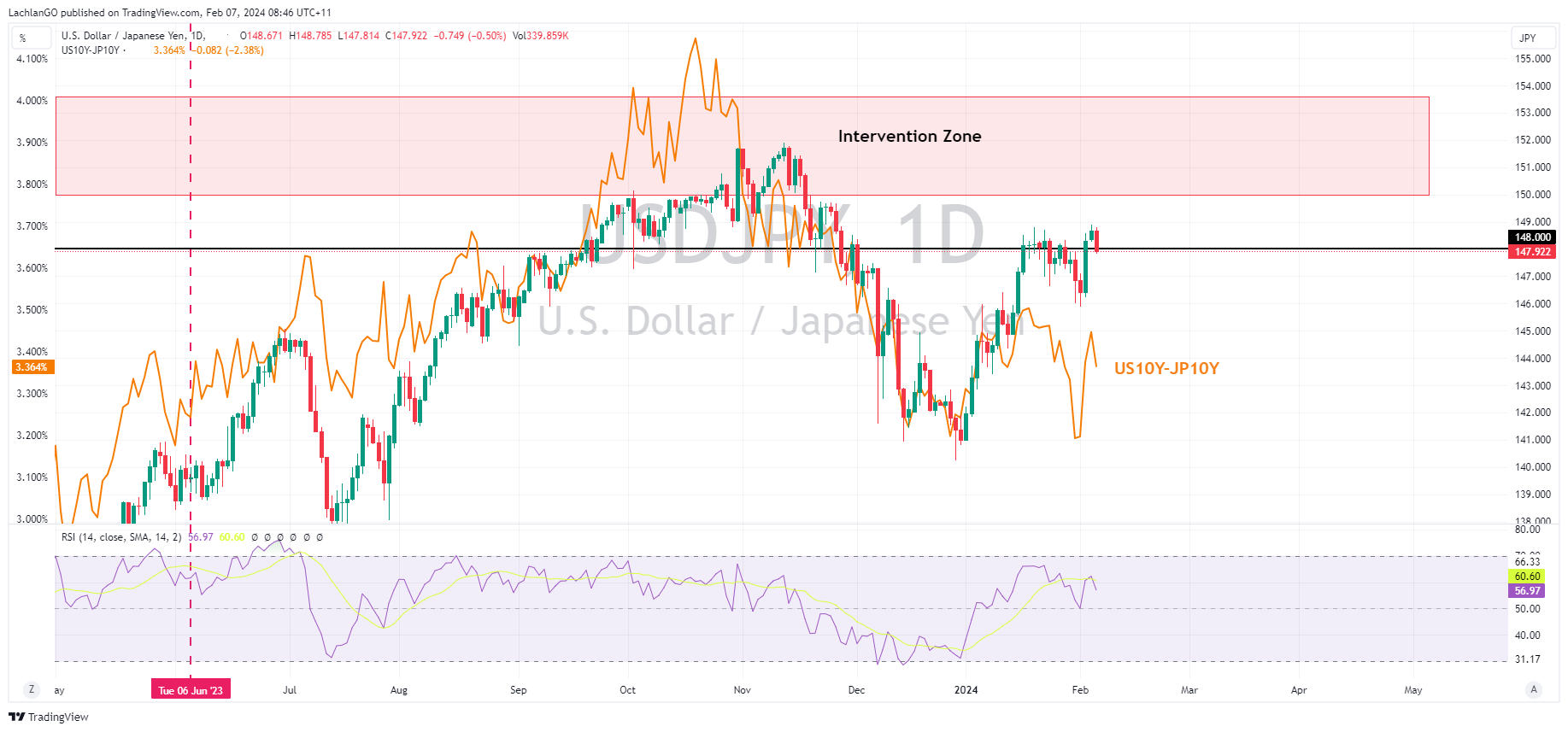

Lower US yields causing a drop in yield differentials saw JPY gain, with USDJPY dipping below 148. A Reuters report that claimed that the BoJ is laying the groundwork to end NIRP by April also lending some support to the Japanese currency.

A weaker USD and some haven flows on bank fears saw gold bounce higher after two down sessions. XAUUSD continues to trade in a tight range with the upside capped at 2070 USD an ounce and good support to the downside around 2020.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Alibaba stock dips after earnings

Chinese e-commerce giant, Alibaba Group Holding Ltd. (NYSE: BABA), released Q4 2023 earnings results before the US market open on Wednesday. The company achieved revenue of $36.67 billion, which was pretty much in line with analyst estimates. Revenue grew by 5% year-over-year. Earnings per share was reported at $2.672 (down by 2% year-over-ye...

February 8, 2024Read More >Previous Article

Ford Q4 2023 results arrive above estimates – the stock is rising

Ford Motor Company (NYSE: F) released the latest financial results for Q4 of last year after the market closed on Tuesday. World’s 11th largest a...

February 7, 2024Read More >Please share your location to continue.

Check our help guide for more info.