- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

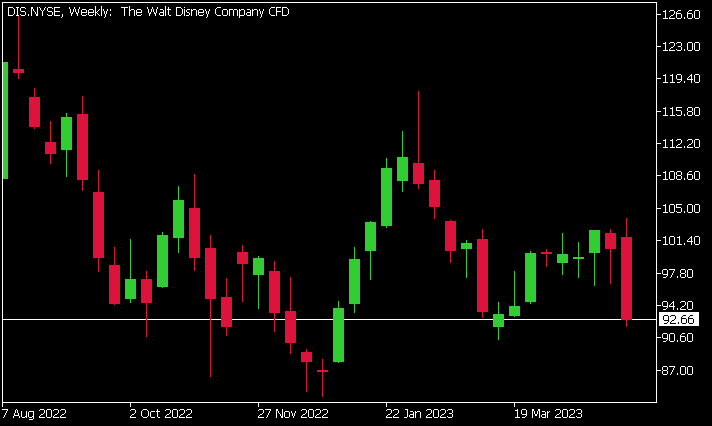

- Walt Disney continues to lose subscribers – the stock is falling

- Home

- News & analysis

- Shares and Indices

- Walt Disney continues to lose subscribers – the stock is falling

- Founded: October 16, 1923

- Headquarters: Team Disney Building, Walt Disney Studios, Burbank, California, United States

- Number of employees: 220,000 (2022)

- Industry: media, entertainment

- Key people: Mark Parker (chairman), Bob Iger (CEO)

- 1 month: -8.31%

- 3 months: -8.31%

- Year-to-date: +6.42%

- 1 year: -11.36%

- Morgan Stanley: $120

- Wells Fargo: $147

- Deutsche Bank: $135

- Barclays: $107

- Guggenheim: $130

- Citigroup: $130

- JP Morgan: $135

- Credit Suisse: $133

- Bank of America: $135

News & analysisNews & analysis

News & analysisNews & analysisWorld’s largest entertainment company The Waly Disney Company (NYSE: DIS) announced second quarter financial results ended April 1, 2023, after the market close on Wall Street on Wednesday.

Company overview

The results

Walt Disney reported revenue of $21.815 billion for the quarter vs. $21.795 billion expected. Revenues were up by 13% vs. same period last year.

Earnings per share fell slightly short of expectations at $0.93 per share (down by 14% year-over-year) vs. $0.933 per share estimate.

Disney+ subscribers fell from 161.8 million to 157.8 million in the quarter. It has now lost 6.4 million subscribers over the last two quarters.

Company commentary

“We’re pleased with our accomplishments this quarter, including the improved financial performance of our streaming business, which reflect the strategic changes we’ve been making throughout the company to realign Disney for sustained growth and success,” Robert A. Iger, CEO of the company said in a statement.

“From movies to television, to sports, news, and our theme parks, we continue to deliver for consumers, while establishing a more efficient, coordinated, and streamlined approach to our operations,” he concluded.

The stock was down by over -8% on Thursday, trading at around $92.66 a share.

Stock performance

Walt Disney price targets

Walt Disney is the 63rd largest company in the world with a market cap of $170.34 billion, according to CompaniesMarketCap.

You can trade The Waly Disney Company (NYSE: DIS) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: The Waly Disney Company, TradingView, MarketWatch, MetaTrader 5, CompaniesMarketCap, Wikipedia, MarketBeat

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

GBPUSD analysis – Is the Bank of England approaching peak rates?

The Bank of England (BoE) is due to release its interest rate decision today, with markets expecting a 12th consecutive hike to take interest rates to 4.50%. There has been increasing speculation that the BoE is reaching its terminal rates and could follow the lead of the US FOMC and the ECB in signaling a slowdown or pause on further rate hikes fo...

May 11, 2023Read More >Previous Article

Rivian results announced – the stock is up

American electric vehicle Rivian Automotive Inc. (NASDAQ: RIVN) reported the latest financial results for Q1 after the market close in the US on Tuesd...

May 11, 2023Read More >Please share your location to continue.

Check our help guide for more info.