- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Central Banks

- Fundamental and Technical Forecasts Ahead of the FOMC meeting

- Home

- News & analysis

- Central Banks

- Fundamental and Technical Forecasts Ahead of the FOMC meeting

News & analysisNews & analysis

News & analysisNews & analysis

The FOMC Meeting is set to be the highlight of the week as it might revive the rising trend of the US dollar.

Watchful eyes are glued to the reactions of the financial markets as the new tariffs officially take effect today. The policy divergence between the Fed and other central banks have put the US dollar in the spotlight and traders are keen to see how the Fed will play a probable fourth rate hike in December.

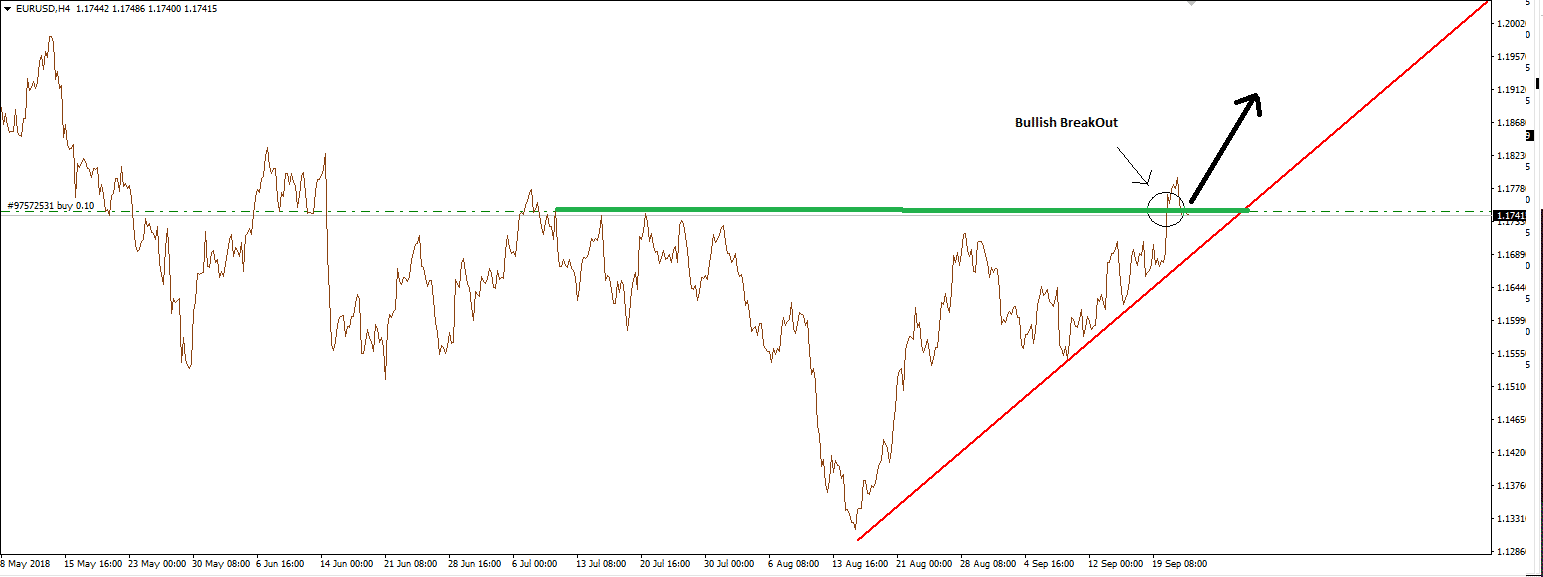

EURUSD

Fundamental Analysis

The EURUSD pair mainly found support by a weak US dollar last week. As we progressed into a new week, the Germany IFO Business Climate and EX CPI figures will be the main events on the data front for the Euro. Core inflation is expected to remain the same while elevated energy prices should drive headline inflation slightly higher at 2.1%. On the political front, attention will be on the Italian Budget.

Technical Analysis

The pair has formed an ascending triangle and the breakout through the resistance level might be the signal of a bullish formation. The uptrend line shows that sellers are losing control and bulls are pushing the pair higher. It is currently trading around the 1.1740 level, and a firm confirmation above that level could provide bulls with trading opportunities.

GBPUSD

Fundamental Analysis

After the renewed confidence over positive Brexit news, the Sterling is trading on the back foot again. A lack of economic releases on the UK-calendar will cause the pair to be mostly driven by Brexit related news.

Technical Analysis

After falling out of the overbought RSI conditions, the Gravestone Doji candle which formed on the weekly chart in an uptrend pattern shows that the selling pressures were able to push prices back down to the opening price of the week. This can signal that the uptrend could be over and long positions should trade cautiously. However, Friday’s sell-off might also be panic-selling so bears should wait and see for a clear down direction to act.

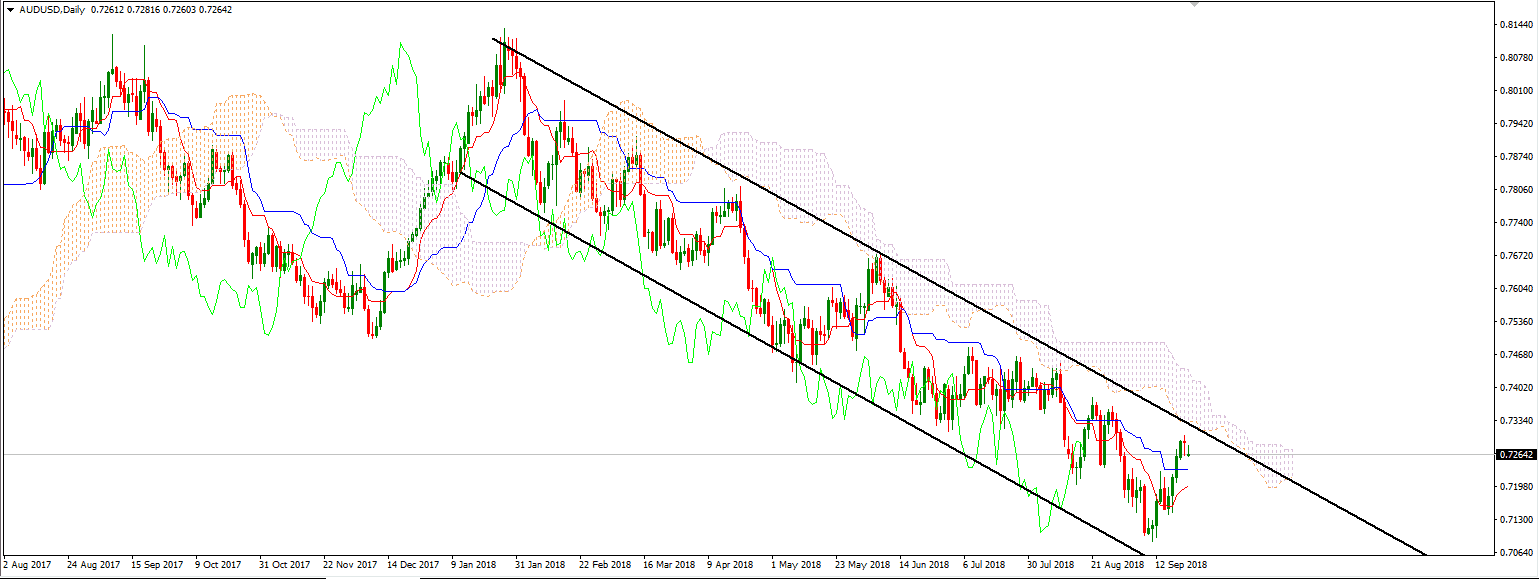

AUDUSD

Fundamental Analysis

This pair remains vulnerable to the US-Sino trade war. A lack of macroeconomic data during the week with only some releases on Friday will likely stay driven by trade angst.

Technical Analysis

On the technical side, the pair remains trapped in a bearish channel. The pair has stayed dampened in since the beginning of the February 2018.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Apple—Can It Survive In Next Decade?

Apple is the first company on this planet to reach a $1 Trillion Market value, each year continuing to release brand new innovative products including the latest iPhone to hit shelves. There is no doubt that Apple is the technology king of this generation given its following, constant growth, and company profits. However, can it maintain its innova...

September 25, 2018Read More >Previous Article

The Art Of War & Trading: Part 4

军势篇 Chapter: The Flow Of Directing Troops (Trades) Original Text: 孙子曰:凡治众如治寡,分数是也; Transl...

September 19, 2018Read More >Please share your location to continue.

Check our help guide for more info.