- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Oil Price tumbles to 7 month lows as recession fears grow

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Oil Price tumbles to 7 month lows as recession fears grow

News & analysisNews & analysis

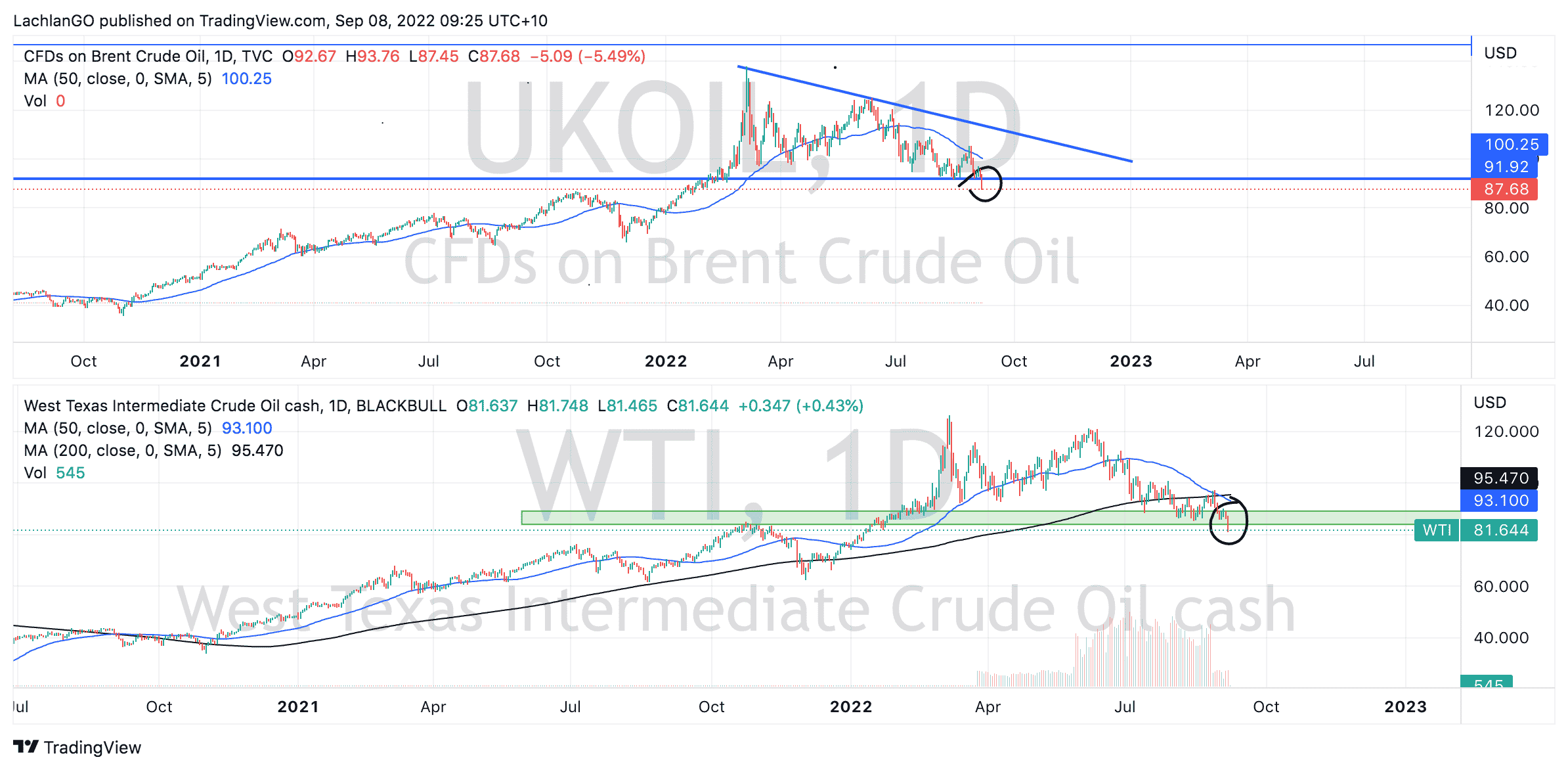

News & analysisNews & analysisBrent Crude and West Texas Intermediate Oil both fell to their lowest levels since January as fresh recession fears swept the market. Brent dropped to $87 a barrel and WTI to $81. The prices dropped following OPEC’s decision to cut the production by 100,000 barrels a day of supply from October.

In recent months with the Russian and Ukraine conflict raging, OPEC had to lift production as supply dipped. However, with the decreasing health of the global economy and a incredibly strong US dollar demand for overseas oil has dipped. Poor economic data from China and its Covid zero strategy has also pushed concerns of weaker demand. In fact, China’s crude oil important dropped by 9.4% from a year earlier signalling the slowdown in demand.

Furthermore, with the US federal reserve expected to remain hawkish until inflation is back to a sustainable level, in the short term there is little resistance in the way of the US dollar continuing to grind its way higher, further pressuring the price of oil. Whilst the current dip may provide some relief for consumers, with uncertainty from the Kremlin and Putin potentially capping their energy exports, the short term volatility will likely continue.

As it can be seen from the charts below, both WTI and Brent have broken down through their key support levels. The price may struggle to fall lower in the immediate short term and may need to consolidate in the short term before pushing lower again.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

Natural Gas – Technical Analysis

The United States used 30.28 trillion cubic feet of natural gas in 2021, making them the world’s largest consumer of natural gas. Natural gas consumption in the United States has two seasonal peaks, largely reflecting weather-related fluctuations in energy demand. One of the biggest consumptions of gas is industrial, residential and commercial co...

September 8, 2022Read More >Previous Article

NIO Q2 results have arrived

NIO Q2 results have arrived NIO Inc. (NIO) reported its unaudited second quarter financial results on Wednesday. The Chinese electric vehicle ma...

September 8, 2022Read More >Please share your location to continue.

Check our help guide for more info.