- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- COTD: PFE – A Booster Shot For Pfizer Shares?

- Home

- News & analysis

- Shares and Indices

- COTD: PFE – A Booster Shot For Pfizer Shares?

News & analysisNews & analysis

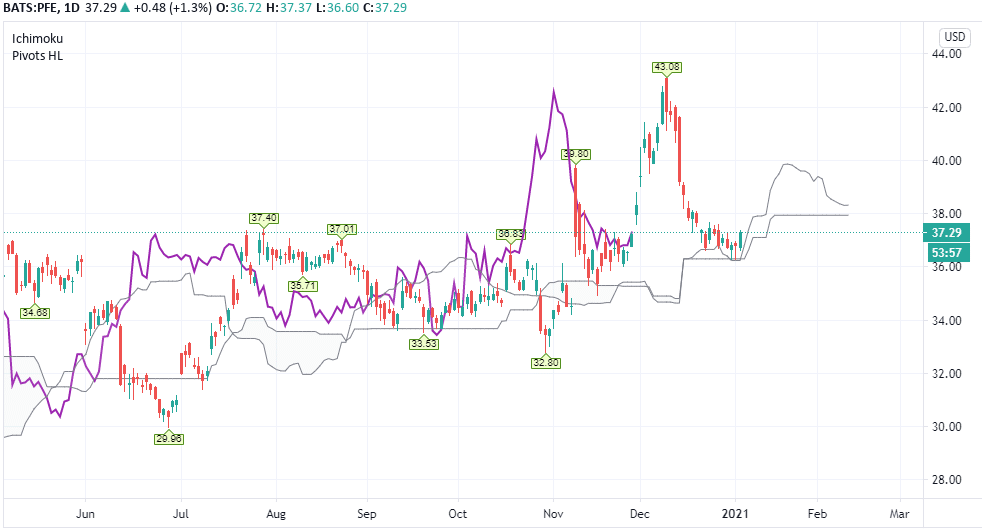

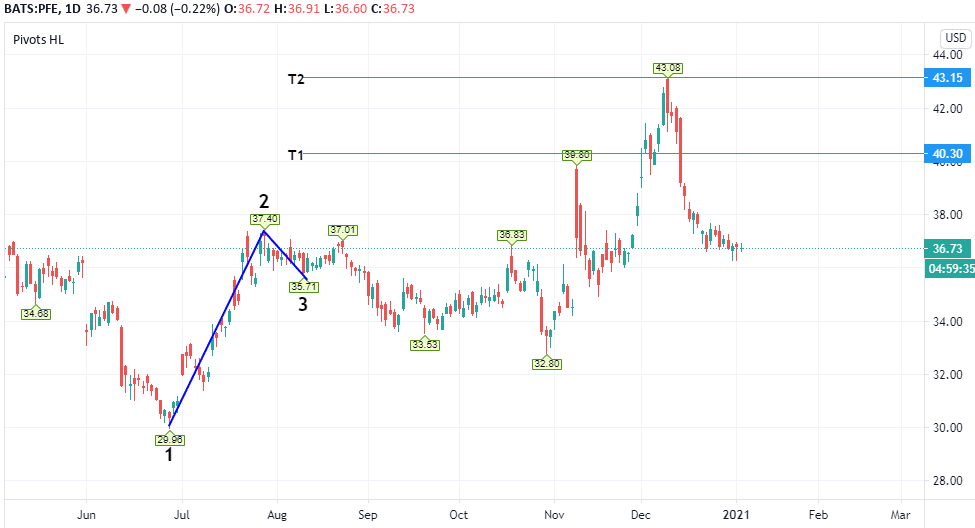

News & analysisNews & analysisPfizer (PFE)- Daily

PFIZER –

Before Christmas, the pharmaceutical giant Pfizer drew much speculation in the market once it became the first company to develop an approved Covid-19 vaccination. We see this reflected in the bullish activity leading up to December. Now that additional vaccines are available elsewhere, it seems to have had a detrimental effect on the overall price and the latest trend, and in today’s Chart of The Day, we will aim to discuss where the stock may be heading.

The longer-term trend remains bullish for the time being as we notice price action generating a series of higher highs. One technique that appears to be tracking quite well is the DiNapoli method. If you’ve never heard of Joe DiNapoli, you may find studying his work useful as it’s a practical application of Fibo levels.

Using the prices labeled ‘1’, ‘2’ and ‘3’ that originated back in July/August last year, we find an initial target of $40.30 (T1) followed by a primary target of $43.15 (T2). As the chart shows, T1 became the November price high, and T2 became another high area in December.

Looking at the same chart using the Ichimoku cloud method below, we can visually see where dynamic support levels are adhering to at the moment. Note the daily closes are remaining just above the cloud. The price action suggests a possible bounce up towards the $40.30 level again before tracing higher. Alternatively, a slip downwards could end up targeting previous support around $35.71 and $33.00 respectively.

Considering the Covid-19 crisis is still very much a global concern, it seems probable that companies such as Pfizer, who are at the forefront of providing life-saving products, will somehow benefit from positive sentiment derived from a cure. However, we must also consider the market as a whole before expecting such news to reflect on individual stock prices.

For those interested in trading PFE as a share CFD, Go Markets has this stock and many more, including companies from the ASX, NYSE, and the NASDAQ.

Note: Click on charts to enlarge.

Sources: Go Markets, Meta Trader 5, TradingView, Bloomberg

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Crude Oil – Saudi Production Cuts Spark Rally

USOIL- Hourly USOIL- It's been an impressive start to the year for Crude Oil prices so far, with prices steadily rising to over $50 per barrel and returning to pre-pandemic levels. It would seem many underestimated such a speedy recovery. Still, with the general uptick in global commodity prices and a pledge from Saudi Arabia to cut production ...

January 12, 2021Read More >Previous Article

Landing soon – Airbnb IPO

Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most...

December 10, 2020Read More >Please share your location to continue.

Check our help guide for more info.