- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Central Banks

- Reserve Bank of Australia surprises the market by lifting cash rate by 25 bps

- Home

- News & analysis

- Central Banks

- Reserve Bank of Australia surprises the market by lifting cash rate by 25 bps

News & analysisNews & analysis

News & analysisNews & analysisReserve Bank of Australia surprises the market by lifting cash rate by 25 bps

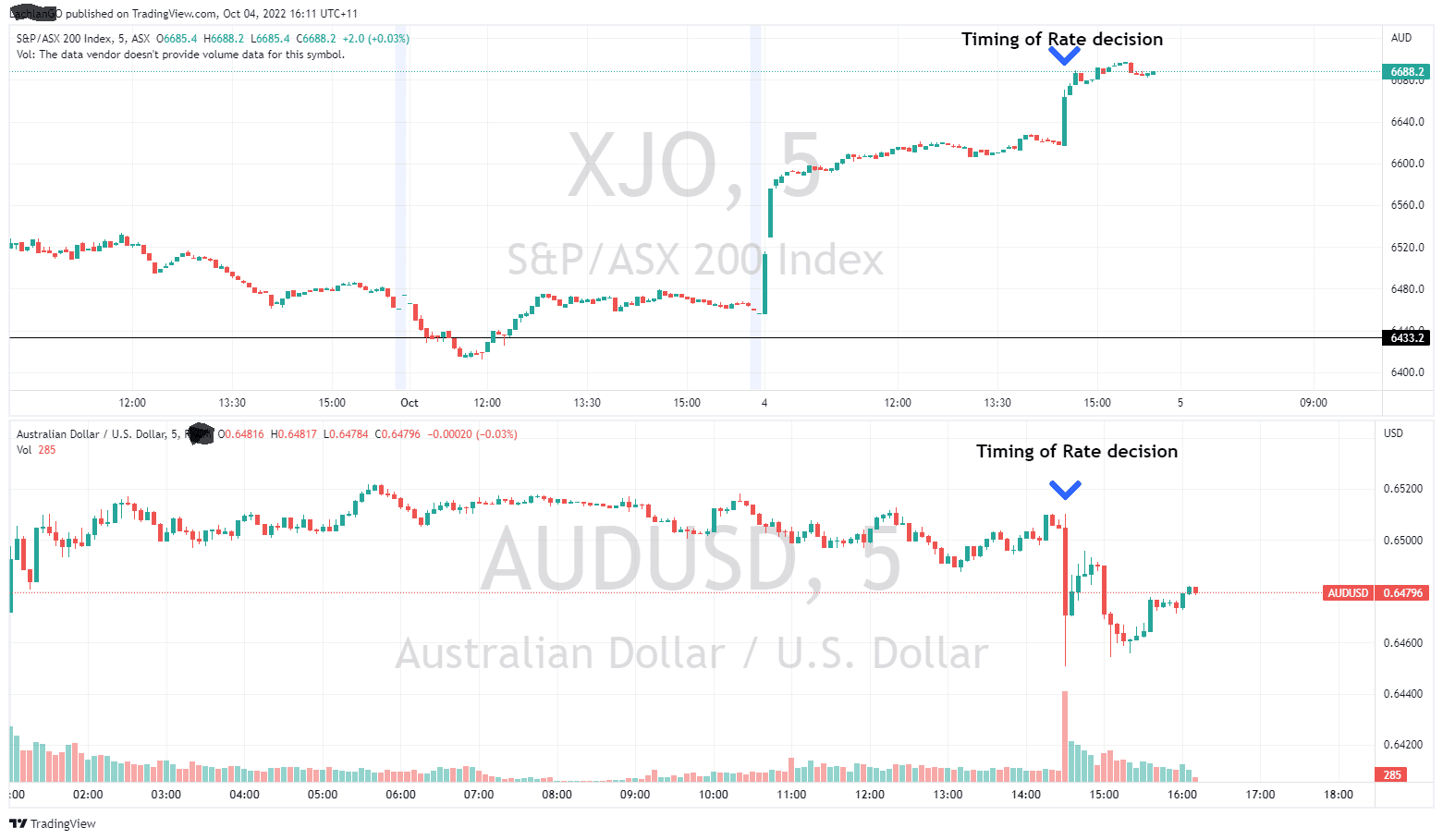

4 October 2022 By GO MarketsThe Reserve Bank of Australia, (RBA) has surprised much of the market by raising the country’s cash rate by just 25 basis points. With analysts expecting a more aggressive 50 bps hike, the smaller lift will provide relief to much of the country’s housing market and equity market. RBA, Chairman, Phillip Lowe outlined how previous rate rises had already begun struggling with the previous rate rises.

International volatility has also become much higher with retirement funds in the UK needing to be bailed out by the Bank of England after the funds found themselves inundated with the liquidity issues due to spikes in yield on many of the UK government bonds that they were holding. With the global financial system so interconnected there was a very real chance that a trillion dollars’ worth of bonds would be exposed without intervention effecting far more then just the UK’s financial system. In addition, worries over both Deutsche Bank and Credit Suisse also being in trouble with their risk of defaulting potentially increasing. This had the RBA worried that the situation could turn very quickly in Australia and sparked the lower rate.

With relatively low rates of inflation the RBA has had more flexibility to adjust the aggressiveness of its hikes as it has gone along and todays changes showed that. The bank still expects inflation for the year to be between 6-7 %.

In response to the hikes the AUD dropped sharply on the news falling by 0.52%. Australian equities saw a large jump increasing by 0.93% for the half an hour after the announcement. With inflation still at elevated levels, there is no guarantee that the lower rate hikes will continue.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

EURAUD testing mean of long-term range

The EURAUD buoyed by a weaker Australian Dollar lighter lighter monetary policy from the Reserve Bank of Australia, (RBA) has seen the currency pair move with some momentum in recent days and weeks. The RBA came out in its most recent meeting and raised rates by an unexpectedly low 25 bps vs 50 bps. This helped equities and housing stability but pu...

October 6, 2022Read More >Previous Article

China Yuan’s Falls to Record lows

I have recently written a piece on the weakening of the Great British Pound (GBP) just the other day, as it looks like the dollar seems to be king...

October 4, 2022Read More >Please share your location to continue.

Check our help guide for more info.