- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX Analysis – USD weaker, AUD , NZD up on firm Yuan fix, JPY jawboning

- Home

- News & analysis

- Forex

- FX Analysis – USD weaker, AUD , NZD up on firm Yuan fix, JPY jawboning

News & analysisNews & analysis

News & analysisNews & analysisFX Analysis – USD weaker, AUD , NZD up on firm Yuan fix, JPY jawboning

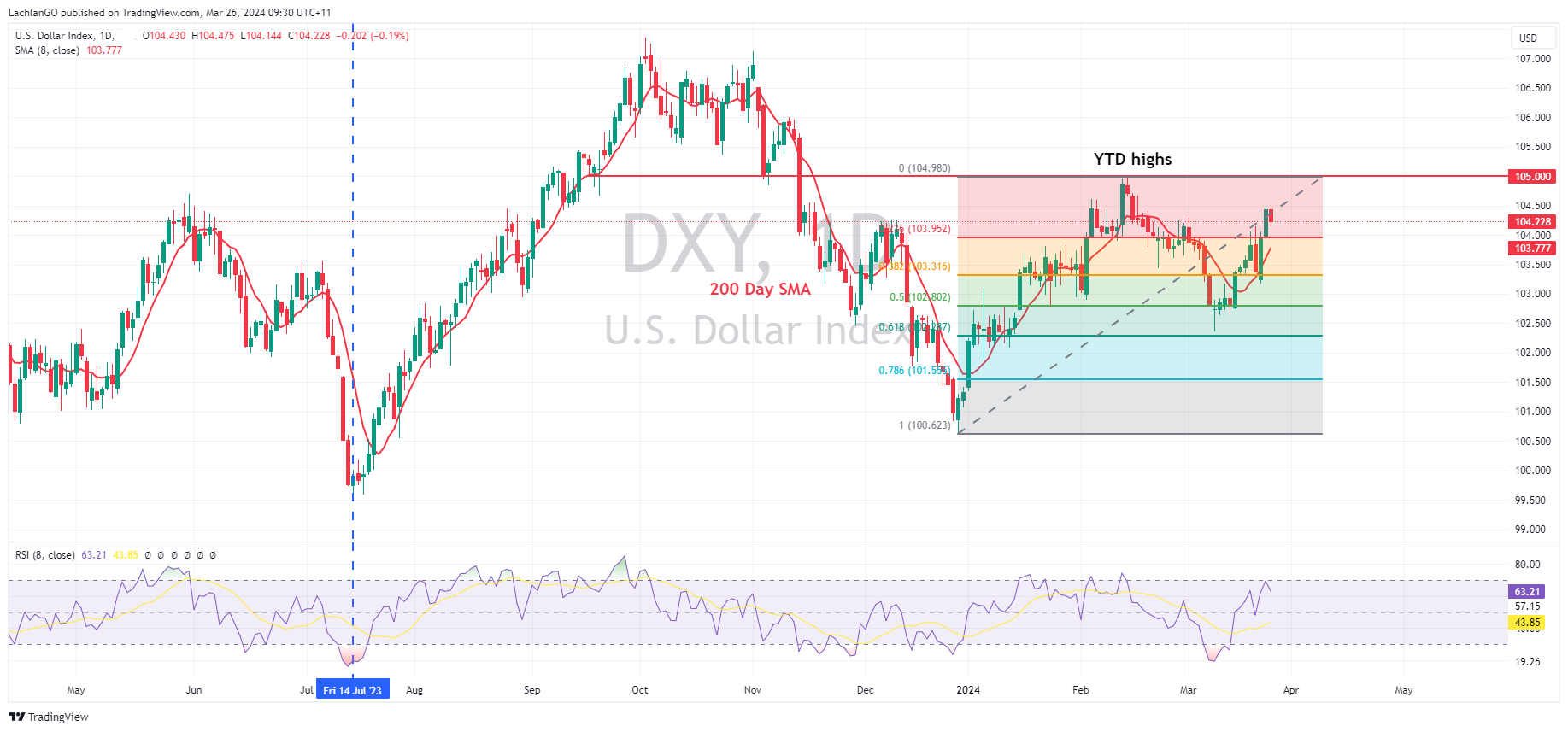

26 March 2024 By Lachlan MeakinUSD was slightly lower on Monday with DXY hitting a low of 104.140, holding above the 104 support level. News was light with only New Home Sales of any note, which missed modestly to the downside (662k vs the expected 675k). There was some Fed speak, the highlight being Fed hawk Bostic where he reiterated his desire of just one rate cut in 2024, this failed to make much impact on the Dollar though.

AUD and NZD saw gains to differing degrees against the USD with AUD outperforming, continuing the steep rally in AUDNZD to see the pair touching on 1.09 and firmly in overbought territory. Both AUD and NZD supported by the surprise Yuan fix by the PBoC that was much firmer than forecast. AUDUSD initially tested Friday’s low at 0.6510, before the fix and improving risk sentiment saw it reverse course to hit a high of 0.6546.

USDJPY was ultimately flat in a tight ranged session. Some more jawboning from top currency diplomat Kanda saying that the BoJ has been closely watching “FX moves with a high sense of urgency and will take appropriate steps to respond” saw the talk of intervention arise with Bank of America noting that intervention is seen as a ‘realistic option’ to support the Yen, especially if the USDJPY cross rises to the 152-155 zone.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Cintas exceeds estimates and raises guidance – the stock reaches a new all-time high

Q1 earnings season is nearly finished but there are still a few companies expected to release their latest results for the previous quarter. On Wednesday, Cintas Corporation (NASDAQ: CTAS) announced their latest financial results. American company that specializes in the manufacturing and sale of workwear and uniforms achieved revenue of $2.4...

March 28, 2024Read More >Previous Article

Accenture stock dips after earnings

Accenture plc (NYSE: ACN) announced Q2 of fiscal 2024 earnings results before the US market opened on Thursday. Irish-American professional service...

March 22, 2024Read More >Please share your location to continue.

Check our help guide for more info.