- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Amazon Joins the Trillion Club

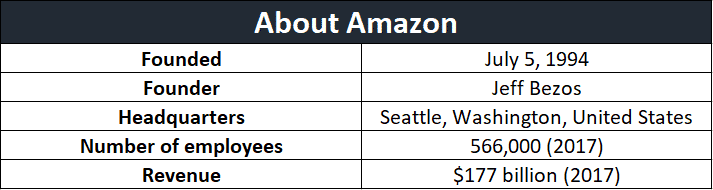

News & analysis Just over a month ago Apple became the first company to reach $1 trillion market cap after its shares closed at $207 per share. Now Amazon has become the second company to hit the historic milestone after its share price rose to $2,050 per share.

Just over a month ago Apple became the first company to reach $1 trillion market cap after its shares closed at $207 per share. Now Amazon has become the second company to hit the historic milestone after its share price rose to $2,050 per share. In case you didn’t know, Amazon offers a range of products and services through its websites. The Company operates through three segments: North America, International and Amazon Web Services (AWS). The Company’s products include merchandise and content that it purchases for resale from vendors and those offered by third-party sellers. It also manufactures and sells electronic devices.

Not many people expected Amazon to reach $1 trillion this quickly. Back in March, Brent Thill an analyst from Jeffries stated that Amazon would reach the milestone in 2022 when the share price was at around $1585 per share. But since then, we have seen the share price increase by around 28% and Amazon become world’s second company to reach $1 trillion market cap. With Amazon continuing acquiring new companies, we could see the share price rising in the future.

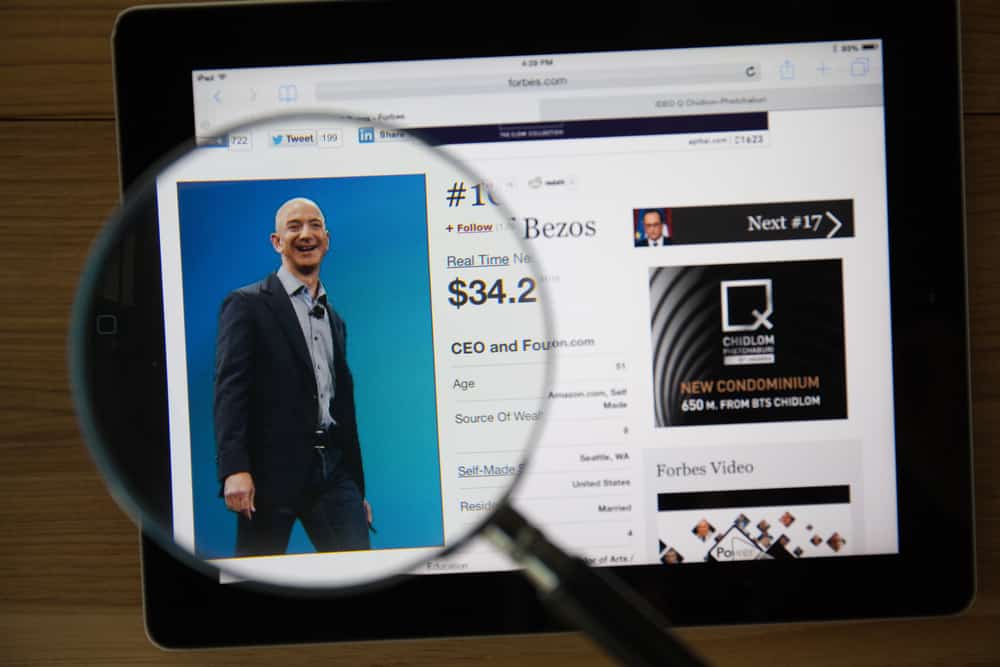

The Worlds Richest Person

The Worlds Richest PersonIt is worth pointing out that Jeff Bezos, Amazon’s CEO is world’s richest person with total net worth of $166 billion. He has increased his net worth by $66 billion just this year alone, according to the Bloomberg Billionaires Index.

Interestingly, if you bought $10,000 worth of Amazon shares back in September 2008 at $80 per share, they would now be worth around $253,750 USD at the share price of $2,030. You might not be the world’s richest person had you made this trade, but perhaps pleased with the overall profit margins.

So has the market topped out or is this just the beginning of further growth for the Nasdaq stock? The jury is still out on this one.

By Klāvs Valters (Market Analyst)

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: TradingView, Google.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

The Art Of War & Trading: Part 3

军形篇 - The Chapter of Tactical Dispositions Original Text: 善战者,先为不可胜,以待敌之可胜。 Translation: Good commanders first evaluate the possibility of being defeated and then wait for an opportunity to defeat the enemy. Don’t you think this sounds very similar to using a trading stop-loss? The concept of setting up a...

September 6, 2018Read More >Previous Article

Emerging Economies – Growth Potential

GDP Dominance The United States dominates the world when it comes to having the largest economy by Gross Domestic Product (GDP), however, ther...

September 5, 2018Read More >Please share your location to continue.

Check our help guide for more info.