- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- USDJPY showing signs of another breakout

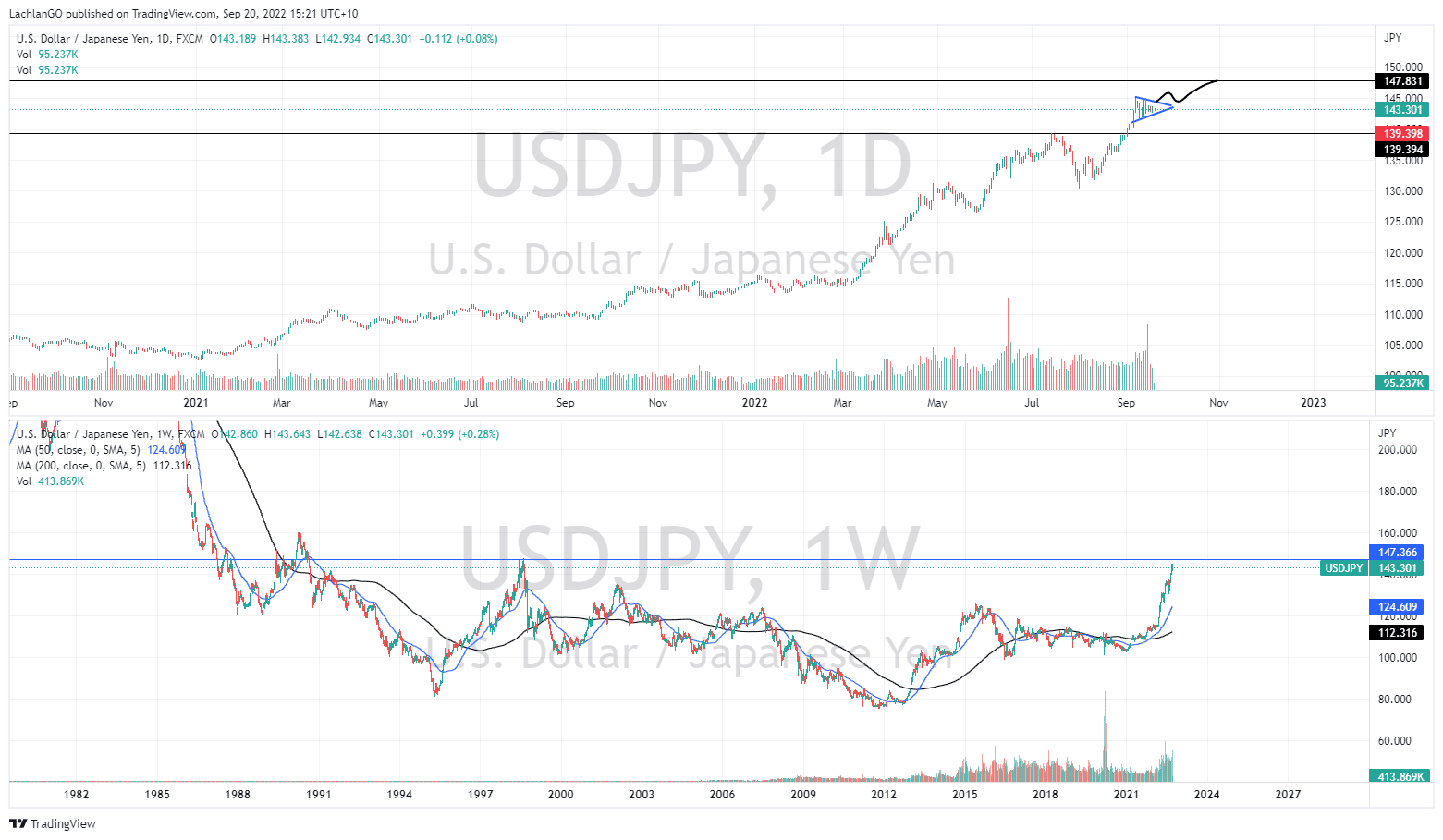

News & analysisThe USDJPY has been one of the strongest performing currency pairs since the beginning of the year. With geopolitical volatility and record high inflation rates impacting the global economy, the strength of the USD has just continued to be on show. On the contrary, the JPY has been pillaged from pillar to post as the Bank of Japan has refused to change form its dovish stance and remain one of the few countries committed to holding interest rates low in the medium term.

The different responses

The US Federal Reserve has become extremely hawkish with its monetary policy, after describing inflation as transitory only last year. After recording extremely hot CPI and Core CP figures for the last month as the yield on US government treasuries has increased and trader price in more interest rate hikes. Conversely the BOJ has continued to keep a 0.25% cap on its 10-year government bonds.

On the other hand, a weak JPY makes the cost of importing energy and food more expensive in Japan. This is especially problematic as the global energy crunch and inflation have sent the price of these goods and commodities sky rocketing. The BOJ has also continued to buy up government debt stimulating the economy which has further weakened the currency. However, unlike, much of the rest of the world, Japan’s inflation level is still relatively low.

These actions of both banks and the current economic climate has led to a situation where the USDJPY is currently at 30-year highs and only looking to go higher. The price has been going up aggressively since 2021 has been an aggressive upward trend. Since March 2022 the price has sped up and broken through decade high levels. The BOJ has so far been unwilling to change, at least until April 2023 meaning there is little to stop the JPY continuing to fall. On the other side, with the Federal Reserve set to continue raising rates there is nothing to stop the USD from continuing to climb.

Technical Analysis

In recent days the price has begun to consolidate into a flag or pennant pattern. As it can be seen on the chart, the price has reduced its range and volume as it has paused amid its push upward. A pattern like this is not unexpected and is standard of a strong upward trend.

In addition, with important economic events to come like the FOMC meeting and the shift in federal funds rate, the USD may increase its strength if the rates incur an unexpectedly increase in rates. The next target if the price does break out of the triangle is 147 and then 160. Various economic events can still play a role in either pushing the price up or down.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

ASX200 resting on a knifes edge

Inflation and recessionary pressures have caused the aggressive sell offs of some of the largest global indices, however so far, the ASX200 or XJO has fared relatively well. However, there are worrying signs that a resilient XJO may be coming to an end. Whilst the inflation rate in Australia is still at levels that are low compared to much of the r...

September 26, 2022Read More >Previous Article

AutoZone latest results have arrived

AutoZone Inc. (AZO) reported its fourth quarter financial results for the period ending August 27, 2022 on Monday. The largest US retailer of after...

September 20, 2022Read More >Please share your location to continue.

Check our help guide for more info.